Exclusive

Equita Capital launches €200m debt fund

Fund will be larger than its predecessor, EDP I, a €100m vehicle that closed in 2017

LP Profile: Polish Development Fund

The Polish Development Fund's private equity programme has kicked into gear this year, making three fund investments with more in the pipeline. Oscar Geen speaks to Annemarie Dalka about PFR's formation and investment strategy

H1 Review: Nordic pricing frothy as cross-border capital pours in

Nordic region retained its position as the most expensive place in Europe for private equity firms to buy companies in Q2 2019

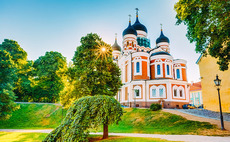

H1 Review: Fundraising and local capital herald CEE buyout revival

Baltic market stands out, recording a higher than usual share of the wider region's dealflow

Primomiglio to launch €80m VC space technology fund

Fund will be larger than Barcamper Ventures, which targets digital and software companies

H1 Review: Large-cap value drives Benelux buyout activity

H1's aggregate value of €11.1bn resulted in a 60% increase on H2 2018, and reveals large-cap activity remains strong in the region

GP-stake sales controversial among LPs

LPs are naturally reticent about their GPs selling stakes in themselves, as emphasis to boost profits from management fees strengthens

Buying and building the modern school

Investments in European private schools and colleges have proven enriching for PE over the past two decades

H1 Review: GPs seek sourcing alternatives in busy French market

While French PE performed well, GPs lost out to corporate buyers on more deals than usual

DBAG buys Cartonplast from Stirling Square

GP deploys capital from its DBAG Fund VII, which held a final close on its €1bn hard-cap in 2016

H1 Review: UK transactions hit by Brexit impact

Total of 96 buyouts recorded by Unquote Data during the period marks the lowest volume seen in the country since H1 2016

Q2 Barometer: small-cap boom offsets mid-market lull

Europe records 533 buyout, expansion and early-stage investments over Q2, a nine-quarter low

Nation 1 launches debut fund with a target of €35m

Vehicle plans to invest in Czech startups and small and medium-sized companies with global ambition

Mayfair makes first exit with Fox International trade sale

Mayfair backed the SBO of the fishing tackle business in 2015, with Next Wave reinvesting

Skylake Capital launches $150m early-stage fund

New venture firm is launched by Marcos Battisti, formerly of C5 Capital and Intel Capital

GPs hungry for Benelux's food and beverages sector

From 2014 to date, Benelux has surpassed all other European regions in terms of large-cap buyouts in the food sector

BlueGem launches €500m third buyout fund

BlueGem III will be larger than its predecessor, which closed on €370m in June 2015

Omnes collects commitments across funds

Omnes Mezzanis 3, dedicated to French small and mid-market businesses, closes on €100m

Paragon closes fourth fund on €780m

2014's The Paragon Fund II closed on €412m and is fully deployed, making its last investment in July

Sovereign gears up for fund launch following departures

Firm is understood to be targeting between ТЃ500-600m for the next-generation vehicle

Aksìa holds €100m first close for fifth fund

Fund targets businesses with potential for high growth, and expansion and buy-and-build opportunities

Kibo Ventures targets €100m for third fund

Kibo's second fund has recently finished its investment period after closing on €71m in 2016

Fund managers turn to steady and reliable Ireland

Buyouts in Ireland have been steadily rising in recent years, with 12 deals in each of 2017 and 2018

Siparex gears up for 2020 fund launch

GP plans to manage the fundraise in house but may appoint agents for specific regions