Buyout values bounce back in 2010

Buyout values in the UK have bounced back in 2010, suggesting improved leverage conditions. Figures from unquoteт Research suggest the market is on its way up once more. John Bakie gives an overview

Recovering economic and business conditions have been very much the talk of 2010, and the private equity industry has been more optimistic, despite continuing worries about sovereign debts and cuts to the public budget. This is, perhaps, particularly true for those at the top end of the market, where the freezing of debt markets in late 2008 led to a sharp and sudden withdrawal of private equity groups from top-level buyouts.

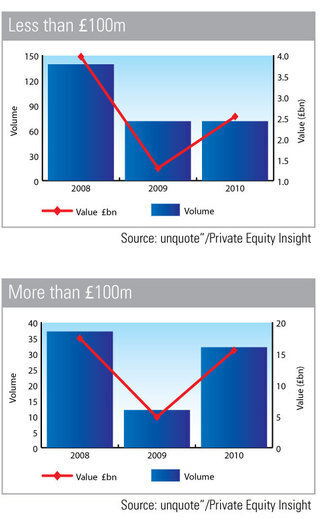

Numbers from unquote" Research show just how much the industry has progressed, and demonstrates a rapid rebound in investor confidence. Analysis of all buyouts for the past three years shows those valued at over £100m are close to approaching levels seen in 2008. Total deal value in this market segment has reached £15.5bn so far this year, just £2bn short of that seen in 2008. Deal volume could also catch up with 2008, with 32 deals this year compared to 37 two years ago.

Looking at deals valued at less than £100m, and a trend towards higher-value deals is revealed. While the number of deals completed to date in 2010 is a 71, the same as seen in 2009, the value of these deals has increased substantially to £2.53bn from £1.29bn. So far in 2010, average deal value in the under £100m space has hit £35.6m, compared to just £18.1m last year. Mean deal value is even higher than in 2008, which saw an average of £28.5m across 139 deals.

While a number of very large deals, including Pets at Home, RBS WorldPay and Tomkins, could be blamed for skewing numbers at the top end of the market, the trend in deals worth less than £100m suggests more and more capital is being deployed for buyouts. With larger deals happening despite several poor fundraising years, it seems likely that more leverage is not only needed, but is being used.

The bounceback in market confidence and buyout activity is perhaps surprising, given the doomsday scenarios two years ago. The recovery in buyout values suggests leverage markets are loosening up. However, with recent predictions suggesting the UK economy could slow down again at the end of year, it will still be some time before we can say it's business as usual for LBO professionals.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds