KKR

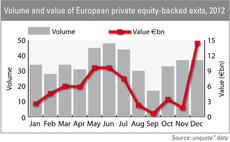

Exit market hits €15bn in December

Almost €15bn worth of capital was realised by private equity portfolio sales in December 2012, the highest amount in the past year, according to figures from unquote” data.

Private equity firms prepare £10bn EE bid

Apax Partners and KKR are bidding against Blackstone and CVC Capital Partners for UK mobile phone operator EE, according to reports.

PE backers to reduce NXP Semiconductors stakes

AlpInvest Partners, Apax Partners, Bain Capital Partners, KKR and Silver Lake Technology Management are due to sell 30 million shares in listed Dutch semiconductor developer NXP Semiconductors.

KKR and Permira looking to exit ProSiebenSat.1

KKR and Permira are looking to sell their stakes in German private broadcaster ProSiebenSat.1 to a trade buyer, according to reports.

KKR bolsters European buyout fund

KKR is reportedly set to use uninvested capital to back its second European buyout fund, while extending the fund's life span, according to reports.

PE-backed IPOs few and far between in 2012

Moleskine might make headlines if and when it finally lists on the stock market later this year, but flotations remained a seldom-explored exit route for GPs in 2012, continuing a trend initiated in 2008.

KKR Europe promotes two to partnership

KKR has appointed Silke Scheiber (pictured) and Philipp Freise as partners in its European office.

KKR and Permira sell ProSiebenSat.1's Nordic unit

Kohlberg Kravis Roberts & Co (KKR) and Permira have sold SBS, the Nordic unit of German media empire ProSiebenSat.1 Media, to trade buyer Discovery Communications for €1.325bn.

NTC Holdings further reduces stake in TDC

The holding jointly owned by Apax, Blackstone, KKR, Permira and Providence has sold 80 million shares in Danish telecommunications company TDC.

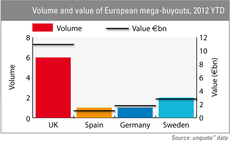

UK mega-buyouts worth more than €10bn this year

In defiance of problems on the continent, the UK has seen a surge in mega-buyouts this year, topped off with the recent acquisition of Annington Homes for ТЃ3.2bn.

Top 5 largest funds of all time

Last week, Advent International raised one of the biggest private equity funds investing in Europe in recent years, but how does it compare with the largest funds of all time?

Capio buys healthcare division of PE-backed Ambea

Capio т a portfolio company of Apax and Nordic Capital т has acquired Carema Healthcare from Carema, the Swedish healthcare division of private equity-owned Ambea.

KKR and Permira to sell Nordic business for up to €1.5bn

Two private equity firms and a trade player are in talks with German PE-backed broadcaster ProSiebenSat.1 Media regarding the acquisition of its Nordic unit т a deal that could fetch up to тЌ1.5bn, according to reports.

KKR considers Spain's NH Hoteles

KKR has made an offer to buy bonds that can be converted into shares in Spanish hotel group NH Hoteles, according to reports.

KKR, CVC, Carlyle and Apax looking into bid for Urenco

Four of the world's largest private equity houses are thought to be considering bidding for British nuclear fuel provider Urenco, according to The Sunday Times.

KKR leads buyout of Acteon from First Reserve

KKR and White Deer Energy have acquired a 52% stake in British oil and gas exploration services provider Acteon Group from First Reserve Corporation.

Top 5 exits of 2012 so far

Top 5 exits of 2012

United against private equity

PE's public image

PE-backed BMG linked to Parlophone bid

Private equity-backed music group BMG Rights Management has been linked to a bid for Parlophone Records, a section of EMI responsible for music by bands including Coldplay and Radiohead.

KKR acquires WMF shares from Capvis

Kohlberg Kravis Roberts (KKR) has bought a 37% capital stake in German cutlery and coffee machines maker Württembergische Metallwarenfabrik (WMF) from Capvis Equity Partners-managed Crystal Capital for €238m.

Alliance Boots partial exit raises £4.3bn cash and shares

KKR and AXA Private Equity have made a partial exit from Alliance Boots following a cash and shares offer from US pharmaceutical retailer Walgreens.

PE houses circle Everything Everywhere

Private equity firms including Apax and KKR are in discussions to bid for UK mobile operator Everything Everywhere in a deal that could exceed тЌ8bn, according to reports.

Carried interest reform sweeps across Europe

As many European governments impose austerity measures, there is a growing demand for a crackdown on loopholes enabling the wealthy to reduce their tax bills. This has led to a re-examination of the rules surrounding carried interest and several major...

TRS head of PE steps down

Steve LeBlanc, head of private market investments at the Teacher Retirement System of Texas (TRS), will step down from his position in June and return to the private sector.