ECI reaches £700m hard-cap for fund 11 in less than three months

UK-based mid-market player ECI Partners has announced the first and final closing of its 11th buyout fund on ТЃ700m.

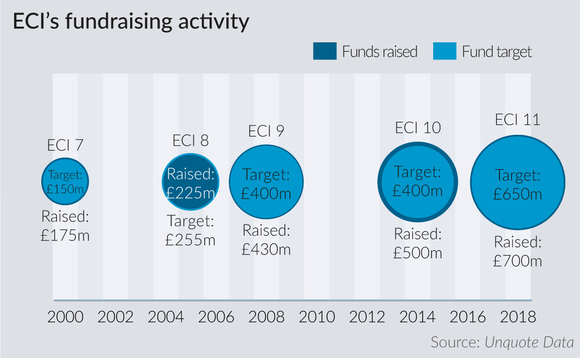

ECI launched the fundraise in mid-April this year with a target of £650m – Unquote Data reported on the vehicle being registered in the UK in early May. ECI 11 eventually closed on its £700m hard-cap less than three months later.

ECI 11 is 40% larger than its predecessor, which closed on £500m in 2014. That vehicle was also raised in a short amount of time, having been launched in April that year with a target of £400m. ECI 10 is now deployed at around 70%, with enough left to finance three deals to be announced over the summer, and a number of bolt-ons for portfolio companies, Unquote understands. The fund's predecessor, ECI 9, closed in December 2008, raising a total of £437m.

Founded as Equity Capital for Industry in 1976, ECI has now raised £2.4bn in external capital since launch, according to a statement. The firm also claimed it had set a new record for the number of buyout funds focused on the same strategy raised by a UK PE firm.

ECI 11 was raised without using a placement agent. Macfarlanes acted as lead legal counsel.

Speaking to Unquote, managing partner David Ewing said the firm expected the fundraise to be quick given the marks of interest received in recent months from prospective LPs, as well as ongoing discussions with existing investors. ECI had to scale back a number of investors in the fund given the demand, including some previous investors that missed out after having been caught off-guard by the speed of the fundraise.

Ewing added that terms and conditions for the fund were "market standard", and did not come up as a significant consideration in discussions with investors during the fundraise.

Investors

According to ECI, fund 11 was "materially oversubscribed" with a re-up rate of around 80% by existing investors. The LP base comprises 25 institutional investors, including pension funds, insurance companies, funds-of-funds, endowments and family offices from across the UK, the US, Europe and Asia.

ECI's goal in recent fundraises has been to diversify its investor base, Ewing told Unquote, with the shift for fund 11 being a slightly more international LP group and a slightly higher representation of pension funds. Around 40% of the capital came from North America, and ECI also welcomed its first Japanese investor.

Click here to view an extensive list of LPs in the fund's predecessor, ECI 10, on Unquote Data

Investments

ECI 11 will stick to its predecessor's strategy – it will focus on growth buyouts in UK companies with an enterprise value of between £20-150m. Given the larger amount raised for the strategy this time around, ECI will aim to make a slightly higher number of slightly larger investments, Ewing said. While the average ticket for ECI 10 was around £40m, it should be around £45m for the new fund, he added.

ECI also intends to make more bolt-ons to its portfolio companies than was the case previously, which partly explains the higher target for fund 11.

People

ECI Partners – David Ewing (managing partner).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds