Denmark

Capidea backs MBO of Klokkerholm Karosseridele

Capidea Management has acquired a 70% stake in Danish auto body part distributor Klokkerholm Karosseridele.

Nordic deal activity stumbles in Q3

Activity in the Nordic region was sharply down in the third quarter, mirroring activity in many parts of Europe, according to the latest unquoteт Nordic Private Equity Index, published in association with KPMG.

unquote" Nordic Private Equity Index Q3 2011

Nordic private equity activity saw a slowdown in the third quarter, mirroring that seen in the rest of Europe.

G4S backs out of ISS deal

G4S has withdrawn its offer for EQT-backed ISS, in a further blow for the company.

Ratos' Stofa acquires TV business from Canal Digital

Ratos portfolio company Stofa has acquired the cable television business of triple play provider Canal Digital Denmark.

Nordic buyouts: Sailing to recovery

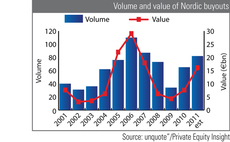

Unquoteт data points to the Nordic private equity industry recovering faster than the rest of Europe. Although buyout activity is low at the moment, trends emerging from long-term data tell a different tale. Sonnie Ehrendal reports

Nordic unquote" October 2011

After a promising start, buyout activity in Europe might slow down even further in the fourth quarter of 2011 and risks falling behind last yearтs levels.

Aescap Venture et al. back Orphazyme

Aescap Venture has invested тЌ14m in a series-A round for biotechnology firm Orphazyme.

Nordic unquote" out now

The latest digital edition of Nordic unquoteт is out now, featuring all the latest analysis, deals and exits in the region.

Nordic unquote" September 2011

Buyout activity in the Nordics could return to levels seen pre-credit crunch, according to unquoteт research. If Nordic deal activity continues at the pace seen in the first half of 2011, volume and value look set to almost reach 2007 levels, marking...

TPG invests in Saxo Bank

TPG Capital has bought a 30% stake in Danish online investment banking platform Saxo Bank from existing investors.

Nordic buyouts set to return to 2007 levels

Buyout activity in the Nordics could return to levels seen in 2007, according to unquoteт research. If Nordic deal activity continues at the pace seen in the first half of 2011, volume and value look set to fall just short of 2007 levels, marking a resurgence...

Pandora IPO lifts lid on PE failings

Pandora is not the only private equity-backed IPO to suffer т it would seem the box is full of underperforming listings. John Bakie reports.

Ratos' Canal Digital add-on gets a no-go

Ratos has decided not to pursue the bolt-on of Canal Digitalтs cable-TV operations for portfolio company Stofa.

Nordic unquote" July/August 2011

Just a few months after closing what many call Europeтs most impressive fund of the year, Montagu is waving goodbye to two directors, unquoteт has learned from sources close to the fund.

Axcel closes fourth fund on DKK 3.6bn

Axcel has closed its fourth fund, Axcel IV, having raised DKK 3.6bn.

Nordic private equity shines in Q2

The Nordic market is back in full swing, according to figures from the latest Nordic unquote" Private Equity Index, published in association with KPMG.

Nordic unquote" Private Equity Index Q2 2011

In the latest edition of Nordic unquoteт Private Equity Index, in association with KPMG.

Ghosh joins GE Capital leverage team

GE Capital has appointed Amitav Ghosh to its European leveraged finance team. He joins the firm as executive director.

Hannes Snellman moves Copenhagen office

Hannes Snellmanтs Copenhagen office has moved to a new address.

Nordic and Deutsche unquote" out now

The latest digital editions of Nordic unquote” and Deutsche unquote" are out now, featuring all the latest analysis, deals and exits in these regions.

Nordic unquote" June 2011

Private equity firms are looking to exit a large number of their portfolio companies in the coming 12 months, according to Grant Thornton UKтs latest Private Equity Barometer.

Discipline key to success in Nordics

тThe mid-market has been remarkably well disciplined in the last couple of years in the Nordics,т Gustav Bard, MD of 3i Nordics said this morning in Stockholm. тSuch restraint will help make this a very good vintage,т he continued, speaking at the seventh...