UK consumer sector exits at record levels

The number of UK consumer goods assets divested by private equity firms is at its highest level in 10 years despite the continued desolation suffered by the consumer market.

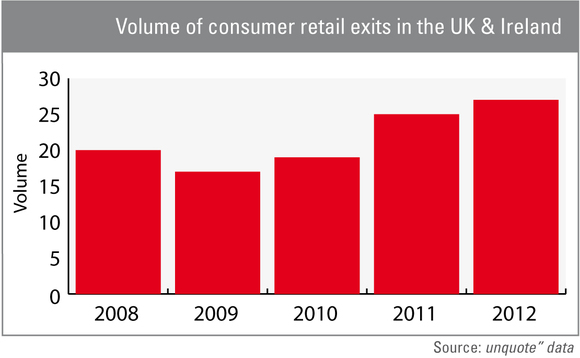

According to unquote" data, the industry exited 27 UK-based consumer goods companies in 2012, representing the highest number of divestments in this sector for more than 10 years. The figures also show that the number of realisations in this space has climbed steadily from 17 in 2009 to 27 last year.

Viewed on their own, the figures are encouraging – but when pitted against the backdrop of a continually weakening consumer market, the results are more than impressive.

This week, two new reports added further doom and gloom to the already depressed sector. First, the Confederation of British Industry (CBI) announced that retail sales fell at their fastest rate in more than a year in May. Through a survey of 69 retailers it was revealed that sales saw their steepest fall since January 2012, highlighting a persistent weakening of shopping activity.

Second was the Centre for Retail Research's (CRR) forecast that total store numbers in the UK will fall by 22% from 281,930 today to 220,000 by 2018. The report also predicted that a further 164 major to medium-sized companies would go into administration over the next five years, resulting in the loss of 22,600 stores and 140,000 jobs. CRR's report also revealed that consumer spending has risen by 12% since 2006, but the increased cash making its way into tills has been outstripped by retail operating rates, which have risen by 20%.

In April this year, retailers were forced to swallow a 2.6% increase to their business rates, after being hit by an additional £500m hike in business rates over the past two years. To tackle this, private equity investors have carefully selected which retail assets to invest in. "Private equity houses steer clear of businesses with a large real estate portfolio unless the leases are cheap or coming to an end," explains Tom Leman, partner and head of client relationships, core industries & markets at Pinsent Masons.

A closer inspection of the companies that were exited last year further vindicates the industry's ability to select the right companies to back. For practitioners investing in the consumer goods segment, brand names have always been a preference; a well-marketed brand instantly resonates with consumers.

Last year saw the divestments of Clipper Teas by Fleming Family & Partners to Dutch trade buyer Royal Wassanen; the sale of Raleigh Cycles by Perseus Capital to Accell; Bridgepoint Capital's sale of Symington's (parent company of Ragu, Chicken Tonight, Campbell's and Aunt Bessie's); Lion Capital's exit of Weetabix; and Rutland Partner's sale of Pulse Home Products, better known as Breville. "Over the years it is clear that private equity houses have targeted British brands that have proven their international growth credentials, such as Dr Martens, Cath Kidston and Wiggle," says Leman.

Outside of familiar brand names, the industry has also carefully selected recession-proof companies, such as LDC's Eveden, a specialist lingerie retailer protected from declining high street sales by targeting a niche market.

Although the number of UK retail exits is encouraging, not every divestment has been a success. The data shows that four of the 27 exits were made through insolvency processes. However, this figure is a big improvement on the nine private equity-backed retail insolvencies recorded in 2011.

In arguably one of the toughest sectors for private equity investing, last year's stellar performance on the exit market for UK consumer goods assets is something to celebrate, and clearly exemplifies the industry's vision when it comes to making careful investment decisions.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds