Mergermarket

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Anaveo sale pulled despite late-stage talks with 3i

Competitive process stalls as vendor Bridgepoint's price expectations were not met, sources say

AutoForm sees Permira join bidder pool ahead of NBOs next week

Carlyle, KKR, EQT, Hellman & Friedman and Francisco Partners were previously reported as potential bidders

Will private equity bank on rising interest rates?

Sponsors want in on banking businesses before greater confidence in asset quality and interest-rate hikes increase valuations

Ambienta launches Nactarome sale, teasers out

Auction for the Italian ingredients producer was initally expected to be launched in early 2022

Leveraged loans issuance sets new record

High-yield bonds backing LBOs followed a different route, with volume decreasing 67% from Q2

IK hires Lazard to advise on Linxis sale

IK acquired Linxis Group (then Breteche) from Cerea Partenaire, Capza and Equistone in July 2015

IK Partners likely Conet buyer as HIG Europe concludes sale

Sponsor submitted a 15x EBITDA offer to acquire Conet, two sources say

Garnica sponsor ICG targets November for sale launch

Vendor has delayed the process in order to build up visibility on its 2021 results, one source says

Idea Taste of Italy contemplates Gelato d'Italia sale

Idea Taste of Italy acquired a stake in Gelato d'Italia – then trading as Indian – in May 2016

Asmodee already attracting PE interest ahead of November launch

Silver Lake, CVC, Advent and KKR are already set to join the race, sources say

Saverglass sale hits snag with remaining bidder Lone Star

future capex spend is a worry for bidders and lenders, sources say

Silverfleet puts Prefere Resins sale in motion

A process could launch with the circulation of a teaser towards the end of the quarter

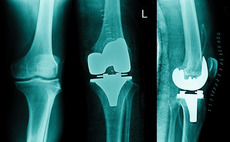

EQT launches LimaCorporate sale

Teasers for the Italian orthopaedic prosthetics producer were dispatched recently, sources say

Argos could revisit Fabbri Vignola sale in 12-18 months

Sponsor was met with unsatisfactory offers for the business in a sale process launched in May, sources say

Unilever tea auction set to close second round in November

Advent is in a strong position, while Cinven, CVC and Carlyle have ESG concerns, sources say

PAI leans towards US listing in dual-track for Refresco

Paris-headquartered PAI is close to appointing Rothschild to advise it on options

Schenck Process owner Blackstone launches sale process

Sale could potentially generate as much as EUR 1.5bn in proceeds, sources say

Lampa attracts interest from L Catterton, Chequers

Milan-based firm adviser Vitale is assisting owner Cronos Capital Partners on a potential exit

Vendis puts Sylphar on the market

Private equity firms are looking with interest at the asset, one source says

Axcel explores dual-track process for Aidian

Rothschild and Carnegie have been mandated as sale and IPO advisers, respectively

VC firm 212 to deploy EUR 32m in two years, gears up for exits

Sponsor has already deployed EUR 17m in 13 investments from its EUR 49m second fund

BB Capital, Vortex explore KidsKonnect sale

First bids in the Baird-run process are scheduled for this month, sources say

Social concerns increasingly important in European consumer M&A

Ethical supply chains, modern slavery, diversity and inclusion, wage gaps, and health and safety are all "potential liabilities" for M&A sponsors