Lone Star Funds

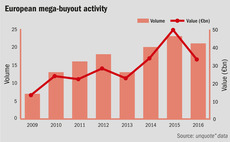

unquote" data snapshot: the five biggest buyouts of 2016

The year’s two largest deals, somewhat unusually, took place in Italy and Poland

PAI Partners sells Xella to Lone Star for €2.2bn

GP's have sold their portfolio company after an eight-year holding period

Lone Star initiates Forterra exit with £360m London IPO

Flotation gave the UK-based brick-maker a total market value of £360m

Lone Star set for £450m Forterra IPO

US GP will list the British brick maker on LSE after a six-month holding period

Lone Star picks up Quintain for £700m

Lone Star plans to accelerate development of Wembley Park

Doughty Hanson scores Balta Group exit

Doughty exits carpet- and rug-maker after more than a decade

Lone Star purchases Jurys Inn for £680m

Lone Star acquires group from consortium of shareholders including RBS

DHB sale to face regulatory scrutiny

Strategic buyers are preferred by regulators according to credit agency Fitch

Lone Star sells Düsseldorfer Hypothekenbank

Bank almost crashed during financial crisis

Blackstone et al consider BMN investment

Blackstone, Lone Star and Cerberus are among the private equity firms which have offered to invest in major Spanish financial group BMN.