In Profile: IK Investment Partners

Having recently closed its first dedicated small-cap fund and with its next mid-cap vehicle likely on the way, IK Investment Partners has remained close to the investment philosophy driving the firm for its quarter-century history. Mikkel Stern-Peltz speaks to CEO Christopher Masek

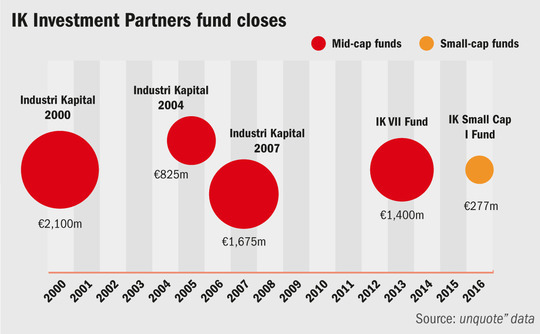

While the past decade has seen many European mid-market private equity firms raise increasingly bigger funds and creep into the large-cap space, London-headquartered IK Investment Partners' latest vehicle – a €277m small-cap fund – stands in stark contrast to the market trend.

The GP held a final close for the fund in March 2016 after a year on the road, surpassing its €250m target. It marks a return to the market segment where IK cut its teeth after it was founded by Björn Savén in 1989 with the launch of its €108m Scandinavian Acquisition Capital fund, within the Swedish bank SEB.

"It was a very refreshing experience to launch our small-cap fund. It's something we've been thinking about for quite some time. Like many funds, you consider what options you have and which areas you can develop," says Christopher Masek, the firm's co-managing partner since 2008 (and CEO since 2015) when he and now-CIO Detlef Densel took over day-to-day operations from founder Savén. He notes how European firms have diversified their operations, with credit and real estate being among the more fashionable choices.

"We've seen other funds that've gone into real estate, debt, distressed – it's a little bit associated with whatever the flavour of the month is and for us that's just not the way we want to operate. This has got to be consistent with what our strengths are," says Masek.

For IK, the choice to raise a small-cap fund was anchored in the firm's historical experience in the sector, as well as the fact it was still seeing considerable dealflow in the space but was unable to act on opportunities due to their size relative to IK's mid-cap vehicle, Masek says. For IK, the small-cap space is also one with less aggressive valuations than the upper-mid and large-cap segments where explosive fundraising has added to ever increasing entry multiples.

Furthermore, Masek sees the return to small-cap as part of the firm's evolution: "It's an opportunity for us to develop and grow as an organisation, which gets you up in the morning and makes you able to attract, retain and develop quality talent in your organisation."

Nordic roots

Headquartered in London since breaking away from SEB in 1993, IK's roots are still very much in the Nordic region. Half of the deals in its most recent mid-cap vehicle – the 2012-vintage €1.4bn IK VII Fund – were Nordic companies.

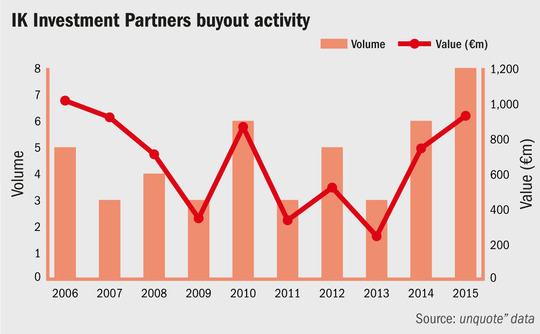

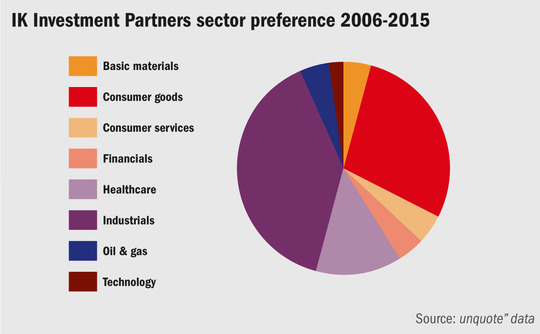

Notable Nordic deals in IK VII include Finnish vacuum toilet maker Evac, which the GP acquired after years of lying in wait, and the DKK 700m dual buyout of Danish premium foods companies Meyers and Løgismose in December 2014. Both deals are illustrative of sectors in which IK is particularly bullish: food and specialised industrials, though the firm's deal history also confirms Masek's mention of consumer goods and business process outsourcing as favourite verticals.

Generally, the GP's strategy sees it target deals with enterprise values in the €100-500m range for its mid-market vehicles and less than €100m for its small-cap fund, across the France, Benelux, DACH and Nordic regions.

Old boys

Despite being the oldest Nordic buyout house, it has not followed the example of its Nordic peers and grown its funds into the large-cap space. Apart from its 2000-vintage fund that closed on €2.1bn, IK's vehicles have been of a size more typically associated with the mid-market since 1999, closing three of its past four funds on an average size of around €1.5bn.

By comparison, former Nordic mid-market competitors Nordic Capital and EQT have raised increasingly larger funds over the same period. Nordic Capital grew its fund size from €800m in 2000 to €3.7bn in 2007 and €3.5bn in 2012, while EQT's most recent vehicle set a Nordic fundraising record at €6.75bn.

"The position and decision we took some time ago is that we identified a space, size of transactions, and markets we wanted to stick to; where we felt we were very strong and where we have real differentiating factors," Masek says.

"This is somewhat contrarian because many funds, particularly today, when they address the market and go fundraising will seek to raise as much money as they can possibly raise. Even if that means developing into a completely different bracket and ultimately developing into another space and out of character from where they were positioned before," he says.

By positioning itself in the mid-market space while other GPs have grown out of it, Masek believes IK has created an advantageous position for itself, in part by reducing competition from large pan-European funds. The lower end of the European mid-market space is predominantly made up of GPs focusing on single geographies or a smaller handful of countries, as opposed to IK's broad European remit. According to Masek, IK has seen success in pitching itself to management teams by leveraging the firm's track record of growing companies from local to European players.

The firm's Nordic roots have served the company well and distinguish it from its "Anglo-Saxon counterparts" when it comes to management teams and sellers, says Masek. IK's approach is more focused on the management team and owners' strategy and vision for the company during the initial meetings in an acquisition process, according to Masek, whereas he sees Anglosphere funds as more finance-focused.

We are risk-takers, but we are risk-takers in areas where we feel we are on solid ground. That starts with size, but also territory and sectors" – Christopher Masek, IK Investment Partners

"Typically, when we meet with management groups in the mid-cap space, where a UK-based fund has met with them before us, management will tell you that that fund would have probably spent more time with the CFO and more time working on numbers, financial modelling and leverage, than speaking about strategy and operations," he says. "We take an approach – whether you call it Nordic or continental European – which is much more focused on strategy, operations and execution, rather than just honing in on the numbers."

Sources familiar with IK's performance say the firm targets a net money multiple in excess of 2x for its funds and has so far achieved that to date. As such, IK is seen by some in the private equity industry as a somewhat conservative firm. Indeed, a disagreement between founder Björn Savén and partner Harald Mix – in part over the firm's strategy – saw Mix break away from the firm to found rival buyout house Altor in 2003, with Mix himself later saying he probably had a larger appetite for risk than his fellow IK founder.

For his part, Masek rejects the idea that IK is a conservative firm: "We are risk-takers, but we are risk-takers in areas where we feel we are on solid ground. That starts with size, but also territory and sectors.

"I think it's refreshing to see now that a lot of the investors are catching on to what we're doing and really see us as Europe's best kept secret."

The team

Christopher Masek

A London-based member of the investment committee, Masek joined IK in 2000 and was part of the team that succeeded founder Björn Savén in 2008. CEO since a firm reshuffle in 2015, he had originally joined the company from KPMG Corporate Finance in Paris, which he had helped found in 1990.

Detlef Dinsel

Appointed co-managing partner alongside Masek in 2008, Dinsel has since been appointed chief investment officer in the 2015 reshuffle. He heads IK's DACH team and investment committee, having joined the firm in 1996. Prior to IK, Dinsel was a manager for Bain & Company and the managing director of ventilation systems maker Schmidlin.

Dan Soudry

Joining from ABN Amro Capital in 2003, Soudry is the chief operating officer of IK. Prior to his time at IK and his stint at ABN, he worked at KPMG Corporate Finance and Paribas in France. COO since 2015, Soudry is based in Paris and heads the firm's French team.

Mads Ryum Larsen

Partner Mads Ryum Larsen joined the firm before it became IK Investment Partners. His time at the firm – then known as Scandinavian Acquisition Capital – began in 1990, joining from an investment boutique in Denmark.

Björn Savén

Having founded the firm in 1989, Savén was chair and CEO until 2008, when he shifted into the role of executive chairman and let Dinsel and Masek take over day-to-day operations. Since 2012, he has been the non-executive chair of IK, based in London since the firm's inception.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds