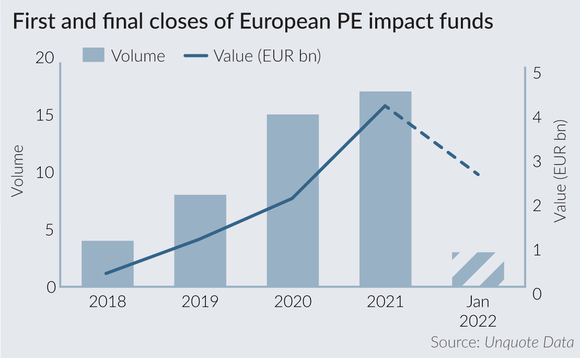

PE impact fundraising surpasses EUR 4bn in 2021

European GPs raised EUR 4.1bn across 17 first and final closes in 2021 for vehicles focusing on impact-driven investments, with EUR 2.56bn raised in January 2022 alone, according to Unquote Data.

The data reveals a steady rise in the amount of capital raised for funds that claim to address a range of measurable impact goals, whether they are pure impact funds for regulatory purposes (classified as Article 9 under the EU's Sustainable Financial Disclosure Regulation (SFDR)) or described by their managers as seeking to measure or address impact.

This comes against a backdrop of increasing regulation and external accountability driven by initiatives including the EU's SFDR, as well as the integration of the UN's Sustainable Development Goals into investment practices.

The aggregate value of funds raised in January 2022 alone surpassed the total for 2020, as well as that of 2018 and 2019 combined. Verdane held a final close for its debut impact growth technology fund, Verdane Idun I, on EUR 300m in January 2022. Fellow Nordic GP Summa Equity held a final close for Summa Equity Fund III on EUR 2.3bn in the same month; founder and managing partner Reynir Lindahl told Unquote that the GP has become increasingly vocal about its impact focus since "the mainstream is understanding that this [strategy] is delivering superior returns, rather than compromising on them."

Another string to the bow

While some emerging mangers such as Trill Impact raised significant amounts in 2021, last year and the start of 2022 has also seen established sponsors launching impact-focused funds to expand on their existing strategy.

One such sponsor is UK-headquartered Apax Partners, which registered Apax Global Impact in September 2021, according to Unquote Data. Meanwhile, EQT is currently on the road for its "impact-driven" Future Fund, which was announced in October 2021 with a EUR 4bn target. And Apollo Global Management launched its first Impact Fund in 2020, according to Unquote Data, with a target of approximately USD 1bn.

Further sponsors with existing impact strategies include industry giant KKR. The firm registered its second Global Impact Fund in June 2021; its predecessor held a final close in February 2020 on USD 1.3bn.

Further closings are expected later in 2022, including that of Planet First's EUR 350m evergreen fund, as reported. Fund-of-funds manager Golding Capital Partners launched its first impact fund in September 2021 and is currently on the road for the fund, while fellow fund-of-funds GP Greenspring Associates registered its second impact fund in June 2021.

Although this trend is unlikely to come as a surprise to many, it confirms the increasing importance of topics including impact and sustainability to LPs and GPs alike, with many managers taking advantage of their existing deal pipelines to source impact-focused opportunities.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds