LP Profile: ATP

Despite no target for its allocations to alternative assets, private equity has been a key driver of returns for Danish state pension fund ATP. Mikkel Stern-Peltz speaks to CFO Bo Foged about opportunism, flexibility and professionalism at the €100bn AUM fund

The second half of 2016 has been nothing if not interesting for the Danish state-backed pension giant ATP. In the span of a month, the organisation saw its CEO announce his departure followed by a strong return on its co-investment in payments provider Nets, which became the largest Nordic private-equity-backed listing for six years upon its DKK 30bn introduction to the Copenhagen bourse on 23 September.

Nets and Dong – the Danish energy company that became the largest-ever Danish IPO when it floated in June – are examples of ATP's substantial presence in the alternatives space, which includes a multitude of LP commitments, direct investments and co-investments.

In the first half of 2016, DKK 3.5bn of a total DKK 6.8bn net return generated by all ATP's investments came from unlisted assets, primarily private equity. The fund's investment alongside Goldman Sachs in Dong provided DKK 2.9bn of the returns from unlisted assets, after the company's record-breaking DKK 98.2bn IPO in June.

For the full year 2015, ATP's DKK 34.9bn portfolio of private equity investments returned DKK 3.64bn of the total DKK 16.5bn profit generated by the fund. The private equity portfolio was also a profit-driver in 2014, when it generated DKK 3.6bn of profit from DKK 32.1bn of allocations. The fund had allocated DKK 32.1bn to unlisted equities in 2014, compared to DKK 25.5bn of listed equities, which generated a combined DKK 4.82bn return.

In the past three years, the largest source of returns for ATP has been unlisted assets, apart from listed Danish equities, the fund tells unquote".

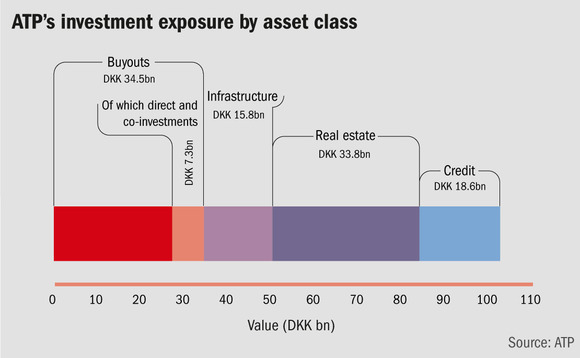

As of October 2016, ATP has DKK 34.5bn of exposure to buyouts, of which DKK 7.3bn are direct and co-investments, with total commitments of around DKK 64bn in total. The fund's unlisted asset portfolio as of October totalled DKK 102.7bn, of which DKK 15.8bn was infrastructure, DKK 33.8bn was real estate, and DKK 18.6bn was credit.

From the fund's annual reports, it is clear that allocations to private equity have substantially increased in the past half-decade, from DKK 24.4bn in 2010 to DKK 34.9bn five years later – generating strong returns for its members.

In a country with a population just shy of six million, ATP counts around five million people as members. Every salaried employee in Denmark can see ATP's name on their payslip, a defined contribution by employee and employer funding the pension scheme since its foundation in 1964. It is the second largest single-pot pension fund in Europe after Dutch PGGM.

We have a very opportunistic approach to investing and our allocation strategy. As such, we do not have a strict policy on how many alternative assets we want to invest in" – Bo Foged, ATP chief financial officer

Receipts from the mandatory contribution have seen ATP's fund grow to approximately DKK 800bn (around €100bn), which it invests across liquid assets, infrastructure, real estate, direct and indirect credit, and private equity – with each asset class managed by dedicated teams.

The bulk of ATP's investments are used to cover the interest rate risks on the fund's guaranteed future pension payments to its members. Additionally, ATP has an absolute return target – set by its board – of 7% after tax and costs, for a pool of capital used to pay out an annual non-guaranteed bonus to pension holders. In 2015, ATP made a total DKK 16.5bn profit, equivalent to a return of 17.2% for the entire fund.

Flexible opportunism

Despite a substantial capital pile and considerable number of investments in private equity, ATP does not operate with any set allocation targets for asset classes or geographies.

"We have a very opportunistic approach to investing and our allocation strategy," says chief financial officer Bo Foged. "As such, we do not have a strict policy on how many alternative assets we want to invest in.

Similarly, it does not set overall return targets by asset class, but by individual investments, including on its commitments to buyout funds. ATP will define target requirements on a case-by-case basis, based on its own calculations and specific needs. "Because we have to trust in our numbers, there is a long list of investments we have had to turn down," says Foged.

He says the pension fund will consider any opportunity where its own profile gives it an "edge" it can bring to the table and is in that sense always seeking out opportunities in the unlisted space. "However, ATP is not explicitly looking to expand its exposure to alternative assets right now and we try to avoid falling blindly in love with certain assets classes," he says. "We want to be faithful to our calculators: to avoid being too moved by market sentiment, but rather look at whether ATP is being appropriately rewarded for the risks we are taking."

The fund is currently taking a positive view on the possible returns in the buyout market, as its ability to take a long-term view allows it to harvest an illiquidity premium for being exposed to the unlisted market, which it considers attractive at the moment. "One of the motivations for us [investing in buyout funds] is the belief it can provide us with a higher return," Foged says. "Because it fits the profile of a pension fund, we can harvest the illiquidity premium without the need to sell our investments if the markets are squeezed."

However, Foged is also acutely aware of the upward price pressure seen across unlisted markets: "There's no doubt that in all the illiquid assets we consider and invest in, prices are starting to look somewhat strained. We're seeing extremely low yields and projections where little can go wrong before the investment sours as well."

Fund of funds-of-funds

Within the fund's organisation, there are two dedicated teams set up to focus on buyout and venture capital investments: ATP Private Equity Partners (PEP) and Via Venture Partners. Via is backed by ATP and fellow Danish pension fund PFA, investing in northern European businesses in the technology and services sectors. In July 2016, it closed its third vehicle on DKK 1bn – the same size as its predecessor – and currently has €402m of AUM. In the first half of the year, PEP generated DKK 700m of ATP's DKK 3.6bn return on unlisted assets, having generated DKK 2.6bn of DKK 3.6bn in the full year 2015.

PEP is ATP's in-house fund-of-funds manager, making LP commitments to buyout vehicles, co-investment and direct investments, currently managing €8.4bn in six different PEP funds. Unlike its parent, PEP has a geographic focus, which includes Europe, North America and select emerging markets. Its most recent vehicle is a €1.5bn fund in which ATP is the exclusive LP – as is the case with all previous vehicles.

Despite the two-vehicle structure, ATP's exposure to private equity is not limited by the funds' sizes. Investment opportunities sourced by either PEP or Via that are deemed to be attractive enough can be held on ATP's own balance sheet – and regularly are – allowing for a more flexible exposure to the asset class.

Foged says dealing with direct and co-investments requires specialisation: "It has been important for us to create an environment that establishes the foundation of our success within a given sector. PEP is an example of that."

ATP has tried to avoid "polluting" PEP and other in-house teams with excessive corporate bureaucracy, according to Foged, allowing them to focus on developing its expertise and core skillset. "Co-investments and the like require special abilities and teams, and an investor has to want to go into the details of these things to become truly skilful in that discipline – so it doesn't help if there are all sorts of things to split focus," he says. "The ultimate risk is that you don't understand the intricacies of what you're investing in."

ATP's current strategy and organisational structure began taking form during the tenure of former CEO Lars Rohde – the current head of Denmark's central bank, Danmarks Nationalbank – and chief investment officer Bjarne Graven Larsen, who has since joined Ontario Teachers' Pension Plan in the same role. The two were key in setting up the investment structure that remains at ATP today. "In more recent years, ATP's understanding of what parameters are involved in illiquid investments is something we have worked a lot on improving, asset class by asset class," Foged says.

Following Rohde's departure for Danmarks Nationalbank, ATP appointed Citi veteran Carsten Stendevad as CEO in 2013 to build on his predecessors' work. Due to family-related issues, Stendevad announced his departure from ATP in August 2016 and the pension fund has not yet revealed any replacement for him. However, while Foged recognises the new CEO and ATP's board will set the fund's strategy, he does not expect any major shifts.

"My impression is that there will be a continuation of our current strategy," he says. "ATP is currently facing a process where these need to be matured and integrated further into the organisation, while we continue to develop our expertise in what ATP does – rather than inventing something completely new."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds