healthcare

Quadrivio to capitalise on baby boomers as it nears wrap for its new EUR 300m fund

The Silver Economy Fund makes its second investment as it highlights trend of GPs doubling down on narrow strategies

Forbion raises combined EUR 1.35bn for venture and growth funds

Ventures Fund VI closes on EUR 750m and Growth Opportunities II on EUR 600m with both upsized by over 60%

Spex Capital launches EUR 100m early-stage healthtech fund

New GP has sights set on further impact vehicles such as food and climate technology

Seventure preps third generation of microbiome fund

Health for Life III to be slightly larger than EUR 250m predecessor; will invest in Europe, US, Israel

German health minister's 'locust sponsors' comments spook live healthcare deals

New entrants scared by remarks on limiting profits; existing investors expected to rush to complete bolt-ons

H2 turns to bilateral talks to get Optegra sale over the line, sources say

Deal with MidEuropa sealed after auction for ophthalmology group went quiet earlier this month

Novalpina fund exits Laboratoire XO to Stanley Capital

French drug maker is the first divestment from liquidated fund Novalpina I, now managed by Berkeley Research Group

EQT closes new European tech growth-stage fund on EUR 2.2bn

Closed above target, the new vehicle has raised a total of EUR 2.4bn in commitments

Ampersand closes USD 1.2bn healthcare fund for US, EU deployment

Fundraise follows hiring push in Europe; GP typically deploys USD 10m-50m tickets in primary buyouts

SHS nears EUR 250m hard cap on sixth fund

Healthcare fund’s EUR 200m target exceeded in first close with commitments from around 60 LPs

Five Arrows exits pharmacy group Laf Sante to Latour

Vendor plans to reinvest in pharmacy chain; Bpifrance takes minority stake

Forbion exceeds Growth Opportunities II target with EUR 470m first close

Biopharma GP sees growing demand for private capital amid IPO lull; gears up for EUR 600m hard-cap by summer end

VC Profile: Jeito Capital in final stretch of biotech fund deployment

Founder Rafaèle Tordjman outlines the French sponsor’s strategy as it aims to remain independent amid wave of consolidation in healthcare funds

QPE backs MBO of Republic M!

The buyout of the British commercial services outsourcer is QPE's seventh platform deal under its maiden fund

Teachers' Venture Growth leads Alan's EUR 183m Series E

Temasek, Index, Coatue, Ribbit Capital, Exor, Dragoneer, and Lakestar also joined the round which values Alan at EUR 2.7bn

Astorg beats sponsors to acquire CordenPharma

The sponsor competed with Advent International in the final round of an auction led by William Blair

Cambridge Innovation Capital raises GBP 225m for Fund II

The VC firm's first closed-end fund will invest in Series A rounds of deep-tech and life science companies connected to Cambridge

GBL bags second healthcare asset this week with SBO of Sanoptis

Vendor Telemos to fully exit DACH eye clinics operator following auction that also saw ICG and Ares compete for the asset

GBL acquires Affidea from B-Flexion

Formerly known as Waypoint, vendor is fulling exiting the pan-European outpatient group; new owner will invest EUR 1bn in equity

Novo-backed ReViral acquired by Pfizer

The British biotech company is also backed by CR-CP, New Leaf, Andera Partners, and OrbiMed, among others

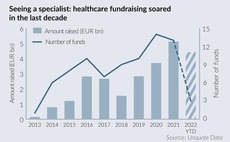

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

Jeito, INKEF, Forbion lead EUR 80m Series B for Precirix

Precirix last raised a EUR 37m Series A in 2018

Gilde Healthcare closes fourth buyout fund on EUR 517m

Double the size of its predecessor, the new vehicle was oversubscribed and saw nearly all Gildeтs existing LPs investing

Ufenau moves Corius and Altano to continuation fund

Bought in 2017, the dermatology and vet groups have been transferred into the Swiss GP’s third continuation vehicle