News

Zurmont looking to sell Röder

Zurmont Madison Private Equity is currently assessing its options for a potential sale of its portfolio company Röder Zeltsysteme.

BGF announces communications director

Jon Rhodes has been appointed director of communications and marketing for the Business Growth Fund (BGF).

Chris Hanna joins Electra Partners

Electra Partners has appointed Chris Hanna as an investment partner.

IMS Group adds three compliance consultants

Compliance and regulation consultancy IMS Group has hired Diana Stevens, Cynthia Griffith and Daniel Sharpe as compliance consultants.

Partners Group has new presence in Paris

Partners Group has opened a new office in Paris.

Hazel Capital raises £41.6m for renewables VCTs

Hazel Capital has raised £41.6m for the Hazel Renewable Energy VCT 1 and 2 vehicles, which are now closed to new investments.

BGF adds new investment director

Duncan Macrae has joined the Business Growth Fund (BGF) as an investment director.

GE overcomes hurdle in Converteam trade sale

General Electric (GE) has reached an agreement with the US Justice Department (DoJ) allowing it to acquire French engineering group Converteam from Barclays Private Equity and LBO France.

Phoenix prepares to sell ASCO

Phoenix Equity Partners has hired Lexicon Partners to advise on a possible sale or part sale of ASCO Group.

Joseph Mukungu joins Neuberger Berman

Neuberger Berman has appointed Joseph Mukungu as senior vice president, head of client services for Europe and the Middle East.

Astorg leads FCI unit auction

French mid-cap firm Astorg Partners has entered into exclusive negotiations to acquire FCI's microconnections division from Bain Capital, according to sources close to the transaction.

Schalast & Partner appoints equity partner

Law office Schalast & Partner has appointed Hans-Peter Leube as equity partner in its Frankfurt office.

Micro Focus drops sale talks

UK software firm Micro Focus has dropped sale talks due to difficult market conditions.

Rumour roundup: Birds Eye, FCI, Orange and more

The summer period has been rife with rumours of major deals in the pipeline. unquote" gives a roundup of the headline-hitting deals expected in the coming months.

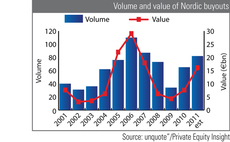

Nordic buyouts set to return to 2007 levels

Buyout activity in the Nordics could return to levels seen in 2007, according to unquoteт research. If Nordic deal activity continues at the pace seen in the first half of 2011, volume and value look set to fall just short of 2007 levels, marking a resurgence...

Olivia Roberts joins Palamon Capital Partners

Palamon Capital Partners has hired Olivia Roberts as associate principal.

Baker & McKenzie appoints senior counsel

Baker & McKenzie has hired Anouschka Zagorski to its banking & finance team in Frankfurt.

Jefferies appoints James Seagrave

Global securities and investment banking firm Jefferies has appointed James Seagrave as managing director of its Global Financial Sponsors Investment Banking Group.

Explorer in talks to acquire Inspecentro

Portuguese buyout house Explorer Investments is contemplating the acquisition of the entire share capital of motor vehicle inspection company Inspecentro.

ThyssenKrupp's nickel alloy unit attracts PE investors

ThyssenKrupp VDM, manufacturer and supplier of nickel alloys and precision engineering products, is drawing the interest of private equity bidders.

Octopus appoints venture partner manager

George Whitehead has joined Octopus as a venture partner.

JPEL buys Arch Cru portfolio for £56.5m

J.P. Morgan's Private Equity fund of funds (JPEL) has snapped up 38 investments from the former Arch Cru portfolios in a deal worth ТЃ56.5m.

Investindustrial pours water on Ducati sale speculation

Investindustrial has poured water on speculation that it is planning to float Italian motorcycle business Ducati in Hong Kong next year.

State Street adds new head of UK, Middle East and Africa

State Street has appointed Susan Raynes as head of its UK, Middle East and Africa institutional business.