IPO

PE-backed Allfunds to list within weeks

Company's backers could raise around €2bn through the IPO, according to Mergermarket

PE-backed Synlab announces IPO intention

Cinven, Novo Holdings and OTTP hold stakes in the Germany-based laboratory diagnostics group

Parsley Box floats in £84m IPO, Mobeus reaps 4.2x return

Mobeus sells one third of its holding, while remaining as the largest institutional shareholder in the business with a 14% stake

Procuritas to net 8x on Pierce IPO

GP acquired the online motorcycle parts and accessories retailer in 2014

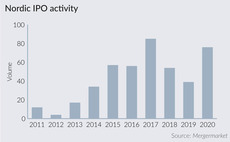

Nordic IPO rush drives exit opportunities for GPs

Wave of Nordic IPOs shows no signs of receding this year, often driven by new opportunities emerging from the pandemic

Bure launches first Swedish SPAC, aims to raise SEK 3.5bn in IPO

Bure says the initiative has been enabled by Nasdaq Stockholm's new SPAC regulations

Summa-backed Olink files for US IPO

Olink has been backed by Summa Equity since March 2019 and increased its revenues by 16.7% in 2020

Virgin Wines floats in £110m IPO, Connection reaps 7.6x

Mobeus remains invested in the business, while Connection makes a full exit

Virgin wines prices IPO, set for £110m float

Selling shareholders, including Mobeus and Connection Capital, will reap ТЃ35m

Nordic Capital-backed Cint lists on Nasdaq Stockholm

IPO was priced at SEK 72 per share, corresponding to a market capitalisation of roughly SEK 9.8bn (тЌ974m)

Verdane-backed e-retailer Desenio to list in Q1

Private placement will give the company a valuation of around тЌ1.1bn

Litorina-backed Fractal Gaming Group completes listing

IPO was priced at SEK 41 per share, which corresponds to a market capitalisation of around SEK 1.2bn (тЌ119m)

PE-backed Oatly could list as early as May – report

Company was previously considering listing in Hong Kong, but is now looking at the US, according to reports

Foresight prices IPO at £455m market cap

Trading for the UK-based multi-asset fund manager commenced on 4 February 2021

VC-backed Auto1 completes IPO

Listing gives the company a market capitalisation of €7.9bn and sees gross proceeds of around €1.8bn

VC-backed Auto1 announces IPO pricing

IPO of the used-car trading platform is expected on the Frankfurt Stock Exchange on 4 February 2021

PE-backed Cint announces intention to float

Offering is expected to provide Cint with proceeds of approximately тЌ75m

Permira-backed Dr Martens prices IPO with valuation of £3.7bn

During Permira's holding period, the boot maker's turnover has grown from ТЃ209m in 2014 to ТЃ672m in 2020

Litorina-backed Fractal Gaming Group to list

Intention to list comes four years after the GP acquired the company via its fourth fund

Lonsdale sells GYG for a 3x return

GYG had a market capitalisation of £35.7m at the time of publication

Nordic Capital-backed Trustly to list before summer – report

According to a press report, Swedish institutions would like the company to remain in Stockholm

Permira-backed Dr Martens to publish IPO prospectus

Morgan Stanley and Goldman Sachs are the joint global co-ordinators on the listing

Sequoia Capital to invest in Auto1 prior to IPO – report

IPO of used car trading website could generate proceeds of €1bn, the company said in a statement

PE-backed Elektroimportøren prices IPO

Company will start trading from 16 December on Euronext Growth Oslo