TA Associates

IK-backed Klingel bidder ELOS Medtech frontrunner in late-stage auction

German medical equipment firm also drew sponsor interest, with some dropping out due to valuation expectations

ESI Group advances talks with buyout firms as strategic interest wanes

Binding offers for the listed French software firm are expected pre-European summer

TA Associates waltzes to USD 16.5bn fundraise

Seven-month raise for the US-based sponsor’s fifteenth vehicle bucks fundraising woes faced elsewhere

AnaCap reaps 4.3x on MRH Trowe minority stake sale to TA Associates

German insurance broker will now be backed by both GPs; deal comes 2.5 years into AnaCap's investment period

The Bolt-Ons Digest – 20 March 2023

Unquote’s selection of the latest add-ons with Cinven's ETC, PAI's Apleona, TA Associate's Fairstone, and more

Hellman & Friedman kicks off talks for TeamSystem stake sale

Sponsors and sovereign wealth funds have been selected for discussions with the Italian cloud software group

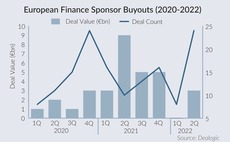

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

Ardian invests in TA Associates-backed Odealim

Sponsors will have co-control of the France-based insurance broker, with TA reinvesting

Hg invests in EQT, TA backed IFS and WorkWave

EQT VIII exits majority of its positions and reaps 3x money after two years invested in the cloud software companies

Equistone sells FirstPort to sponsor-backed Emeria

Deal for UK property management group marks first exit from Equistone Partners Europe Fund VI

TA Associates prepares Odealim for H2 exit

Lazard is likely to be mandated for the sale of the French insurance brokerage firm

Inspired Education stake sale attracts Blackstone, EQT, H&F, KKR

Information memorandums for the GIC- and TA Associates-backed national schooling company should be circulated next week

Nordic Capital invests in PE-backed RLDatix

Existing investors TA Associates and Five Arrows will retain their majority stake in the business

TA, LEA to merge Enscape, Chaos

LEA bought Enscape in 2020

First bids due for TA's Laboratoires Vivacy

TA Associates made an undisclosed investment in Vivacy in 2019

TA Associates buys Ambienta's Nactarome

TA beat contender Apax, which came second in the auction for the Ambienta-backed company

TA Associates takes minority stake in Foncia

TA secures a 25% stake, while Partners Group remains the controlling shareholder

RGI sale by Corsair Capital draws CVC, Nextalia interest

Carlyle, Investindustrial and TA Associates are also among the sponsors showing initial interest

Montagu sells Servelec to PE-backed Access Group

GP acquired the health and social care software developer in a GBP 223.9m take-private in 2018

TA buys Smiths Medical from parent Smiths Group

Deal gives the medical subsidiary a USD 2.3bn enterprise value

TA Associates closes TA XIV fund on $12.5bn

Firm also closes its second-generation re-investment fund, TA Select Opportunities Fund II, on $1.5bn

TA backs Söderberg & Partners in SEK 2.5bn share issue

The issue reportedly values the financial services company at тЌ2.27bn

TA Associates, Partners Group buy Unit4 in $2bn deal

Sale ends a seven-year holding period for Advent International, which took Unit4 private in a €1.2bn deal

Synova scores 4.5x on sale of Fairstone to TA

UK-based IFA consolidation platform is the first exit for Synova's third fund