In Profile: Silverfleet Capital

Following the close of Silverfleet Capitalтs Cimbria exit, Denise Ko Genovese talks to managing partner Neil MacDougall about fund performance, recent activity and strategy

"It was like doing a double backflip off the 10-metre board," says Silverfleet Capital managing partner Neil MacDougall, referring to the GP's buyout from Prudential and simultaneous fundraise in 2007.

Indeed, Silverfleet dates back to 1985 when the group was a subsidiary of the insurance firm, mandated to invest policy holder money. "Getting our own buyout over the line was a career highlight and ended up taking almost two years," says MacDougall. The GP now has two euro-denominated funds to its name.

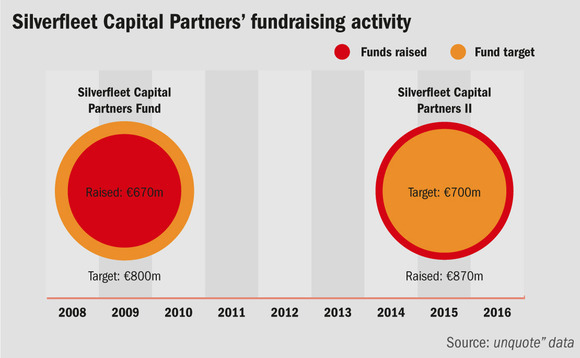

Silverfleet Capital Partners Fund closed on €670m in March 2007, shy of the €800m target. A key pension fund investor pulled out of equities, leaving a gap that was hard to fill in the investment climate of 2008-2009, says MacDougall. Fund I is fully deployed and committed through 10 investments, four of which have been exited.

"With the fourth exit [Cimbria], we will have repaid the fund since all of them generated over 3x money, with a DPI over 1.3x," says MacDougall.

The GP's second fund, Silverfleet Capital Partners II, closed on €870m in 2014, well above the original €700m target. The private equity house hit a hard-cap of €850m and the GP team added an additional €20m. The fund has so far made four investments and is 30% invested, says MacDougall.

In terms of LP base, Silverfleet I attracted 16 investors, the majority of commitment by value being UK insurance firms while Silverfleet II has 25 investors with the same bias towards insurance. "Only four LPs re-upped in Fund II, though they accounted for a significant percentage of the Euros committed," says MacDougall. "We just weren't the right strategic fit for some LPs anymore, the ones focussed on smaller GPs."

Four sectors, four exits

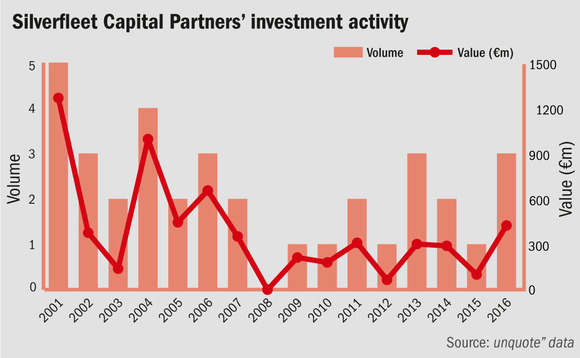

On paper, the two Silverfleet funds boast 14 investments but MacDougall is keen to stress that thinking of the firm's activity since the 1990s, the figure is well in excess of 100, pointing to the team's lengthy track record of investing Prudential policy holder and pension fund money.

This year alone Silverfleet has acquired three companies: French chemicals producer Coventya in March; UK aerospace company Sigma in May; and UK business training and employment agency group Lifetime Training in June. The diversity of these three alone attests to the GP's wide-ranging remit.

The GP invests in four sectors – business and financial services, healthcare, speciality manufacturing, and retail – across the UK, DACH, France, Benelux and the Nordic region.

And although these parameters could potentially be flexed to encompass almost any company in Europe, MacDougall insists that everything successful has a niche element to it.

Step in the right direction

Office Shoes, which Silverfleet acquired in 2010, is a prime example: a regular shoe company on the outside but in reality one that has contracts with several brands such as Converse to sell exclusive products to Office alone.

"One problem when we bought it was that it had a website that was selling things without knowing whether the warehouse had it in stock. So an early investment was to put in a fully integrated stock management system," says MacDougall. "The finance IT system had lost its 2008 data below sales in a computer crash so we did a lot of work checking 2007 and 2009."

As well as a hefty investment in IT with a new website launched and enhanced e-commerce with click & collect and tablets in store, other key developments under Silverfleet's ownership included the opening of 40 stores, strong cash generation enabling early senior debt repayment and the repayment of £25.3m of shareholder loan note interest. By the time Silverfleet sold the company in December 2015 after five years at the helm, EBITDA was £34m, up from roughly £22m.

We used a [large] bank club for Coventya and a unitranche from Bluebay for Masai, so there is the whole spectrum of lenders [in our portfolio]" – Neil MacDougall, Silverfleet Capital

While some mid-market private equity houses shy away from retail, Silverfleet embraces it. Currently in its portfolio are Danish women's clothing brand Masai, German fashion and consumer distribution brand Creatrade Holding and French wholesaler and retailer of women's fashion La Fee Maraboutee.

When it comes to financing its transactions, Silverfleet remains open-minded. "We used a [large] bank club for Coventya and a unitranche from Bluebay for Masai, so there is the whole spectrum of lenders [in our portfolio]," MacDougall says. For the re-cap of Office Shoes in 2014, Silverfleet used a bank club comprising HayFin, Lloyds and ING in a debt package akin to a senior term loan B note.

Silverfleet has made four exits so far from its existing funds. UK healthcare group Aesica generated 3.2x money in 2014; UK shoe retailer Office generated 3.3x money in 2015; German sausage casing producer Kalle was sold to Clayton Dubilier & Rice in April 2016 and generated 3.4x; and the €310m imminent sale of Cimbria to a trade player will rack up more than 3x.

In response to the obligatory Brexit question, MacDougall thinks UK manufacturing has a lot to gain, but how the British consumer reacts will be the real test, which will only become apparent over time. As for the impact on the private equity model itself, MacDougall is equally cautious in his optimism: "We implemented AIFMD [Alternative Investment fund Managers Directive] and our aspiration is - going forward - that this country will maintain equivalency to that legislation at least, but let's see how things pan out."

Key People

• Neil MacDougall, managing partner, joined in 1989 and led the buyout from Prudential in 2007. He currently chairs the GP's investment committee.

• Gareth Whiley, partner, joined Silverfleet in 1997 and heads the group's UK investment team with additional responsibility for the retail, leisure and consumer sectors, as well as activity in the Nordic region.

• Alexandre Lefebvre, partner, joined Silverfleet in 2011 as co-head of the French investment team. Prior to this, he was at Ixen Partners and Arthur Andersen.

• Guido May, partner, joined Silverfleet in 2001 from 3i and is responsible for the Germany, Austria and Switzerland region. He also heads the manufacturing investment activities.

• Adrian Yurkwich, partner, joined Silverfleet in 2005 and is responsible for the firm's investment activities in the financial and business services sectors.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds