Growth capital: Quietly rising

As mega-buyouts slowly return to the scene, most media attention is focused on the high end of the market to see if it will maintain momentum. However, the biggest improvement for 2010 may well be a rather more low-key affair. Greg Gille reports on growth capitalтs stunning recovery.

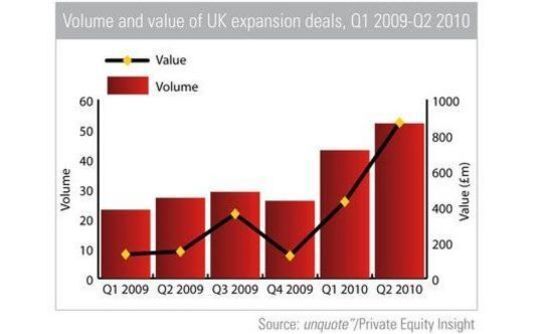

While the whole of Europe witnessed a notable improvement on the growth capital market in the first half of 2010, the UK clearly stands out as the most active player so far. According to unquote" proprietary database, Private Equity Insight, the 95 deals recorded since January almost match the 105 investments recorded overall in 2009. In terms of value, the combined £1.3bn of 2010 already trumps the £770m recorded over the whole of last year.

Better yet, the second quarter of 2010 saw a significant increase over the first, with a 25% uptick in volume, while the amount invested more than doubled. These encouraging figures seem to indicate that the market is gaining momentum; if the trend continues for the rest of the year, 2010 may well see a return to pre-crisis levels of growth capital activity.

The most obvious explanation has to do with the cycle of economic activity. Chris Allner, head of growth capital investments at Octopus Ventures, is not surprised by the recovery: "We're going through a normal cycle; as we get out of the recession, smaller companies are starting to grow again and need to raise money." This need for fresh funds is made even more beneficial to investors by the relative scarcity of debt - companies that find it difficult to borrow from banks see private equity as a more available alternative. "This lack of funding gives an opportunity for growth capital, especially with combinations of equity and mezzanine to minimize the risk," continues Allner.

The downturn might have been gruelling for most businesses, but it also opened interesting perspectives for the ones that managed to weather it. In a 'survival of the fittest' scenario, companies that emerged from 2009 unscathed are now eager for acquisition finance facilities to snatch up their competitors. "It's been a great time for the stronger companies," agrees Allner. "They're the ones who will come out of the recession the strongest, having consolidated their market."

A good example of how later stage growth capital investors can play a part in this can be seen with Sovereign Capital, which has been keen to pursue this build-up strategy with its portfolio companies Paragon and LM Funerals.

The impact of the recession on the property market also benefits healthy businesses looking for a roll-out of their activity, like Octopus Ventures-backed Gymbox. "More reasonable prices, weaker operators going out of business... Now is a relatively attractive time to acquire new locations, and these companies need funding," states Allner.

It remains to be seen whether growth capital investors can keep the pace for the rest of the year. If they do, it would be proof that a dearth of leverage and a slowly recovering economy, like all clouds, can have a silver lining.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds