In Profile: Ardian

On the back of Ardian's 20 year anniversary last year, Denise Ko Genovese talks to Dominique Gaillard about swift fundraising and why we are currently in a seller’s market

"Our first fund was just for small LBOs – and was €95m in total – which seems pretty small now but wasn't small at all back then," says head of direct funds Dominique Gaillard, as he recalls how Ardian – then Axa Private Equity – started two decades ago. "Compared to then, we are now in every single segment of private equity life," he says, referencing the diverse range of funds it now runs such as growth capital, buyouts, co-investments, infrastructure, secondaries, private debt and real estate.

Gaillard joined founder and CEO Dominique Senequier in 1997 to help manage the first fund and, since then, Ardian has become a stalwart of European private equity. What began as a very France-focused investment company has morphed into a very European network with portfolio companies in Germany, Italy, Spain and the UK. Axa Private Equity officially became Ardian in 2013 when it formally split with the Axa group.

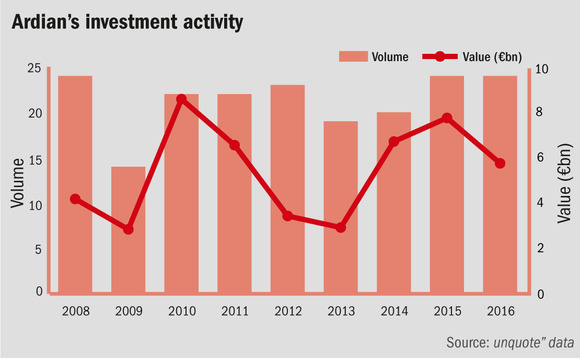

With more than 20 years of investment activity under its belt, Gaillard says Ardian now sees two main challenges in 2017: increased competition and rising prices for assets.

"There is much more competition in the buyout segment. New players such as some of the Canadian pension funds, which two generations ago were only LPs in our funds, went on to co-invest alongside us, and are now sometimes competing against us for assets," says Gaillard. "Since they are happy with lower returns and longer holding periods, this can appear as an appealing proposition for management teams of targeted companies."

And coupled with this increased competition is the proliferation of cheap debt which is driving the overall price of assets up, Gaillard says. "We are therefore very active in selling right now and cautious on the buying."

Selling spree

Indeed, the exits have been well underway for a while with the sale of Laboratories Anios to Ecolab completed this month; news of exclusive negotiations with Accenture over the sale of portfolio group Arismore in December; the sale of premium fashion retailer Schustermann & Borenstein in October; the sale of a majority stake in Bruni Glass in October; and the majority stake sale of Altares to Naxicap Partners in September.

Despite Gaillard's caution towards buying, investments are not on the backburner completely. Over the past few months the GP made investments in takeaway frozen snack maker Piz'wich in January; optical laser treatment developer Schwind Eye-tech Solutions and pharmaceutical group Unither in November; and lighting systems company SLV and car parts producer Weber Automotive in October.

Different pots, same strategy

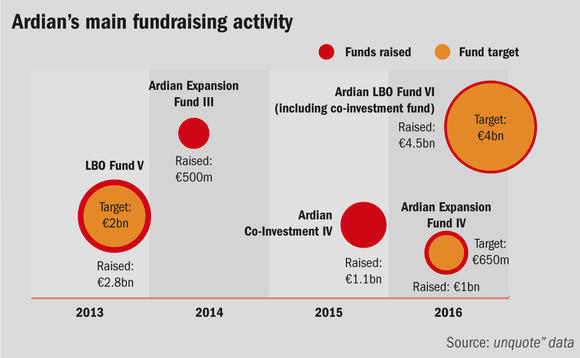

Ardian LBO Fund VI raised €4.5bn at final close in September 2016 after just four months fundraising, a significant increase from its predecessor of €2.5bn. It is 25% committed over five companies: Hypred, Dedalus, Weber Automotive, SLV and Unither – with the latter subject to a binding offer and exclusive negotiations and the subsequent signing of a definitive agreement and approvals from authorities. Enterprise values of targeted companies are in the €200m-1.5bn range with an average equity stake of around €250-300m.

Ardian Expansion Fund IV raised €1bn at close in July 2016. It is 23% deployed over four companies: Ionisos, Diam, Lagarrigue and Schwind. Enterprise values vary between €50-200m and the average equity ticket is €50m.

The aim of both funds is to make 18-20 investments.

The overall strategy is the same for all investments with two mottos underpinning the GP's activity. The private equity house tries to implement an international buy-and-build strategy where possible, and seeks to invest in companies that already have an export mentality in place, explains Gaillard. Though there has been a bias for more than 10 years towards companies with Paris headquarters, Ardian is now keener than ever to select companies that want to expand beyond their native borders.

Ardian's ownership of Novacap encompasses both mottos and its tenure of Spotless is particularly notable for its buy-and-build approach.

"[Spotless] had been the subject of three previous LBOs and when Ardian came to it we told the CEO we didn't want to only carry out development in France. He agreed and in four years we made six bolt-on acquisitions in France, Holland, Spain, England, Italy and Ireland. When we sold our majority stake to BC Partners several years ago, Spotless was in eight countries and we had trebled EBITDA," says Gaillard.

LP traction

Ardian believes its multi-segment strategy has gained much traction with its LP base, as many are keen to diversify but remain committed to the GP. Some investors have put money to work in up to four of Ardian's different strategies, says Gaillard.

The fact Ardian has a dedicated co-investment fund is testimony to the increasing demand from LPs, though it also invites co-investment in its regular buyout funds.

"[Co-investment] is definitely a theme that LPs are pushing and we feel the pressure. Of course it is driven by the "no fees – no carry" feature but we have strict rules of allocation and we are very clear about that during fundraising," explains Gaillard, adding that roughly one in three buyouts is a co-invest.

Unither was the last buyout investment where Ardian provided co-investments to its LPs.

"From time to time, some of our competitors might have produced better returns, but, with Ardian, LPs see consistent profitability with low volatility across fund generations, and it is the consistency that they like foremost. The re-up rate for the €4.5bn mid-cap fund was extremely good, with some historic LPs doubling and even tripling their commitments."

"The fund structure is a pretty standard 20% carry and 8% hurdle rate."

Key People

• Dominique Senequier, president, joined the Axa Group in 1996 and founded Axa Private Equity. Prior to this, she was an insurance commissioner at the French Ministry of Economy before joining GAN Group, where she was in charge of private equity investments.

• Dominique Gaillard, head of direct funds, joined in 1997 and leads expansion, mid-cap buyout, co-investment and infrastructure investment activity. He was previously at Charterhouse France.

• Vincent Gombault, head of funds-of-funds and private debt, joined in 1998. Prior to this he worked in Axa Group's industrial holdings department after a stint in M&A at Societe Generale.

Other members of the management team include Benoit Verbrugghe (head of Ardian USA); Mathias Burghardt (head of infrastructure); Olivier Decanniere (head of Ardian UK); Jeremie Delecourt (head of corporate and international development); and Philippe Poletti (head of mid-cap buyout).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds