A third of deals in doubt from September

Recent changes to the Takeover Code would have impacted 32% of UK deals since 2005. But if properly considered, P2Ps will still be do-able. Kimberly Romaine reports.

In just over a month's time, take-privates will become much more difficult for private equity firms targeting UK-listed businesses. This is because, despite efforts by the BVCA, the changes to the Takeover Code will go ahead on 19 September.

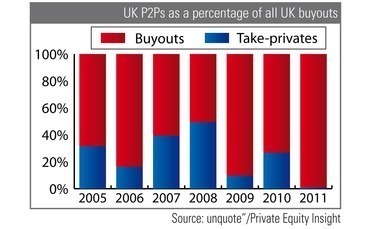

According to unquote" data, roughly one third of the UK deal value since 2005 has been from P2Ps. The figure was highest in 2008, when half the value of UK deals stemmed from de-listings.

These changes include identifying offerors at the start of an offer period, which may deter publicity-shy parties from bidding and therefore drive down pricing as a result of decreased competition. The other, more contentious change, involves the 28-day "put up or shut up" clause that forces identified offerors to make an offer or retreat after 28 days.

"The proposed change to the Takeover Code of a 28-day ‘put up or shut up' limit creates a new, un-level playing field between cash-rich corporates and private equity firms, which must secure funding and do extensive due diligence," BVCA chief Mark Florman said.

Not all GPs agree, with many telling your correspondent they were not fussed, for two reasons: Firstly, take-privates do not form a meaningful part of their dealflow (less than 7% of UK deals done since 2005 have been from stock markets). And secondly, when they do consider a P2P, the 28-day limit would not be disastrous, since they will only pursue such a deal if they have done proper diligence on the target and can proceed promptly.

There is scope to extend the 28-day period if the target consents, indicating that the rules are intended to deter hostile bids rather than friendly approaches, according to David Petrie, head of the ICAEW's Corporate Finance Faculty: "The Panel is looking to see that private equity is really serious about bidding for listed entities and will therefore have to do as much pre-work as possible. The fact they'd be named earlier in the process should encourage more friendly approaches; the Panel is aiming to discourage any hostile or ill-considered bids."

Larger players are more reliant on stock markets for their deal flow: P2Ps have accounted for £45.6bn of £149.7bn of UK deals done since 2005, and spread across 73 deals, corresponds to a hefty average deal size of £625m.

It is these larger players that will be most impacted, given their reputation for making ill-considered bids in an effort to drive up share prices. If such players are deterred from making public offers, there could be downward pricing pressure on listed assets, according to Christopher Field, partner at Kirkland & Ellis: "Sponsors are going to be more cautious before making an approach and will most likely reduce the number of approaches they consider making - which is ultimately going to be to the detriment of target shareholders."

Any drop-off in P2P activity may go unnoticed, since numbers have already been on the wane since 2009. Following a 2008 peak, 2009 saw take-privates account for just 9% of deal value in the UK. The figure picked up in 2010, with just over a quarter of value accounted for by P2Ps, but this year it is a paltry 1%.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds