UK activity surges in July after slow start

Following a rather lacklustre start to 2011, the UK has seen a sudden spike in private equity investment activity this summer, and professionals will be hopeful this can continue through the rest of the year.

While the UK has long been the jewel in European private equity's crown, consistently being the largest private equity and venture capital market by both volume and value, the country experienced a shaky start to 2011. As unquote" reported in June, France has been rapidly catching up to the UK in 2011 with a string of high-profile deals as well as consistently high levels of activity in the mid-market. While the UK market is still larger, its share of the European market has taken a tumble in 2011.

However, unquote" has noted an increase in deal activity in the UK last month, and with numerous deal rumours currently circulating in the market, this could be an indicator that the country will recover its reputation as Europe's premier private equity destination.

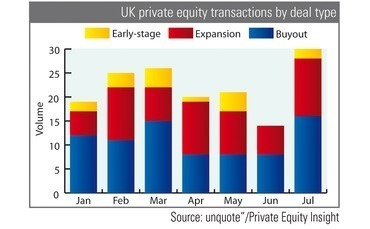

July has seen more deals than any other month so far this year with 30 transactions recorded, more than double the 14 seen in June and 13% higher than the 26 in March, the second most active month.

Buyout and expansion deals were the primary growth areas, with both seeing deal numbers double in July compared to June with 16 and 12 deals respectively. There were two early-stage deals compared to none in June. The increase in buyouts was particularly notable following several months of low deal activity.

While this uptick in activity will be welcomed by industry professionals, there are still numerous economic concerns affecting the UK and Europe. Economic worries regarding sovereign debt have worsened significantly in recent months, with a downgrading of the US's debt rating and fears that Italy and Spain could default, threatening the stability of the Euro. Britain itself is facing severe public sector cuts and social unrest, which are likely to further dampen economic recovery.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds