Gimv

Gimv takes 60% stake in Acceo

Ekkio Capital (formerly Acto Capital) held a 40% stake in the group prior to the transaction

Gimv takes majority stake in Summa

Roll cutter specialist group looks to increase its turnover by 50% by 2020 with Gimv's support

Gimv-backed Brakel acquires Argina Technics

Gimv acquired a majority stake in Dutch group Brakel in September 2015

Gimv in talks to sell Lampiris to Total

Gimv invested €40m in Lampiris via its Gimv XL buyout fund alongside SRIW in 2013

Real Impact raises €12m series-A from Gimv et al.

Backers include venture capital firms Fortino Capital and Endeit Capital

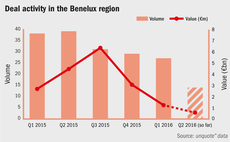

Usual suspects working hard in sedate Benelux market

Trend of declining dealflow in the region shows little signs of change, though buyout multiples return towards lower long-term averages

Safinco takes 24% stake in Gimv's Vandermoortele

Family shareholders will regain full ownership of the business following the transaction

Endeavour et al. lead $25m series-D for Endostim

Endeavour Vision led the funding round alongside Gimv and Wellington Partners

Gimv backs €10m Arplas MBO

Management team acquires a minority stake in the welding technology supplier alongside the GP

Gimv acquires 40% stake in Joolz

Investment firm invests alongside the company's managing director and founder

Gimv et al. lead €36m series-A for G-Therapeutics

Listed buyout house Gimv invested €6m in the funding round led by LSP and Inkef

Gimv and Draper sell GreenPeak to Qorvo

Sellers include Robert Bosh Venture Capital, Gimv Arkiv Technology Fund and other shareholders

Epidarex leads €14m series-A for Topas Therapeutics

Backers include life-sciences-focused investors Gimv, EMBL Ventures and Evotec

Gimv exits Onedirect to Naxicap

French private equity investor Naxicap acquires a majority stake in the company

Benelux: New investments slow down while large exits abound

New investments in the Benelux region have been subdued, but a number of large exits have bumped up Q1's figures

Gimv acquires 32% stake in Contraload

Existing investor Down2Earth, founded by former Gimv executives, retains a 38% stake

Gimv et al. in final exit of Punch Powertrain

Chinese trade player Yinyi Group buys the powertrains manufacturer at around €1bn EV

Gimv sells controlling stake in VCST

Gimv has announced a net positive impact of €4.6m on the equity value at the end of 2015

Motion Equity Partners buys Altaïr Group

Azulis Capital and Gimv exit after five-year ownership of cleaning products maker

Boosting returns by reducing carbon emissions

This second instalment in our investigation of PE and the green economy looks at reducing emissions in existing investments

Gimv's Vandeurzen to step down in June as part of succession

Resignation marks the end of the GP’s five-year transition into investing via four platforms

Gimv buys Itho Daalderop and Klimaatgarant for merger

Group is latest business to enter Gimv’s Sustainable Cities programme

Gimv acquires minority stake in Legallais

Ironmongery distributor Legallais reported a turnover of €225m for 2015

Gimv buys 75% stake in Brakel

GP invests in the Dutch natural climate control business via its balance sheet