unquote" data snapshot: the five biggest buyouts of 2016

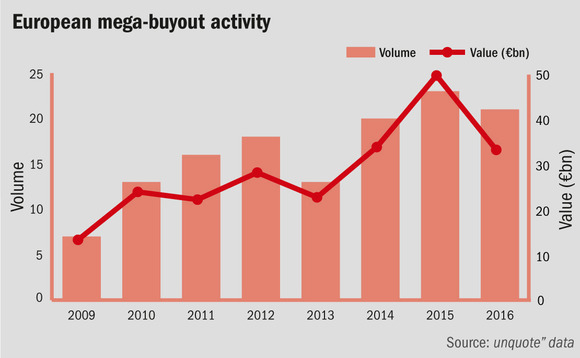

Following last year’s five-year peak, European mega-buyout volume and value saw a reversion to the mean in 2016. Below, unquote” takes a look at the five biggest deals of 2016

The number of €1bn+ mega-buyouts has fallen this year compared to 2015, returning to a level more in line with the average of the past half-decade.

In 2016, unquote" data registered 21 mega-buyouts worth around €33.1bn in total, compared with 23 worth a combined €49.5bn EV in 2015. This year's figure represents a reversion to the average deal volume and value seen in Europe since 2012, after 2015 saw the highest number of billion-euro buyouts since the financial crisis.

Below are the five largest European private equity buyouts of 2016.

5. Lone Star in €2.2bn SBO of Xella International

The year's fifth-largest transaction saw Texan GP Lone Star acquire German building materials producer Xella Group in a secondary buyout.

The December deal saw PAI Partners and Goldman Sachs Merchant Banking exit their holdings, giving the business a €2.2bn EV according to unquote" sources.

PAI and Goldman's exit came eight years after the 2008 €1.6bn EV carve-out from parent company Haniel Group. PAI held a 47% stake in Xella, while the precise size of Goldman's stake remained undisclosed.

4. Advent's €2.42bn buyout of Safran Identity and Security

September saw Advent International tap its Advent International GPE VII and VIII funds alongside BPI France to acquire the identification and security arm of Parisian technology group Safran.

The buyout was made for the purpose of merging Safran Identity and Security with Advent's portfolio company Oberthur Technologies, which the GP holds a majority stake in following a €1.15bn investment in 2011.

BPI France supported Advent in the acquisition, which is pending approval from US and EU authorities. The new entity inherited a debt package equivalent to a 4.5x EBITDA multiple. The deal also included the issuance of preferred equity to the benefit of Goldman Sachs and Partners Group.

3. Carlyle acquires Atotech in $3.2bn deal

In October, Carlyle acquired German speciality chemicals producer Atotech in a $3.2bn EV buyout from French oil and energy business Total.

The acquisition price paid by the GP represented an entry multiple of 11.9x Atotech's 2015 EBITDA. Carlyle drew down capital from two vehicles for the equity portion of the deal: 2013-vintage buyout fund Carlyle Europe Partners IV and US-based vehicle Carlyle Partners VI.

Carlyle reportedly came in with the winning bid in an auction process that also included CVC Capital Partners, BC Partners and Cinven.

2. Cinven, Permira and Mid Europa in $3.3bn buyout of Allegro

The second largest deal of 2016 came in what is typically a less active region for large-cap buyouts, in the form of Permira, Cinven and Mid Europa's investment in Polish online marketplace Allegro.

With an EV of $3.253bn, the consortium's buyout of the company from South African media group Naspers is among the largest deals to ever take place in central and eastern Europe. Announced in October, the transaction is around six times larger than the second largest CEE buyout of 2016.

The group of private equity houses reportedly won the auction process by seeing off competing bids from CVC, General Atlantic, Advent and Hellman & Friedman.

1. Amundi acquires Pioneer Investments for €3.5bn

After what would have been the largest deal of 2015 fell through due to regulatory issues, Italian asset manager Pioneer Investments takes the top spot as Europe's largest buyout in 2016.

At €3.545bn, Amundi Private Equity's December buyout of the Milan-based asset management group is €1.8bn smaller than last year's scuppered deal for the same company, in which Warburg Pincus- and General Atlantic-backed Santander Asset Management would have merged with then Unicredit-owned Pioneer.

Amundi acquired Pioneer for €3.5bn, which included €1.5bn in excess capital and a €1.4bn capital increase. The GP issued €600m of senior and subordinated debt underwritten by Crédit Agricole Group to support the acquisition from Warburg Pincus, General Atlantic, Unicredit and Santander.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds