LP Profile: DBPE's thirst for co-investments

With $12bn of assets under management, alternative investment manager DB Private Equity (DBPE) launched its global co-investment-focused strategy in 2014. Managing director Claudio Siniscalco speaks to Kasper Viio about the firm’s recent evolution

Having invested since 1992, the private equity arm of Deutsche Bank (DBPE) has historically focused on primary funds-of-funds, secondary opportunities and direct equity co-investments. But having grown to a respectable 4% of the firm's $12bn in assets under management in just two years, co-investments are on the up at the German asset manager. According to Claudio Siniscalco, managing director and global co-head of equity co-investments, the LP is growing its deal execution team, but can also leverage resources on the greater DBPE platform.

Prior to DBPE, Siniscalco's career spanned HarbourVest Partners, Audley Capital, InvestCorp, Hicks Muse and Salomon Brothers. While Siniscalco is relatively new to DBPE's co-investment platform, Deutsche Bank has been a participant in the co-investment market as a fiduciary for over a decade from its asset management division, and previously even concluded private equity co-investments using its own balance sheet.

We can optimise dynamically across categories, alongside a manager that hopefully delivers expertise in several of these areas" – Claudio Siniscalco, DB Private Equity

DBPE's third party manager exposure spans private equity, private debt, energy and infrastructure strategies. Unlike LP platforms with permanent capital, DBPE has no set target for primary or co-investment allocations, instead responding to client demand.

Strength in diversity

At its core, its approach benefits from elements of both flexibility and specialisation, looking to pursue the best opportunities to deliver a portfolio diversified by industry, geography, stage and lead manager. "We can optimise dynamically across categories, alongside a manager that hopefully delivers expertise in several of these areas," Siniscalco says.

While the team is not country- or sector-focused, instead aligning with specific managers, Deutsche Asset Management maintains firm roots in Germany. Consequently, Siniscalco, in partnership with DBPE's Cologne-based head of primary private equity, Andreas Schmidt, recently announced the final closing of the German Access Fund, raising €260m to co-invest in German private equity transactions. In the past 12 months, DBPE's co-investment portfolio has therefore ended up tilting more towards this market than elsewhere, with four local co-investments over the past year.

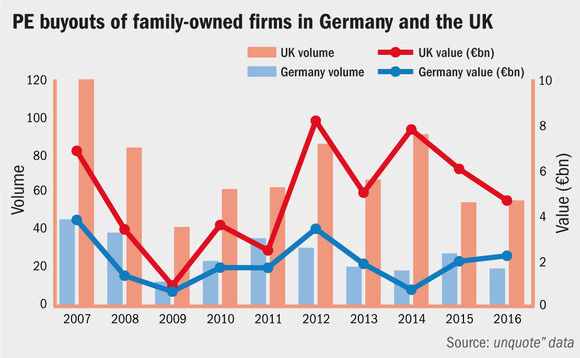

The German Mittelstand poses an attractive opportunity, Siniscalco explains. The vast majority of the country's workforce and GDP is tied to small and medium-sized firms, with relatively few of those accessible via publicly available shares. Yet, in this major swathe of the European economy, there are very few well-funded domestic private equity investors, leaving the majority of opportunities to be executed by pan-regional and/or smaller domestic "boutique" players. DBPE positions itself as the co-investment partner of choice for both of these communities of investors.

DBPE participated in two mid-market transactions in Germany this spring. In March, Duke Street led a consortium of investors, including funds advised by DBPE, in the buyout of Medi-Globe Corporation. The company generates a turnover of €120m from the development and distribution of medical devices focusing on minimally invasive surgery in gastroenterology and urology.

Soon after, DBPE's team participated in the €197m tertiary buyout of Amor Group, a supplier of affordable jewellery, alongside Gilde Buy Out Partners. The acquisition will allow Amor to expand its operations internationally.

DBPE's greatest advantage is its international network of global, regional and domestic private equity investors, enabling it to position itself as a partner of choice both locally and among the major international actors. "We are not leading deals, never competing with GPs; but we want to be seen as their favourite, first-call partner for Germany," Siniscalco says.

Scouting for deals

As its initial focus has been Germany, Siniscalco notes this has put DBPE in a position to seek further investment exposure elsewhere. To illustrate the point of headroom in markets outside Germany, it is worth considering that half of the manager's GP network is based on the North American market, 40% in west Europe and the remainder in Asia. In comparison to peers, "everyone else has already monetised their co-investment allocation funnel globally – we have not. DBPE can therefore offer the highest level of customisation among its peers," Siniscalco says.

That said, these may be times when adverse selection is really coming to the fore among co-investors, with robust LP interest for the buyout funds, and subsequently less demand for capital from co-investment specialists. "Like the average PE fund underperforms, the average co-investment fund can do that too," Siniscalco says. "The only way to mitigate that is to be very selective about opportunities to pursue."

This comes against a backdrop of LPs piling pressure on GPs to gain access to co-investment opportunities. "The good news is that we are starting from a low base", Siniscalco points out, "hence we are putting very little pressure on our GP relationships".

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds