In Profile: Livingbridge

With a final close on £660m surpassing target for Livingbridge 6 last week, Denise Ko Genovese talks to the GP's managing partner, Wol Kolade, about digital expertise and plans to open a US office in 2017

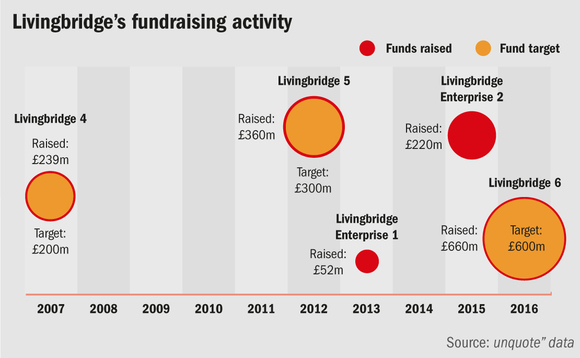

UK-based GP Livingbridge currently manages four funds, two of which are being actively invested: Livingbridge 5 closed at £360m in 2012 and is over 70% deployed; Enterprise 2 closed at £220m in 2015 and is 20% deployed in five transactions; while Livingbridge 6 made a final close at £660m this month after a first close at £445m in July this year (the target was £600m). Additionally, the GP manages evergreen venture capital fund The Baronsmead Venture Trusts, which makes £5-10m equity investments at a time.

To view a full profile of the Livingbridge 6 fund on unquote" data, including a list of LPs committed to the vehicle, click here

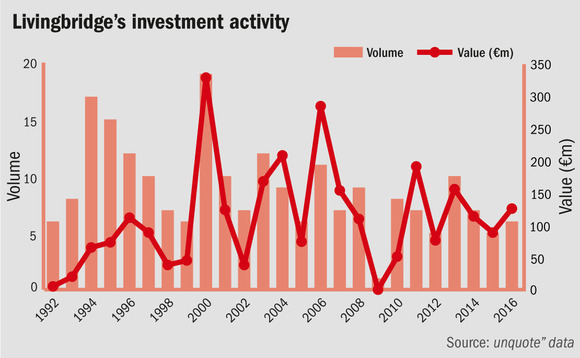

"We have been at this since 1998 and have done more than 100 primary deals, plus 30-40 add-ons," says Livingbridge managing partner Wol Kolade, adding that there have been 70 exits to boot.

By June this year, the GP had already made five investments; a minority stake in UK-based procurement company Efficio in January; expansion capital for UK heating-oil price comparison site Boiler Juice in March; an MBO of UK biscuit and cracker company Fudge in April; the acquisition of UK online ferry ticket aggregator Direct Ferries in April; an £8m investment in senior executive search and networking service The Up Group, also in April; and the buyout of UK telco firm Southern Communications in June.

The private equity group also made a late summer acquisition in the guise of clinical consulting business Four Eyes Insight at the end of August, marking the sixth investment for 2016.

In terms of exits, Livingbridge and ECI Partners announced the sale of corporate travel management company Reed & Mackay to Inflexion at the start of August generating a multiple of 3.4x cost to investors. In June it also exited insurance broker Kingsbridge Risk Solutions to Dunedin and IT infrastructure Group Onyx to trade buyer Pulsant. Prior to this, Frank Recruitment Group (FRG) was the only realised investment of 2016 – sold to TPG Growth in April. But just before year end, Livingbridge also exited vehicle rental group Nexus to Bowmark delivering a money multiple return of 4.5x at an IRR of 26%. The company's turnover grew five times since Livingbridge acquired it in 2008.

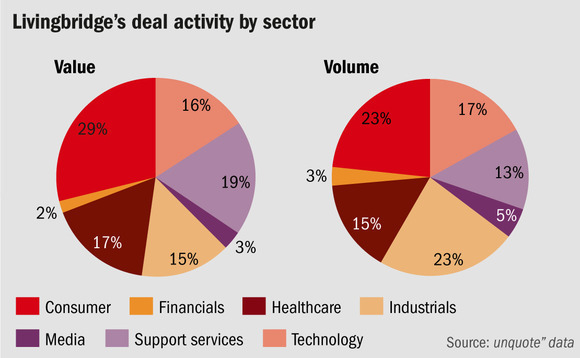

The private equity firm was set up in 1998 and, though its portfolio seems eclectic, its common thread is that its investments are services-led. The GP operates in the UK lower-mid-market investing in small and fast-growing sectors – consumer, healthcare, IT, business services and education. "We do majority and minority investments and don't differentiate between the two," Kolade says. "The important thing is that we want to interface with entrepreneurs and operate in service-led sectors."

Although very much a UK-based mid-market house, the GP has always had an eye on overseas expansion. It opened an office in Melbourne, Australia, earlier this year and already has its sights on opening one in the US – Boston or New York – in 2017. "We're hoping for a US office next year but the right person is absolutely key," says Kolade, adding that Gareth Young, who set up the Australia office, previously worked for Livingbridge for eight years in London.

The idea is to have a platform on the ground mainly in a support role function to help expand operations, but it could also lead to sourcing add-ons as well. "We want to increase our international capability and, since our last five investments have had a growing international presence, it makes sense. Some businesses we bought started with 30% revenues in the US but grew to having more than 60% sales from across the Atlantic. The US is a very good market and we want to play to that."

Livingbridge's investment Frank Recruitment Group was a case in point. The company specialises in recruiting permanent and temporary contract candidates into vacancies relating to enterprise software. The GP acquired the company in 2013 and opened a San Francisco branch at the same time. Within three years, the split of revenues from the US skyrocketed from 20% to 60%.

"A US-based Livingbridge office will only help companies like this, in terms of know-how and infrastructure," Kolade says, citing Efficio and YSC as portfolio companies that should benefit as well.

The digital challenge

Kolade believes finding online expertise is one of the biggest challenges facing a private equity house in 2016: "It [digital expertise] is scarce and not enough people have risen through the ranks yet so the pool of talent is small."

Kolade uses the example of retail where the difference between online and in-store is like chalk and cheese. "Online retail is actually a very difficult task," he says. "Tangible retail is all about the state of your shop, whereas being a retailer online is being like a wheelbarrow in a market, it all depends on whether they look at your wheelbarrow."

Livingbridge's e-commerce investments have included cycling retailer Wiggle, car hire broker TravelJigsaw and beach holiday retailer On The Beach. "The challenge is that we want to invest in what will be hot tomorrow, not what is hot today, and that is counter-intuitive."

Key People

Wol Kolade leads the Livingbridge team. He graduated from Kings College London in engineering and has an MBA from Exeter Business School. After starting his career with Barclays in 1990, he joined Livingbridge's predecessor firm in 1993. Kolade is also chairman of the Guy's and St Thomas' Charity, a 500-year-old charitable foundation with total assets of £600m.

Shani Zindel is a founding partner and chief investment officer, responsible for driving deployment across the funds. She leads Livingbridge's new investment teams.

Mark Advani is a founding partner and broadened the firm's reach in the UK by opening offices in Manchester and Birmingham. Over the last year he has led the opening of the first international office in Australia, and is now looking to the US.

Mark Turner is co-head of Livingbridge's Value Strategy Group – the team that works with portfolio companies throughout the life of the investment. Mark is also a founding partner of Livingbridge.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds