Exclusive

LSP closes LSP 7 at EUR 1bn

The GP says it is the largest life sciences venture capital fund ever raised in Europe

Henko Partners prepares to hit fundraising trail next year

Spanish GP will target EUR 140m-EUR 150m for new fund, with debut vehicle expected to be fully deployed by end-2023

Motive, CPP Investments in USD 1.4bn equity raise for FNZ

The deal values the London-based wealth management platform at more than USD 20bn

Inflexion sells Alcumus to Apax for 5.9x money

Inflexion acquired the UK-based risk management and compliance firm for GBP 92m in 2015

Nuveen closes impact fund on USD 218m

GP could return to market for Fund II in 2022 or early 2023 given current deployment opportunities

Lauxera closes first health tech fund on EUR 260m

Debut fund will invest EUR 20m-40m in European and US health technology companies

Swen raises additional EUR 43m for Blue Ocean Fund

Total funds raised for the ocean conservation fund reach EUR 95m towards its EUR 120m target

Polestar launches circular debt fund with EUR 400m hard-cap

Fund will back Netherlands-based projects and companies involved with carbon and waste reduction

BC Partners announces EUR 6.9bn fundraise for BC XI

Final close fell below the original target;Т GP expects to return to market for its next fund in H2 2023

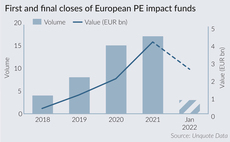

PE impact fundraising surpasses EUR 4bn in 2021

Figures from Unquote Data reflect the increasing prevalence of impact and impact-driven deals

EIM acquires Bonna Sabla from Bain-backed Consolis

Carve-out of the precast concrete manufacturer follows 20 years of private equity ownership

Holland Capital buys business applications provider Appronto

Acquisition will enable close collaboration with other companies in the GP's portfolio

CapMan commits to science-based targets for net zero

Commitment is part of the GP's ESG strategy across the firm itself and its portfolio

Activa acquires Rhétorès, Cap Fidelis

GP plans to be ahead of the consolidation phase in the financial advisory market, which it believes is underway

Polaris V holds final close on EUR 650m hard-cap

Fund has EUR 690m to deploy including the GP commitment, and has made five platform investments

Synova sells majority stake in Mintec to Five Arrows

Synova reaps 12x invested capital and will reinvest in the company for a minority stake

Primary Capital exits Readypower in trade sale

Readypower was acquired in a management buyout in 2017

Vivalto to close first EUR 700m fund in summer

New GP specialising in healthcare has already deployed 65% of the fund's target

VNV announces European growth plans and hires four investors

Sweden-based technology investor has been listed on the Swedish stock exchange since 1997

GP Profile: Triton lays out ESG plans

ESG head Graeme Ardus and recently appointed head of sustainable investing Ashim Paun detail the firm's approach to ESG

Planet First seeks sustainability investments ahead of EUR 350m fund close

Managing partner and co-founder FrУЉdУЉric de MУЉvius speaks to Unquote about the firm's evergreen fund and its investment strategy

Bridgepoint sells Element to Temasek for 3.7x money, 30% IRR

Testing, inspection and certification company is reportedly valued at USD 7bn in the sale to Temasek

Infravia Capital closes Growth Equity Fund on EUR 501m

Fund will invest in digital and technology infrastructure companies across Europe, and seeks to be deployed in 18 months

MML exits Waystone to Montagu, Hg for 11x money

Exit also sees 164% IRR and has returned 100% of the committed capital in MML Fund VI