Mobeus in £18m Tessella MBO

Mobeus Equity Partners has pumped ТЃ18m into science-focused technology and consulting services provider Tessella, marking the GP's first buyout since its spinout from Matrix Group.

The deal was a combined debt-and-equity package from Mobeus, which allowed the VCT to write a larger cheque than is standard, while also simplifying the transaction.

Following the deal, Mobeus intends to bring Tessella's sales approach up to date – currently it is marketed by word-of-mouth. It will also review the company's IP to potentially capitalise on Tessella's "knowledge" built up over its 30+ year history, according to Mobeus.

Mobeus was introduced to the deal by Wendy Hart at Grant Thornton, who led the deal.

Company

Tessella was founded in 1980 and is based in Abingdon. The firm opened an office in Den Haag in 2000 and expanded into the US in 2003; it currently has offices in Boston and Washington DC. Today, Tessella employs 200 people and generated turnover of more than £18m for the year to 31 March 2012.

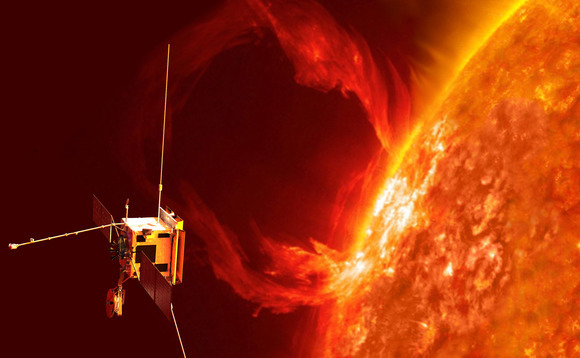

The business has worked with the European Space Agency to design a satellite to send to the sun as well as the UK Government to provide flood water and defence modelling.

People

Guy Blackburn and Tom Chaloner will join Tessella's board to represent Mobeus. Alan Gaby is managing director of Tessella and led the management team. Mobeus operating partner Steve Curl joins Tessella as investing chairman while the company's founder, Kevin Gell, remains on the board in a non-executive capacity.

Advisers

Equity – Osborne Clarke (Legal); PBD Consulting, Lisa Whelan (Commercial); HW Corporate Finance, Charles Whelan (Financial).

Management – HMT Corporate Finance, Andrew Thomson (Corporate finance).

Vendor - Grant Thornton, Wendy Hart, Paul Short (Corporate finance).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds