Ardian (formerly Axa PE)

Teasers out for Ardian-backed imes-icore

No formal process has kicked off for the German medtech firm but significant sponsor interest is expected

The Bolt-Ons Digest - 3 July 2023

Unquoteтs selection of the latest add-ons with Palatine's Anthesis, Nordic Capital's Regnology, Waterland's Janssen and more

GP Profile: Ardian Expansion doubles down on generalist approach, eyes EUR 3bn Q2 fundraise launch

With its current EUR 1.5bn fifth fund almost at full deployment, Ardianтs Expansion strategy expects to benefit from LP appetite for its strategy ahead of EUR 3bn fundraise

Ardian's d&b audiotechnik to hit market in 2023 as large-cap sponsors circle

GP acquired the audio equipment maker in 2016 from Cobepa and Odewald & Compagnie for around EUR 300m

Ardian acquires Mimacom Flowable Group

GP will invest alongside management to drive growth for Swiss software and IT consultancy through acquisitions

Eurazeo's Groupe Premium attracts multiple PE bidders ahead of IMs

Insurance broker has seen interest from parties including Ardian, Bridgepoint, BC Partners, Cinven, CVC

Ardian preps Imes-icore for sale; sellside pitches ongoing

Healthcare tech company could hit the German auction pipeline later this year

Ardian plans North American drive with tech, services deals on radar

French sponsor looks to more than double exposure to US and Canada when next flagship buyout fund launches

Progressio exits Assist Digital in sale to Ardian

French GP plans further internationalization and M&A for Italian CRM technology provider

Ardian closes new credit fund on EUR 5bn amid "ongoing bank retrenchment"

Managing director Mark Brenke tells Unquote the firm sees strong opportunities with expanding role of direct lending in Europe

Ardian reinvests in Neopharmed alongside NB Renaissance

French GP will move stake from fund VI to VII; additional capital allows for European M&A

Ardian exits Unither to GIC, IK-led consortium

Existing investors Keensight and Parquest to remain in share capital alongside company's management

Ardian readies engineering and consultancy group Expleo for sale

Citi and Boston Consulting Group are advising on French company's auction, due to kick this month

Tikehau et al. sell majority stake in GreenYellow to Ardian

French sponsors to reinvest in the renewable energy firm following EUR 1.4bn deal

Ardian exits majority stake in Opteven to Apax

New owner will aim to accelerate the insurance provider's international growth

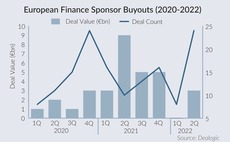

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

The Bolt-Ons Digest – 13 July 2022

Unquote’s selection of the latest add-ons with Ardian's Aire, Kester's Rephine, Arta/KKR's Alvic, Capiton's Dec Group, and more

Ardian's Dedalus sale postponed until September

Owners of Italian software group in “wait-and-see mode” as M&A faces challenging environment

Ardian invests in TA Associates-backed Odealim

Sponsors will have co-control of the France-based insurance broker, with TA reinvesting

Montagu launches Arkopharma sale; attracts PE and trade buyers

Bridgepoint and CVC’s Cooper among parties interested in the natural medicines and food supplements maker

BC Partners, Ardian among sponsors in second round of Simago sale

Antin and Eurazeo also in race for minority stake in the French medical imaging specialist

Bridgepoint in exclusivity to acquire G Square's Dentego

Mergermarket reported that sponsors including Ardian, BC, Eurazeo and IK showed interest in the asset

Ardian readies Dedalus for controlling stake sale

Morgan Stanley and UBS are preparing an auction for the Italy-based hospital software group

Doxx to collect initial bids amid fierce midmarket sponsor interest

German digital healthcare staffing specialist has attracted GPs such as IK, DPE, Ardian, Chequers, Triton, PAI, Equistone, Rivean Capital