Exclusive

Spire Capital Partners holds EUR 57m first close for debut digital/tech fund

CEE-focused sponsor has a EUR 100m hard-cap for its first fund and will deploy EUR 7m-EUR 15m tickets

HV Capital doubles down on DACH investments with new EUR 710m early-stage and growth fund

Fund IX is the German VC and growth firmтs largest fundraise to date and will be split into two separate vehicles for venture and growth

VC Profile: Klima lines up green energy deals from EUR 210m debut fund

Franco-Spanish Alantra and EnagУЁs-backed VC initiative expects to lay the foundations for its second fund in 2024

Newly launched Utopia Capital aims to deploy EUR 10m-plus by 2028

Angel investor Christian Schroeder's new investment vehicle will support early-stage tech companies addressing humanitarian issues

VC Profile: HTGF optimistic on seed stage opportunities as exit environment toughens

German seed investor secured almost EUR 500m for its fourth and biggest fund to date at a time when VC funding is slowing down

GP Profile: Opera Investment Partners doubles fund size with EUR 200m target for next vehicle

Fund I тalmost fully committedт with one exit completed and two-three more realisations expected in the next 18 months

Women in PE: Foresight's Alvarez on SME deployment plans, regional expansion drive

Partner Claire Alvarez speaks to Unquote about opportunities in the current market and the UK-based sponsorтs diversity ambitions

Podcast: Q1 2023 - Bank runs, fund home runs and markets come undone

Unquoteтs reporting team discuss themes that have arisen in Q1 2023, ranging from liquidity management to venture and growth activity

Houlihan Lokey poaches Nielen Schuman's Theys to open up Antwerp office

Hire to cement Houlihan Lokey’s position in Belgium, which represents 30% of the advisor’s Benelux deals

GP Profile: Aurelius goes global with US expansion as it eyes new EUR 800m fund

German carve-out specialist is 18-24 months away from fundraising for its Fund V with EUR 750-EUR 800m target

Metric Capital and Scope acquire majority stake in Maileg

Deal for Danish toy brand marks second investment this year out of Metricтs fourth fund, which is now about 85% deployed

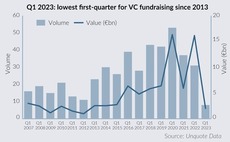

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

Charterhouse transfers Sagemcom to AlpInvest-backed continuation fund - filings

GP will make a return of over 5x MOIC on the deal for French telecoms business

Procuritas raises EUR 407m for PCI VII

Swedish GP's seventh fund is 28% larger than predecessor and will invest in Nordic buyouts

Hunter Point buys minority stake in Coller Capital

Proceeds from the deal will be invested into secondaries investor Coller Capitalтs funds

Spending bottom dollar: Valuation gaps take Q1 buyout levels back to 2009

Sponsors make just 95 buyouts in Europe in the first quarter - a figure not seen since Sony sold 12m floppy discs in one year

PE roll-up strategies face regulatory heat with focus on consumer industries

With longer holding periods facilitating more bolt-ons, regulators including the UK's CMA are intervening

Quadrivio reaps 40%-plus IRR, 2.2x cash-on-cash from EPI sale

Trade sale of Italy-based sports merchandising specialist marks Industry 4.0 fund’s first exit

VC Profile: Hi Inov in pre-marketing for next fund, outlines plans to wrap up Fund II investment period

France and Germany-based early-stage investor has made 15 of its up to 20 planned investments from its EUR 100m Fund II

Infravia aims to raise up to EUR 1bn for next growth fund, eyes mid-2024 launch

French sponsor expects to raise EUR 750m-EUR 1bn for B2B tech-focused second growth fund

VC Profile: Target Global assesses B2B opportunities in final stretch of current fund deployment

Nearing full deployment for its second growth fund, pan-European VC firm outlines plans to back defensive B2B models and institutionalise its co-investment strategy and LP base

Triton to reap 4x MOIC in Norres Baggerman exit to Nalka

Industrial hoses group grew revenues by 170% to over EUR 100m during Triton’s investment period

EQT closes LSP Dementia on EUR 260m hard cap

Series A-focused fund exceeded its EUR 100m target and extended fundraising after increased LP interest in its strategy

Newton Biocapital heads for year-end close for second, EUR 150m life sciences fund

Belgian-Japanese VC has raised EUR 50m to date and is lining up exits from its debut fund