In Profile: CBPE Capital

With CBPE Capital recently closing the acquistion of SpaMedical, Denise Ko Genovese talks co-investment appetite and the art of selling well with managing partner Sean Dinnen

"One of the skills of running a private equity business is ensuring timely returns of capital," says CBPE managing partner Sean Dinnen. "The key to this is selling those businesses that are less successful. You have to be disciplined," he adds, referring to the decision to sell Away Resorts in April last year around the same time as IDIS.

"We had two remaining assets in fund VII - and after the success of the IDIS sale, which generated 22x money, the best thing to do was to sell Away – which still made 1.1x money – so the fund was fully realised."

Another timely sale was for restaurant asset Côte. Despite owning the French-style bistro chain for less than two years, the GP expanded the group to 67 sites from 44 and grew EBITDA to £20m from £12m. The sale to BC Partners in July 2015 represented a money multiple of 2.9x and an IRR of 78%.

"At the end of 2014, a few restaurant deals were on the market and we had quite strong demand for Côte," says Dinnen. "Since BC Partners agreed to do the deal in a timely manner, we agreed and ended up returning 2.9x money in 22 months."

"Maybe the moment has passed for backing casual dining rollouts. The National Living Wage has had a massive impact on the industry so in retrospect the [Côte] sale came at a good time for us," says Dinnen. "Again, selling well is as important as buying well."

Milestones

The GP began life as Close Brothers Private Equity in 1984 as part of the Close Brothers Group, and, up until 2000, there were a series of five funds focused on minority stakes in deals with an enterprise value of up to £25m.

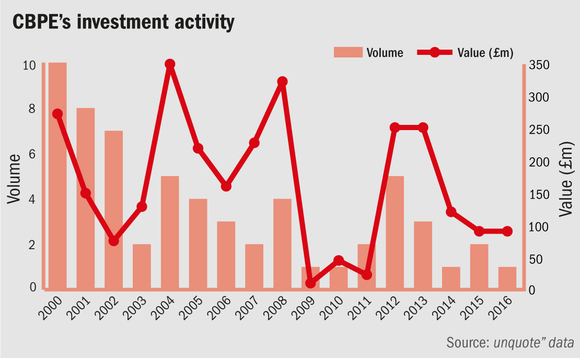

In 2000, the GP raised a £200m fund, CBPE Capital VI, and started doing buyouts and deals with EV from £25-100m. For the first time, its LP base incorporated international investors. Subsequently, CBPE Capital VII raised £360m in 2004 and was deployed in 12 companies and is now fully realised. Together, funds VI and VII generated 2.8x gross return on money invested.

Click here to view a complete profile of CBPE Capital IX, including a comprehensive list of LPs and their individual commitments, on unquote" data

In 2008 CBPE completed its own management buyout and officially rebranded as CBPE Capital. CBPE Capital VIII closed on £405m in 2010, and has been fully invested in 13 companies with only two exits so far. The GP's ninth fund CBPE Capital IX closed on £459m in August 2016. The target had been £425m and the £459m hard-cap was achieved.

One of the skills of running a private equity business is ensuring timely returns of capital. The key to this is selling those businesses that are less successful. You have to be disciplined" – Sean Dinnen, CBPE Capital

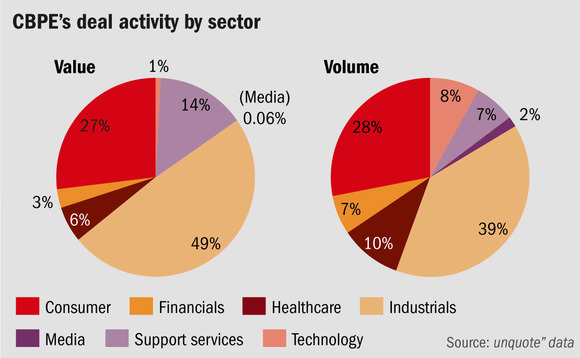

Since 2000, when the GP started making buyouts, it has recorded 43 investments, 30 of which have now been sold. A total of 12 went for a money multiple of more than 3x; four returned more than 7x; and two made in excess of 17x – chemical supplier to the coal and metal mining markets Minova and pharmaceutical supplier IDIS.

The remaining 13 current investments are ophthalmic services provider SpaMedica; Caravan manufacturer ABI; occupational healthcare provider OH Assist; captive insurance manager Kane; glass container group Allied; teleradiology group Medica; employee benefit and administration company Xafinity; furniture retailer Sofa.com; legacy consultancy Compre; energy solutions provider Anesco; fertility clinic group ARGC; corporate fund and private client services company JTC; and laboratory service Ingemino.

Voracious appetite

"We are asked about co-investments by LPs all the time. It is a fact of life these days. It has been for a while, but it is increasing," says Dinnen, pointing to investor relations director Eleanor Mountain, who was an LP herself before joining CBPE in 2013. "It was a fact of life five years ago but we are definitely seeing more appetite," says Mountain.

CBPE has historically completed two or three co-investments per fund – each of £10-15m in size. In CBPE Capital VIII, two co-investments were offered: in Côte and Allied.

In terms of investor base, CBPE has witnessed big change between the last three funds. A total of 30 LPs committed for fund VIII and 20 for Fund IX. In Fund VIII there were some smaller European family offices and fewer international LPs. Subsequently, in Fund IX, 60% were existing investors and 25% of the capital came from outside Europe.

Debt change

Having joined the firm in 1999, Dinnen has seen his fair share of market trends. But the biggest change over the last five years is the use of a debt adviser, he says. "Five years ago this wasn't the case but now we want continued good communication with the lenders, which an adviser can help to provide," says Dinnen. Indeed, with their help, it is a borrower's market for good companies, especially with the proliferation of direct lenders over the past few years.

As a private equity house, CBPE's use of debt is relatively conservative, with the average multiple on entry for Fund VIII investments (where debt was in place) at 2.7x. Though not averse to using direct lenders – Alcentra backed Anesco and European Capital supported Sofa.com – the majority of the GP's financing comes from the traditional banking community.

Key People

• Sean Dinnen, managing partner, joined CBPE in 1999 and is a member of the investment committee and executive committee. He has overall responsibility for the firm's investment activities, with a focus on the consumer, leisure, healthcare and pharmaceutical sectors.

• Ian Moore, partner, joined CBPE in 2011 and is a member of the investment committee. He has led several investments, notably in the business and financial services sector.

• Mathew Hutchinson, partner, joined CBPE in 2002 and is a member of the investment committee. He has a particular focus on the industrials sector and businesses the north of England.

• Anand Jain, partner, joined CBPE in 2007 and is a member of the investment committee. He has a particular focus on the healthcare and pharmaceuticals sector.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds