Private equity to benefit from oil & gas boom

The high price of oil could provide a boom to many operating in the oil & gas sector in the UK, and private equity players are looking to take advantage of the opportunities it offers.

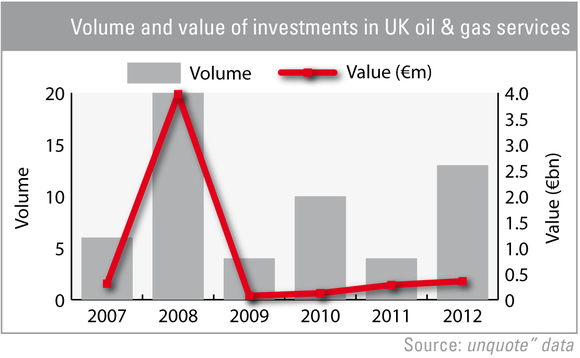

Figures from unquote" data show the number of investments in oil & gas services companies – those businesses that provide a range of specialist products and services to oil producers – hit its highest level since 2008 last year and 2013 looks set to be even busier for the sector.

In 2012, there were 13 investments in UK oil & gas services companies totalling £358m, up considerably from the four deals worth £284m in 2011.

Jimmy Williamson, director at Lloyds Acquisition Finance in Aberdeen & Edinburgh, says the high cost of oil is helping to support a boom in demand for the kind of services UK oil & gas specialists can offer.

"Today's oil price means it is becoming more viable to extract oil in hard-to-reach, hostile locations and UK-based businesses have a lot of knowledge and experience in this gained from working in the North Sea," he explains.

UK oil and gas businesses had suffered several difficult years in the wake of the 2009 recession, but a growing need to extract oil from more difficult locations, along with greater health and safety demands following the Deepwater Horizon incident – which saw huge quantities of oil leak into the Gulf of Mexico and vast fines for BP – means many British businesses with specialist knowledge offer significant growth potential. Political instability in the Middle East, one of the few regions with large quantities of easily accessible oil reserves, is also driving up the price and increasing the need to extract oil in hostile environments.

Recent deals include an investment in Integrated Subsea Services by Oaktree Capital, thought to value the business at over £100m. The company provides support services for oil and gas rigs, including diving and remotely operated underwater vehicles. In December, Dunedin backed Premier Hytemp Group, a company which provides engineering components for oil and gas exploration.

Research suggests that the market is set to grow even further in the coming years. Specialist energy advisory business Douglas-Westwood forecasts worldwide deepwater capex is set to hit around $335bn between 2012-2016.

"The market is very buoyant right now and is driven by different growth dynamics to the rest of the economy," says Williamson. "Demand is being driven primarily by the BRIC economies – China in particular – has a lot of demand for oil."

With the UK market already exhibiting strong interest for private equity players, driven by the siginificant expertise built up in Aberdeen, it seems oil and gas services will be a sector to watch next year.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds