France

MBO Partenaires backs Cofigeo SBO

MBO Partenaires and Société Générale Capital Partenaires have acquired a stake in the buyout of French ready-meals specialist Cofigeo.

Gimv and Alsace acquire Wolf in SBO

Gimv and Alsace Capital have acquired French designer and manufacturer of women’s underwear Wolf Group from Cathay Capital and EPF Partners.

Seventure raises €62m towards new life sciences fund

French GP Seventure Partners has held a first close on тЌ62m for Health for Life Capital, a new vehicle with a тЌ120m target.

BDC's Mezzo di Pasta to change hands in Q1

Bridgepoint Development Capital-backed Mezzo di Pasta, a struggling French pasta fast food chain, is expected to be bought out of “redressement judiciaire” in February.

Keensight backs Smile MBO

Keensight Capital has acquired a majority stake in Smile Open Source Solutions as part of a management buyout alongside existing investor Edmond de Rothschild Investment Partners (EdRip).

OpenGate pulls Kem One out of administration

Global buyout house OpenGate Capital has acquired European PVC producer Kem One out of administration.

Spie eyes IPO

French engineering company Spie, backed by Clayton Dubilier & Rice (CD&R) and Ardian, is considering a public listing by the end of the year.

Lucibel closes cash and bonds funding round

French LED lighting solutions provider Lucibel has raised €15m from Bpifrance, Aster Capital and CM CIC Capital Innovation.

Gimv and Cube to acquire VTB

Gimv and the Cube Infrastructure Fund are to wholly acquire Veolia Transport Belgium (VTB), the Belgian operations of France-headquartered Transdev Group.

Ixo holds first close on €85m

Ixo Private Equity has held the first close of its Ixo 3 fund on €85m, having received commitments from all the LPs invested the firm’s Ixo 1 and 2 funds.

Ardian sells Cegos stake

Ardian has divested its minority stake in French vocational training services business Cegos Group to management and existing shareholder Cegos Association.

Iris et al. invest $40m in Talend

Iris Capital and BPI France have led a $40m funding round for French open-source data integration company Talend alongside existing investors Silver Lake, Balderton Capital and Idinvest Partners.

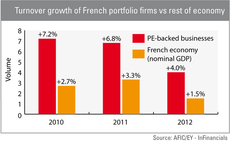

French PE-backed firms outperformed rest of economy in 2012

French private equity-backed companies significantly outperformed their peers in terms of job creation and turnover growth in 2012, according to a new survey by Afic and EY.

Activa and Paluel-Marmont back Gaz Européen

Activa Capital and Paluel-Marmont Capital (PMC) have invested in Gaz Européen, a French B2B energy supplier.

Q&A with Fleur Pellerin, French minister for SMEs

Q&A: Fleur Pellerin

Seventure et al. back EndoControl

Seventure Partners, CM-CIC Capital Innovation and Viveris Management have injected €4m into EndoControl, a French surgical robotics developer.

Siparex makes 5x on Manuloc exit

Siparex has sold its stake in French logistics business Manuloc to existing backer CM-CIC Capital Finance after more than 10 years as a minority shareholder.

Deal in Focus: Astorg to buy Kerneos for €600m

The background work has finally paid off for Astorg Partners: after looking at a raft of deals in the past 12 months to no avail, the French GP has entered exclusive negotiations to acquire chemicals company Kerneos for €600m.

Omnes et al. invest €8m in Gecko Biomedical

Omnes Capital, CM-CIC Capital Finance and CapDecisif Management have backed an €8m series-A round for Paris-based medical devices company Gecko Biomedical.

Kima launches new start-up initiative

Kima Ventures has launched its new Kima15 initiative, which aims to invest in more than 50 start-ups over the next 12 months.

TCR acquires GEC in MBI

TCR Capital has acquired Générale d’Etanchéité et de Couverture Ile-de-France (GEC) in a management buy-in, bringing in Jean-Christophe Blot to succeed the company’s current president.

Sketchfab raises $2m

Sketchfab, a French online publishing platform for 3D files, has raised $2m in a round led by Balderton Capital.

Astorg to buy Kerneos from Materis for €600m

French GP Astorg Partners has entered exclusive negotiations to acquire chemicals company Kerneos from Wendel-owned Materis for €600m.

Idinvest targets retail investors for new debt fund

French manager Idinvest Partners has started raising a second retail debt vehicle.