LP Profile: Finnish pension fund Keva eyes larger investments

Markus Pauli, CIO for alternative investments at Finnish local government pensions institution Keva, tells Kasper Viio how the LP’s appetite for buyouts has increased over the years

Serving 1.3 million recipients, Finnish pension fund Keva is in charge of handling the pension schemes of the local government, state, Evangelical Lutheran Church of Finland and Kela, the Social Insurance Institution of Finland.

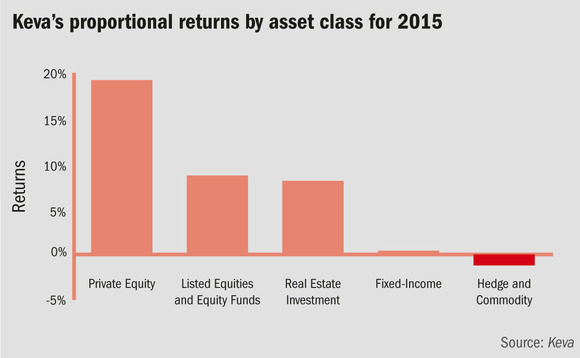

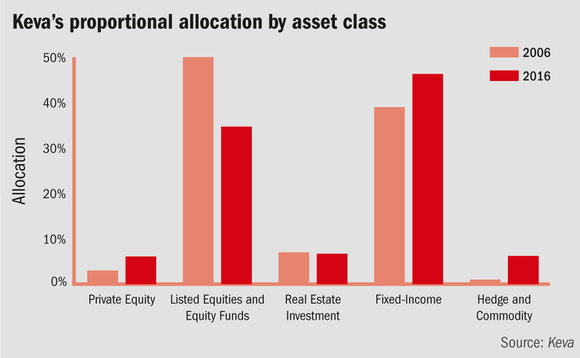

Keva's CIO for alternative investments, Markus Pauli, leads a seven-strong alternatives team, which manages a portfolio of assets worth more than €6bn across buyouts, hedge funds, indirect real estate and infrastructure. Of all the asset classes that Keva invests in, including alternatives, its best result over 2015 was generated by private equity buyout funds, which returned 19.2%. At year end, the market value of the private equity and venture capital investments covered 6.1% of Keva's investment portfolio and today the portfolio value has risen close to €3bn.

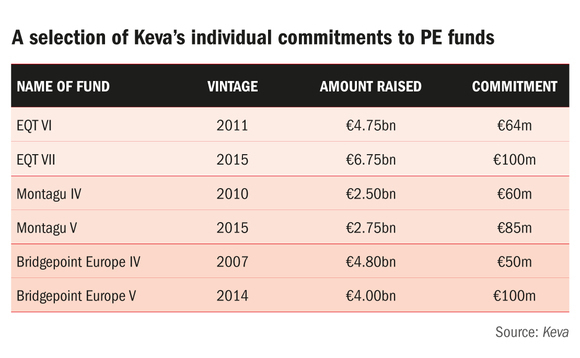

Over the past few years, Keva's private equity programme has been cash-flow neutral. It has required at least €800m in commitments on an annual basis to increase exposure to private equity. However, "the team has increased investment pace", Pauli says. "We want to allocate more capital to the asset class than we get back in." Keva has, accordingly, shifted to allocate larger commitments per ticket, doubling its average investment to €100m per case, shifting more focus to larger asset managers.

The LP committed more than €1bn to private equity funds last year, including Cinven's Sixth Fund and Blackstone's Core private equity fund, the latter being a long-term fund available only to a small number of big-ticket LP investors.

Venturing out

Interestingly, Keva's biggest commitments in the asset class are to externally managed vehicles focused on growth, early-stage or venture investments in the US. The approach has borne fruit for Keva: its €217.5m commitments to Keva Investments Ky had a book value of €312m as of the end of 2015. The performance from three US-based partnerships included in this vehicle have also exceeded Keva's expectations – the investor is thinking of striking a fourth partnership in the US, Pauli says. Substantial externally managed vehicles have also been a platform for Asian small buyouts and growth investments.

Meanwhile, Keva has not invested directly in venture funds in Europe for several years. In its domestic market, Finland, Pauli's team has made an allocation to the asset class via Finnish Industry Investment's FoF Growth funds.

Buyout allocations entered Keva's investment strategy in the mid-1990s, with its footprint growing from the domestic and Nordic markets to continental Europe, the US and Asia. But more than 20 years of exposure to the asset class meant that Keva stretched out its investments across a large number of funds, across varying sizes and markets. The LP took the decision to rationalise its private equity investments, selling a €350m portfolio of tail-end smaller and non-core fund investments last year. The move generated cash and saved time in terms of portfolio management resources, Pauli explains.

Upping direct investments

While primary investments dominate allocation to buyout funds, Keva's alternatives investment team has warmed to secondary opportunities as well in recent years. "The preference is to get exposure to fund portfolios of managers that Keva knows well from the past, or to buy portfolios of funds as part of a consortium, entering the fund together with an LP that we have done business with previously," Pauli says.

In line with other Nordic peers, direct equity investments are not shied away from. Keva has made "a couple" of direct co-investments with its GPs per annum in recent years, but Pauli's team is committed to speeding up this strategy. Its most notable transaction has perhaps been the shareholding in local electricity distributor Caruna, alongside Finnish employment insurer Elo, and infrastructure funds managed by First State Investments and Borealis Infrastructure.

The scope of direct investments is geared more towards international deals, rather than domestic opportunities, Pauli says. Keva's preference is to get involved at a later stage in an investment process, once there is security of a deal actually taking place. In recent years, the LP has notably invested alongside its core managers MBK Partners, EQT and Bridgepoint.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds