Deals, leverage on the up but refinancing remains a worry

Renewed confidence is propelling the nascent recovery. But pressure to deploy capital and refinance companies means uncertainty persists. Kimberly Romaine reports.

The industry will require more than £3bn of debt this year to fund a wave of new deal doing, with nearly two thirds of the market expecting activity to pick up and less than 4% anticipating a decline. "Confidence has returned amongst private equity professionals," says Mo Merali, head of private equity at Grant Thornton, the firm behind the statistics. "Coupled with the shifting of their focus from managing and supporting their portfolios to making new investments will add further impetus to new deals." What's more, yesteryear's deals are performing well: a staggering 85% of respondents expect their portfolio companies to meet or exceed targets in 2011.

The figures are from the latest Private Equity Barometer, carried out for Grant Thornton by IE Consulting, and canvassed the opinion of more than 100 UK private equity professionals.

The survey found 39% of respondents are likely to need £25-100m of debt this year, and 15% will require more than £100m (see Graph 1). The increased appetite of banks coupled with new sources of funding should make this possible, says Ian Sale, MD at Lloyds TSB Acquisition Finance: "Good quality deals shouldn't struggle to obtain senior debt within the leveraged finance arena this year and, at the bigger end of the market, high-yield bonds should help meet a proportion of the demand for funding."

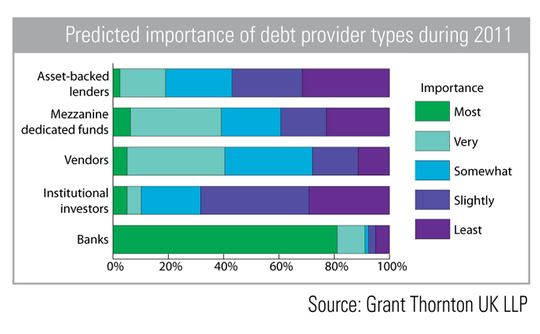

Merali suggests creativity on the part of GPs will help meet the demand, too: "Private equity firms clearly seek debt to leverage their investments and generate returns. They have, however, adapted their investment models to cater for lower debt multiples than those seen before the credit crunch and are prepared to fill the gap by providing more equity. We are also seeing an increase in creative debt structures provided by boutique mezzanine and junior debt funds as well as willingness from asset-based lenders to support certain buy-outs."

Pressure's on

But it's not all good news. Some of the anticipated deal doing may be down to GPs feeling pressured to deploy capital. "There are a number of reasons why we will see more investment activity," explains Merali. "In addition to renewed confidence, another is the pent-up demand for private equity firms to put their money to work in order to generate returns for their investors." Though impossible to get anyone to admit this on the record, the survey revealed that 30% of respondents have already or expect to ask investors about extending the investment period of their current funds.

Additionally, though the need to refinance companies has stopped gathering pace, it still worries some, with nearly one third fearing the wave of refinancings due in the coming years poses a threat to the industry. 41% of respondents are unlikely to need to refinance any portfolio companies this year. The same percentage expect to refinance less than one in ten portfolio companies and just 5% are likely to have to refinance a quarter of their portfolio.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds