In Profile: HIG Europe

HIG Europe has enjoyed a bumper year, with five exits, two acquisitions and a further two investments in the pipeline. Denise Ko Genovese talks to Carl Harring about the firm's investment thesis and recent activity

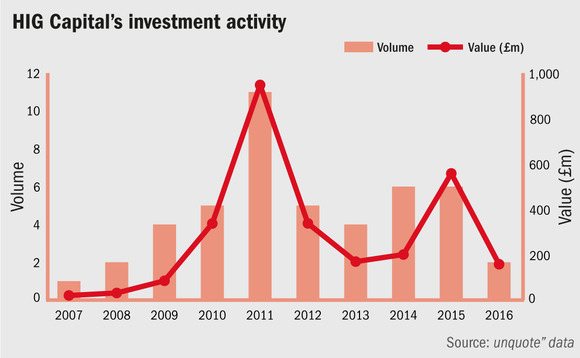

HIG Europe began life in Europe nine years ago, after the Miami-headquartered private equity firm HIG Capital raised €600m for European investments. Almost a decade later and HIG Europe has fully deployed Fund I and will have invested 40% of its €825m second fund raised in 2013 by year end. The group has also managed to build out a credit arm – Bayside – as well as a direct lending wing – HIG WhiteHorse – and a real estate team.

"We have done more than 300 transactions as a firm globally and Sami Mnaymneh still chairs our investment committee – he is our managing partner and co-founder – so all that investment and transaction knowledge is still there," says HIG Europe managing director Carl Harring. "We are the antithesis of large LBO oriented private equity firms that stick to the same process for each transaction. We have an entrepreneurial mindset and like driving hands-on growth by running the businesses ourselves."

HIG's recent sale of Nordic personal finance broker Zmarta epitomises a typical deal, according to Harring. In 2013, HIG drew down commitments from Fund I and acquired the three individual companies that were subsequently renamed Zmarta Group.

"We built a tech platform, putting three companies together, enhanced senior management, brought the company online and rebranded it. We improved every aspect of it," says Harring, adding that by the time the GP sold the business in July this year, reaping an 8x return multiple, Zmarta's EBITDA had doubled to €14m since 2013.

Another company that is experiencing HIG's hands-on approach is Nordic taxi operator CabOnline previously known as Fågelviksgruppen or FVG, which it acquired in May 2015. The company generates SEK 6.6bn in revenues and is currently going through a series of M&A transactions to drive growth.

From debt to equity

HIG's relationship to its credit arm Bayside differentiates the group from other GPs and has been a deal facilitator at times, allowing it access to certain situations by acquiring a debt position.

In 2013, Dutch nursery provider Estro (formerly Catalpa) closed a restructuring process via a scheme of arrangement in which senior lenders were awarded the equity of the business in exchange for a debt haircut, as incumbent sponsor Providence Equity Partners walked away from the business. KKR and Bayside had bought into the debt at distressed levels and also provided a new facility, giving them an additional slug of the equity that brought them a 75% controlling interest in the business. The following year in July 2014, HIG acquired 250 of the 360 centres run by Estro (with KKR selling its interest) and relaunched under the brand Small Steps.

"Bayside had bought into the debt prior to bankruptcy so we already had a seat at the table and could work together," says Harring. "We then bought the business out of a pre-pack and they passed over the running of the business to us [PE colleagues], securing the future of the company."

In a similar transaction, HIG Europe acquired UK-headquartered bed specialist Silent Night in a pre-pack administration in 2011. Only a few months before, Bayside had become the group's biggest creditor when it acquired Silent Night's senior debt at a discount to its face value.

With relation to debt financing for more classic buyout situations, HIG Europe is unable to tap its direct lending arm WhiteHorse since there is a Chinese wall in place to allow the latter to transact with other sponsors. Harring says the firm often uses other direct lenders and unitranche providers that he considers to be more accustomed to providing the type of analysis required for HIG's more niche deals. The GP used Alcentra to finance its buyout of French theme park operator Looping, Avenue Capital for Zmarta and GSO for HCS.

Expanding the pool

The past year has been eventful for HIG with five exits, including French theme park operator Looping, German temporary space provider Losberger, Swedish consumer finance broker Zmarta, French electrical components and equipment group VM Industries and Italian education business International School of Europe Group. There were also two acquisitions – Dutch recycling group Ecore and Italian non-wovens producer Texbond. It is also on the cusp of announcing a further two investments, says Harring.

In order to sustain this pace, over the summer Dyal Capital Partners II – a capital vehicle managed by investment manager Neuberger Berman – acquired a passive non-voting stake of less than 15% in HIG Capital. Proceeds will be primarily used to increase the firm's investments in its own funds, and to seed and fund a number of growth initiatives, in order to further capitalise on the firm's unique position in the small- and mid-cap market, according to a statement at the time.

"We wanted to create a permanent capital vehicle, and [Dyal] has the balance sheet so we can continue to pursue our growth objectives," says Harring.

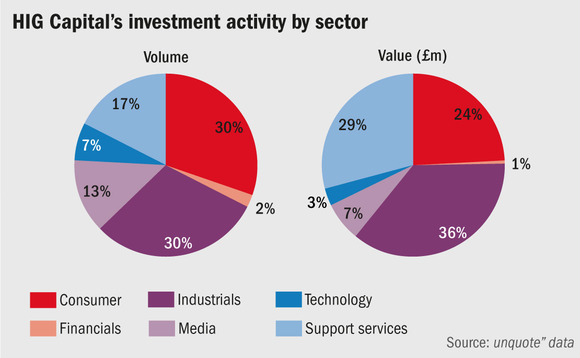

Harring estimates that its team of 40 private equity professionals in Europe look at roughly 2,500 deals a year, targeting companies making €10-70m, but currently only invest in about five.

• Carl Harring, UK managing director, previously worked at HgCapital and Apax Partners.

• Wolfgang Biederman, managing director, leads HIG's private equity team in Europe and is the firm's German country head. Prior to joining, he was CEO of investment firm Pricap Venture Partners.

• Holger Kleingarn, Germany managing director, joined HIG from Palamon Capital, where he was a partner and member of the management committee.

• Jens Alsleben, Germany managing director, previously was a managing director at Strategic Value Partners in Frankfurt.

• Jaime Bergel, Spain managing director, joined HIG from Spanish private equity house Gala Capital, which he founded and chaired.

• Raffaele Legnani, Italy managing director, was the founding partner of special situations investment group Atlantis Partners.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds