UK and Ireland small-cap soars amid general buyout lag

Buyout activity in the UK and Ireland is off to a slow start in Q1 2018, down against both Q1 2017 and the preceding quarters, while deals with an enterprise value of less than тЌ25m are on an upward trend. Oscar Geen reports

Unquote recorded more buyouts in the UK and Ireland in 2017 than in any other year since the financial crisis, a total of 215 deals worth €39.5bn according to the Annual Buyout Review. The largest growth bracket was for deals with enterprise values between €5-25m, which was up 84% year-on-year.

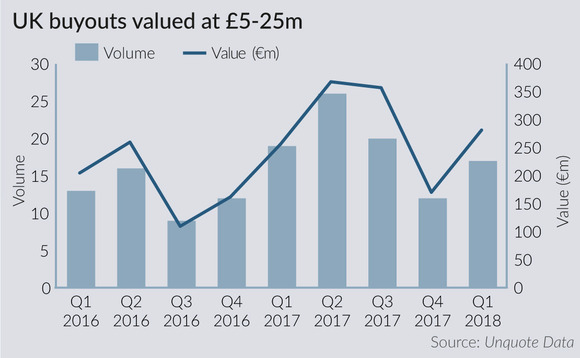

One of these trends has continued while the other has dropped off in the first quarter of the new year. Only 45 deals were completed in Q1 2018, compared with 65 in the previous quarter and 57 for Q1 2017. However, 16 deals were completed in the €5-25m segment, up from 12 in the previous quarter and just four short of the 20 seen in Q1 of 2017.

FPE Capital spotted the opportunity in this segment early and closed its maiden institutional fund on £100m in October last year to target the space. Managing partner David Barbour explains: "We have identified 55,000 UK-based SMEs with turnovers of £5-25m and around 40% of these are in the sectors we target: TMT, energy services, financial services and business services." This is also reflected in Unquote Data's deal statistics, which show that 99 of the 191 buyouts of this size were completed in the industrials or technology sectors.

Raw talent

Companies at this stage of their development need a lot more work than in the mid-market and therefore generally fetch lower entry multiples. Barbour says this is what makes them attractive to PE: "Businesses at this stage offer a significant opportunity for the right investor to add value. FPE does that by using its network to bring in personnel to support management teams, expanding and professionalising the sales and marketing functions to promote regional and international growth, and strategically positioning the company for a later-stage buyer."

"Being the first institutional investor in a company brings a lot of benefits, and organic value creation is much more likely at this stage," says Barbour. "Nine out of the 10 deals from our first fund were primary buyouts and, so far, all three from our second fund have been the same." Again this is indicative of the wider market, 82.5% of buyouts in the €5-25m enterprise value bracket were sourced from family or private vendors compared with 60% for all buyouts of UK companies.

FPE is not alone in this realisation, which has led to a few mid-market PE firms raising ancillary funds to get in on the action. "We are seeing a lot of the funds that would traditionally operate in the large-cap and mid-market space raising lower-mid-cap strategies and doing deals just above our size range," says Barbour. Silverfleet, Inflexion and Livingbridge are three GPs that have launched small-cap strategies alongside their primary mid-market buyout vehicles in the past two years, according to Unquote Data.

Being the first institutional investor in a company brings a lot of benefits, and organic value creation is much more likely at this stage" – David Barbour, FPE Capital

Launching multiple strategies to capture a wider range of deals makes sense in a competitive market, but Barbour says the problems start when businesses are misrepresented: "Some advisers have caught onto this and are marketing businesses aggressively, with the promise of lots of bolt-ons, in order to push the equity cheque up into the higher deal bracket, above where we invest, where they can achieve a higher multiple."

Whether these businesses can generate the expected returns at these multiples will remain to be seen. However, one area that larger funds would not be expected to struggle is with supporting international expansion. Barbour says that the US is often the most important market, although they have expanded companies to continental European corporates as well, notably making a 3x return on the secondary buyout of Small World by Equistone in March 2018.

"For the sectors we invest in, particularly software, the US is the logical market for expansion for cultural and linguistic reasons, but also for developing client relationships with large US strategics, which can generate exit opportunities," he says. "Our sale of Creditcall to NMI is a good example of this." FPE made 4.2x its investment on UK-based digital payments software developer Creditcall to US trade buyer Network Merchants in February.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds