Advent Venture Partners

Advent Life Sciences gears up for growth fund

Healthcare-focused strategies remain bright spot in otherwise dull fundraising market

Advent Life Sciences hires three partners

Dominic Schmidt is based in the UK, while Satish Jindal and Katrine Bosley join in the US

Advent Life Sciences raises $215m across two new funds

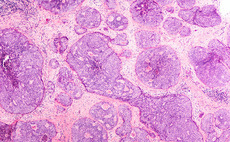

Funds invest in early- and mid-stage life sciences companies developing new therapeutics and technologies

Advent, Columbus lead €22.6m round for Highlight Therapeutics

Company intends to use the fresh capital to further develop its drug candidate BO-112

Novartis, Novo lead €9m series-A for Rappta Therapeutics

Round also saw participation from family office Advent Life Sciences, and Business Finland

VCs in £27m series-A for MiroBio

Advent Life Sciences, SR One, Oxford Science Innovation and Samsara Biocapital have invested

Longitude leads £25m Kandy Therapeutics series-C

Recently founded biotech company will advance its menopause drug to the testing phase

VC-backed Farfetch gears up for listing

Online fashion marketplace files a registration statement for an IPO on the New York exchange

Advent gears up for launch of third life sciences fund

VC makes investments in life sciences companies based in the UK, continental Europe and the US

Advent France Biotechnology holds €64.75m first close

Firm was launched in 2016 and targets early-stage companies in the life sciences sector

Advent and Medicxi lead £11m series-A for Capella

Round for London-based biotech firm saw participation from two VCs and Osage University Partners

French IPOs: Last chance saloon?

Despite a large number of French listings over the past 18 months, rocky performance could close the window

Mary Kerr joins Advent Life Sciences as operating partner

Kerr worked with GSK for 14 years

Gilde Healthcare et al. invest £10m in Levicept

Company will use the funding to carry out its first clinical study

Deal in focus: uniQure raises $91.8m in IPO

Netherlands-based uniQure’s debut on the Nasdaq marks one of the latest in a string of European venture capital-backed biotechs flocking to the US markets, but the lack of activity in Europe's public markets does not necessarily equate to a slowdown in...

VC-backed uniQure raises $91.8m in IPO

Venture capital-backed Dutch gene therapy company uniQure raised well above its original expectation in its listing on the Nasdaq, bagging $91.8m.

VC-backed uniQure files $75m IPO

Dutch gene therapy company uniQure, backed by several venture capital firms, plans on raising up to $75m in its IPO on the Nasdaq.

European venture: patience rewarded

Patience rewarded

Serena Capital leads £10m round for WorldStores

Serena Capital and existing backers Balderton Capital and Advent Venture Partners have jointly invested ТЃ10m in a series-C funding round for UK-based online retailer WorldStores.

Oxford Capital et al. in $3m Celoxica round

Oxford Capital Partners has led a $3m funding round for London-based ultra-low latency market data provider Celoxica.

Cisco buys venture-backed Ubiquisys for $310m

Small cells developer Ubiquisys, a portfolio company of Advent Venture Partners, Accel Partners and Atlas Venture, has been bought by US corporate Cisco for $310m.

Advent Venture appoints new operating partner

Advent Venture Partners has appointed Ian Nicholson as an operating partner in its life sciences team.

Ubiquisys raises a further $19m

UK-based 3G technology company Ubiquisys has raised $19m in an oversubscribed round from existing investors, as well as new Chinese investors Mobile Internet Capital and Nissay Capital.

Advent Life Sciences gets re-up for latest fund

Advent Life Sciences Fund I, a 2010 vintage venture vehicle managed by Advent Venture Partners, was reopened to accept a new commitment as well as increased investments from existing LPs.