In Profile: Lyceum Capital

Lyceum Capital is preparing for its fourth fundraising in 2017, with its third vehicle now 70% invested. Denise Ko Genovese speaks to Andrew Aylwin and Jeremy Hand about the firm's evolution

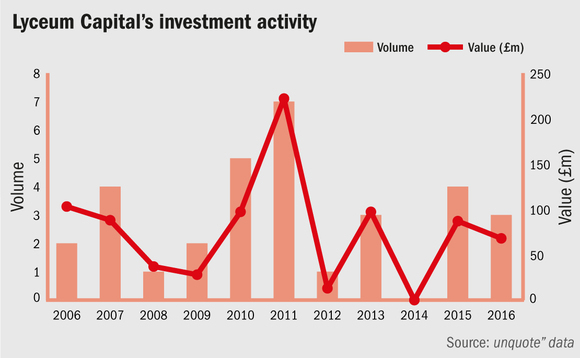

Lyceum Capital will officially set off on its next fundraising trail in 2017, with Lazard poised as placement agent. It will be the GP's fourth fund after raising £200m, £255m and £330m respectively for its first three.

"We started out in 1999 with a £100m cornerstone from WestLB and £100m from friends and institutions we'd worked with previously. That constituted our first fund," says Lyceum managing partner Jeremy Hand.

The team then bought itself out of WestLB – a process that took three years but completed at the end of 2006 – and subsequently closed its second fund in 2008 on its £255m target. Fund II is fully deployed over nine deals with seven investments already realised, comprising Access, Adapt, Clearswift, Compact Media, M&C Energy, Synexus and UKDN.

Fund III held a final close in 2013 on £330m against a £275m target and is roughly 70% drawn with investments in Bellrock, Briefing Media, Coryton, Isotrak, Sabio, Sequence Care, Style Research and Total Mobile.

The majority of Lyceum's investors are state pension funds, though sovereign wealth funds are also present. Most of its LPs are from Europe, with the remainder hailing from the US and the Middle East.

"We continue to see really good demand for well-run GPs with a decent track record in the lower-mid-market space," says Lyceum partner Andrew Aylwin, regarding the fundraising landscape. "There are always players chasing fees and moving up and out of the space, but for us it's been a conscious decision over the past 17 years to stay focused on fund returns – strong alpha and low beta."

Indeed, the focus for Lyceum has not materially changed since inception. The GP aims to take a meaningful stake in UK-headquartered companies with enterprise values of between £10-100m, though its sweet spot is narrower at between £25-75m. The average ticket size is roughly £30m. Up to 20% of the fund can be underwritten.

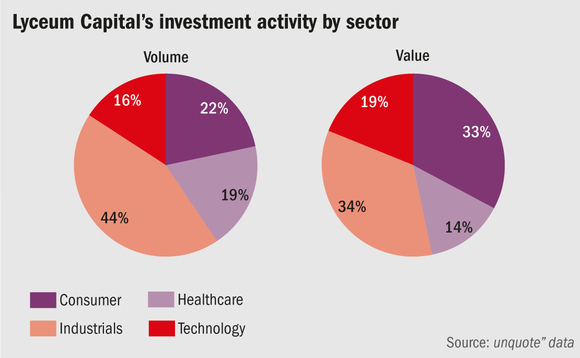

However, one development in its investment thesis is that Lyceum no longer invests in consumer-facing companies. UK sandwich group Eat, which it acquired in 2011 and is still under Lyceum ownership, was the last in the sector.

"We've built a strong franchise and network across B2B services and technology," Aylwin says, citing National Britannia, Leasedrive Velo, M&C Energy, Access, Adapt, Bellrock and Sabio as prime examples of this strategy.

Edge and Advantage

During its tenure of National Britannia, the group invested heavily in the infrastructure and systems of the business. Coupled with eight add-on acquisitions, sales at the company grew 81% to £49m and EBITDA rose from £3.1m to £8.6m by the time it sold to Connaught in 2007.

"[Portfolio company] Access was founder-led at the time we invested, with an outstanding product and services, but it didn't have a clear future roadmap," says Hand. "It's a recurring theme with SMEs that have built a great reputation and market position but don't really have a clear view of the future, with owners who have become defensive and are reluctant to invest heavily in new strategies to accelerate growth."

Portfolio company Bellrock, which Lyceum acquired last year as a carve-out from Johnson, is going through a similar transformation.

Over three quarters of portfolio companies in Fund II were sold to trade, including M&C Energy to Schneider Electric, Adapt to Datapipe and National Brit to Connaught.

Key people

• Jeremy Hand, managing partner, co-founded Lyceum and focuses on sourcing and executing investments. He was previously a founding shareholder and partner at Duke Street Capital.

• Andrew Aylwin, partner, leads the financing of all investments and is responsible for Lyceum's investor relations and fundraising. Prior to joining in 1999, he spent five years at PwC.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds