UK-focused GPs getting creative with buyout sourcing

In a climate characterised by growing competition and record-high valuations, UK-focused investors are searching for new ways to deploy capital, with take-privates and minority investing proving particularly popular. Katharine Hidalgo reports

Growing competition has made it more difficult to acquire high-quality targets and generate strong returns across Europe. Despite political uncertainty, the UK has not been spared in that regard, with certain sectors and company profiles commanding hefty multiples. How to acquire companies at reasonable valuations is at the top of most UK-focused investors' minds, as Epiris partner Owen Wilson says: "More and more funds have been raised, which drives more competition for deals, increasing the need for creativity in finding deals."

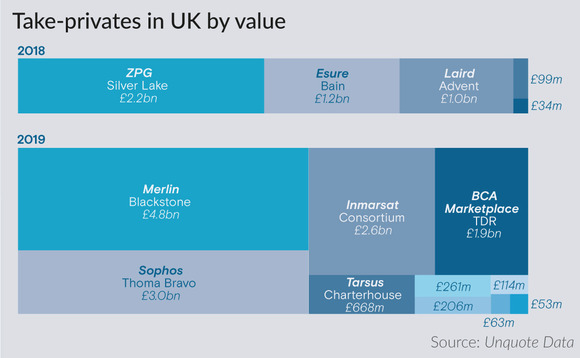

One way this trend has manifested itself is in the proliferation of take-privates. In 2019, 10 take-privates have been agreed in the UK and Ireland to date, up from five in 2018, according to Unquote Data. Mega-deals include Blackstone and the Canada Pension Plan Investment Board's £4.77bn bid for Merlin Entertainments. However, mid-market firms such as Bowmark Capital and Sovereign Capital also acquired listed companies this year. Epiris completed a £206m take-private of Ireland-based financial services business IFG Group in August 2019.

Floating PE's boat

Several factors have driven the popularity of take-privates in the UK, in addition to increasing competition. Primarily, valuations offered on the stock exchange can be more attractive than that of many private companies. The global co-head of Jefferies' financial sponsors group, Fotis Hasiotis, says: "The multiples and premiums being paid in UK take-privates are healthy, but prices are still undervalued relative to most other global markets."

Furthermore, the immense size of funds raised in recent years has put many listed companies within the reach of PE firms. This has been compounded by weakened sterling, which has made UK companies cheaper to international buyers, as well as making many of the FTSE's exporters more attractive based on overseas earnings.

In addition, severe losses on listed equities in 2008 and 2009 led to a change in attitude among both boards and shareholders, making them more likely to accept a private-equity-backed takeover offer. Philip Noblet, head of UK investment banking at Jefferies, says: "Post-crisis attitudes have readjusted and, in today's UK market, investors are willing to accept PE bids."

Public equities' weak returns exacerbated the attitude shift, encouraging investors to take returns where they can find them. Noblet says: "With the overall malaise of UK investors, they've become a lot more willing to take a private equity bid. You saw that with [institutional investor] Silchester and Cobham, [in which it held a significant minority stake and] voted in favour [of a sale] despite its public reservations." At the time of publication, the government was reviewing Advent International's £3.9bn offer for aerospace parts manufacturer Cobham.

The fact that GPs are taking on the risks associated with take-privates demonstrates the difficulty of winning traditional deals. As Epiris partner Alex Cooper-Evans says: "There's a different set of execution risks in a take-private, though there's always a competitive element." In the case that a GP is out-bid, a public airing of what went wrong may occur and exorbitant advisory expenses may be wasted.

Small but mighty

Minority investments are also an option for GPs looking to deploy capital creatively. As there are not as many GPs with dedicated minority investment strategies, the field is less crowded, potentially offering lower valuations for stakes.

In the mid-market, Three Hills Capital Solutions III – which is dedicated to minority investments and private debt – closed on €540m in January 2019. The fund made a £40m investment for a significant minority stake in UK-based telematics company Trak Global in August 2019. Inflexion also closed its second minority investment fund on £1bn in 2018. The option to offer minority investment rather than the acquisition of a controlling stake may help sway founding owners and provide an advantage in primary buyouts, as Unquote has previously reported.

In addition, in the small-cap market where primary buyouts are common, ADM Capital announced its minority-investing-focused Cibus Enterprise fund in March 2019, with a target of $75m.

However, large-cap funds, which are unlikely to target primary buyouts, have also caught on to the trend. Advent International's dedicated Global Technology fund targets minority and small control investments and closed on $2bn in September 2019. Blackstone Tactical Opportunities Fund III, a vehicle that offers flexible capital, held a close on $4.1bn in June 2019. The fund mainly takes minority stakes.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds