Spain

Suma Capital launches new fund

Spanish GP Suma Capital has launched a new fund to support Catalonian SMEs.

Greylock Partners backs Social Point

US venture capital investor Greylock Partners has reportedly injected $2.9m into Spanish online games producer Social Point.

Mercapital sells Lasem Group to management

Spanish GP Mercapital has sold its 41% stake in Catalan company Grupo Lasem, which operates in the baking and confectionery industry, according to reports.

CRB and Inveready back Amadix

Spanish VC investors CRB Inverbio and Inveready have injected €2m into biotech firm Amadix.

Southern Europe unquote" February 2013

“The 2006 acquisition of Avio represented what today remains the largest leveraged buyout ever completed by a single private equity house in Italy,” says Roberto Italia, partner at European buyout house Cinven.

Cerberus buys loan portfolio from Liberbank

US private equity house Cerberus Capital Management is understood to have acquired a portfolio of loans worth €574m from Spanish lender Liberbank.

Carlyle-backed Applus buys EDI

Testing firm Applus, backed by Carlyle and Investindustrial, has bought Chinese engineering firm EDI.

Cofides supports Agrovin with €3m

Cofides has injected €3m into Agrovin, a Spanish manufacturer and distributor of wine products.

VenturCap launches new fund

Catalonian VC investor VenturCap has launched a new fund, VenturCap II.

Axa and Permira's Odigeo completes refinancing

Odigeo, the online travel agent backed by Permira and Axa Private Equity, has placed €325m worth of five-year secured bonds to refinance its senior debt.

Oonair raises €600,000 from Spanish VCs

Social video solutions provider Oonair Mobile Technologies has raised €600,000 from existing and new backers.

EIF and Oquendo to launch €100m Iberian fund

Spanish bank Banca March, the European Investment Fund (EIF) and Spanish Iberian mezzanine provider Oquendo Capital are to raise a fund to back local SMEs, according to local reports.

Advent's Maxam completes €280m refinancing

Maxam, a Spanish explosives manufacturer backed by Advent International, has taken out a €280m syndicated loan to refinance debt and fund expansion.

Holiday deals round-up

European private equity saw an exceptionally busy Christmas period this year, with many investors wrapping up deals right at the end of 2012. Here’s a round-up of all the events of the last two weeks.

Spanish GPs set sights on Latin America

Latin America

Southern Europe unquote" December 2012/January 2013

The sixth annual unquote” Italia Private Equity Congress took place in November at the Four Seasons in Milan, bringing GPs, LPs and advisers together to discuss the issues shaping the industry.

Carlyle and Vista sell Orizonia for mere €141m

Carlyle and Vista Capital have sold Spanish tour operator Orizonia to tourist group Globalia in a deal valued at €141m, six years after buying it for more than €800m, according to reports.

Cabiedes & Partners leads funding round for Floqq

Cabiedes & Partners has led a €405,000 funding round for Madrid-based Floqq, an online education platform designed for those seeking employment.

Nazca buys Ovelar for €28m

Spanish GP Nazca Capital has wholly acquired visual merchandising company Ovelar Merchandising for €28m.

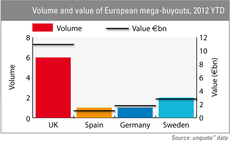

UK mega-buyouts worth more than €10bn this year

In defiance of problems on the continent, the UK has seen a surge in mega-buyouts this year, topped off with the recent acquisition of Annington Homes for ТЃ3.2bn.

La Caixa launches new €23m fund

Spanish bank La Caixa has launched its new fund, Caixa Innvierte Industria, which attracted €23m in commitments and will be managed by Caixa Capital Risc, according to reports in the Spanish press.

Miura PE backs MBO of GH Induction Group

Miura Private Equity has backed the management buyout of induction heating technology firm GH Induction Group from industrial holding company Corporación IBV.

Southern Europe unquote" November 2012

After a bleary-eyed summer, Southern European deal activity awoke in October with a notable increase in both volume and value.

PE-backed Cortefiel refinances €1.3bn debt

Spanish clothing retailer Cortefiel, backed by CVC, Permira and PAI partners, has refinanced €1.3bn worth of debt, according to reports in the Spanish press.