In Profile: Vitruvian Partners

As part of our In Profile series, unquote" takes a look at Vitruvian Partners' recent activity and what lies ahead for the UK-based GP.

With its latest vehicle, Vitruvian Investment Partnership II (VIP II), now more than 60% committed, Vitruvian Partners is expected to kick-start its next vehicle in 2017. The GP registered VIP III at Companies House in August 2016, with Vitruvian Partners as the general partner. Vitruvian has historically worked with both Monument Group and Park Hill Group on the placement side and this configuration is unlikely to change, unquote" understands.

Vitruvian has been busy in the run-up to the fundraise. Deals struck in the past 12 months include the purchase of a minority stake and subsequent sale of Skyscanner to Chinese trade buyer Ctrip.com International (November 2016); the sale of Group IMD to Inflexion (September 2016); the sale of Inspired Gaming Group to listed US holding company Hydra Industries Acquisition Corp (July 2016); the sale of OpenBet to trade buyer William Hill (April 2016); and the acquisition of a majority stake in Unifaun Group (February 2016).

The firm's first vehicle, VIP I, raised €925m at final close in February 2008 against a €900m target. This first fund was deployed over 12 investments: Latitude Group, Tinopolis, Callcredit, Inspired Gaming, Independent Media Distribution, Just-Eat, RL360, Verastar, Benify, Instinctif Partners, Healthcare at Home and Inenco Group. Notable exits from the fund include return multiples of more than 5x on Just-Eat and CallCredit.

Distribution to paid-in on VIP I now exceeds 100% and is in the top quartile for IRR according to Cambridge Associates, having generated more than 15% net since 2007.

VIP II followed in 2013, reaching a first and final close on £1bn against an £800m target. This second fund has been deployed over 12 investments to date: Snow Software, Linimed, Farfetch, JacTravel, Solvinity (previously Bitbrains), CRF Health, Trustpilot, Voxbone, Ebury, Accountor, Skyscanner and Unifaun.

VIP II has started to reap cash returns and the average net is roughly 20%, unquote" understands.

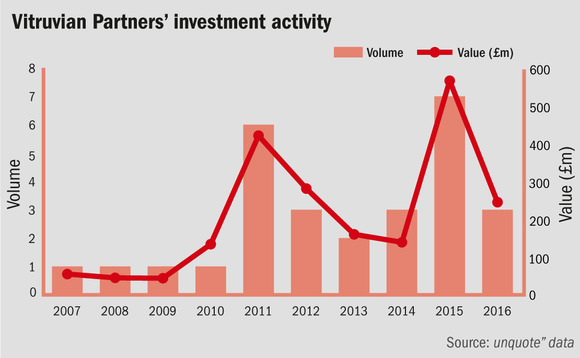

Vitruvian was founded in 2006 by former partners at Apax, BC Partners and Bridgepoint. Its two funds to date are deployed over more than 85 investments (including both platforms and add-ons). According to unquote" data, the most active investment years for Vitruvian were in 2011 and 2015, with the most number of exits taking place in 2014 and 2016.

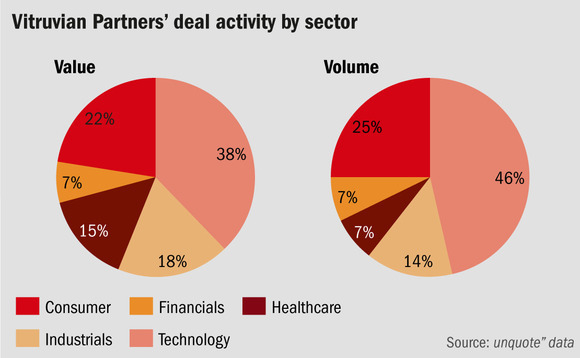

The first fund's investments mainly took place in the UK, whereas the second fund has only a minority of holdings in the UK and a significant number of investments in the Nordic region, Benelux and more selectively in the DACH region. Sectors-wise, technology is usually a key component in many Vitruvian deals.

The GP makes investments of £25-150m in companies valued in the £50-500m range through growth capital and buyout deals, as well as through selected public market interventions such as take-privates. There are now 11 partners and managing directors within the team.

Key People

• Mike Risman, managing partner, is founder of Vitruvian. He previously spent 10 years at Apax Partners as a global equity partner and head of Apax's information technology investment team in Europe. Prior to that, he worked at Cap Gemini as a strategy consultant.

• Ian Riley, founder of Vitruvian Partners, has 20 years of experience in private equity having previously worked at BC Partners and Schroder Ventures (now Permira).

• David Nahama, senior partner, is a founder of Vitruvian. He was previously a Venture Partner at Apax Partners and also held positions at Morgan Stanley and Salomon Brothers.

Other partners include Stephen Byrne, Mark Harford, Ben Johnson, Joseph O'Mara, Philip Russmeyer, Thomas Studd, Torsten Winkler and Jussi Wuoristo.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds