Impact agenda: Attracting institutional capital

Global PE firms are launching impact funds tailored to appeal to institutional investors that have so far largely ignored the space. There will be growing pains, but the benefits should be wide-ranging

[Editor's note: This article first appeared in Unquote sister publication AVCJ]

"People with large pools of capital don't know about Aavishkaar, they know about TPG and KKR. It doesn't matter whether I am better than anybody else, capital will find safety in the processes and systems of these firms," says Vineet Rai, CEO and managing director of Aavishkaar Venture Management, an India-based impact investment firm.

Seventeen years after Rai entered the impact space he is now being joined by those brand name players. The North America-focused Bain Capital Double Impact Fund led the way, closing in the middle of last year at $390m. It was followed a few months later by The Rise Fund, a global impact vehicle established by TPG Capital, which received $2bn in commitments. KKR is expected to launch its own fund in due course as more global private equity firms tap into growing interest among institutional investors for impact exposure.

Rai does not begrudge Bain and TPG their headlines. It draws the spotlight to the substantial social and environmental challenges that impact investors are seeking to address. The likes of Rise might also serve as a new exit channel, buying companies that Aavishkaar has nurtured.

This is a different kind of investment to that practiced by smaller incumbents who pursue deep and intentional impact by backing early-stage companies in frontier markets. Most institutional LPs are unable to accept even the possibility of a below-market-rate return on an impact product. As such, some of the planned funds will gravitate to the other end of the spectrum, offering deals from the standard commercial pipeline – from microfinance businesses in India to renewable energy projects in Australia – that also happen to meet one of the UN Sustainable Development Goals (SDGs).

Rai describes it as "old wine in a new bottle," but he stresses that the new arrivals are not attracting capital that might otherwise have been deployed with smaller funds or enterprises. Indeed, there may even be a halo effect with more money finding its way to smaller players, helping them broaden LP bases that are typically dominated by development finance institutions (DFIs) and family offices.

"It's a false choice when people say something is a commercial deal rebadged as an impact deal," adds James Gifford, head of impact investing at UBS Wealth Management. "I would flip it around the other way. If a deal isn't commercial then it isn't going anywhere: it's not scalable, it's not going to attract any quantity of capital, it's just semi-philanthropic. There is a role for that, but if we want to fulfill the SDGs, that requires such a large volume of capital the only way to make it happen is through full commercial investment."

On the sidelines

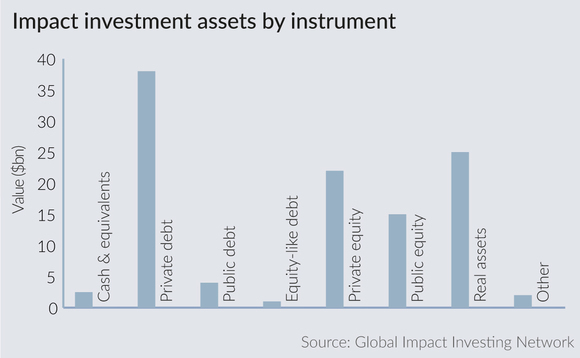

Of the $114bn held in impact investing assets as of year-end 2016, $21.8bn was in private equity, according to the Global Impact Investing Network (GIIN). Institutional involvement in the space is not unknown. Emerging markets-focused LeapFrog Investments raised $135m for its debut fund in 2009, with the bulk of commitments coming from DFIs. Five years later, when Fund II closed at $400m, the DFI share fell to 30% as insurance companies and pension funds – such as Swiss Re, Prudential, Axa, TIAA-CREF, and Hesta – came to the fore.

This is a typical rundown of the more sophisticated investors that enter impact funds, but if LeapFrog achieves its Fund III target of $800m, it would not be a typical impact GP. Most of its peers are sub-$100m and focus on a smaller subset of geographies. To pick two Indian examples: Lok Capital is currently seeking $100m for its third fund, compared to $64m last time around; and Aavishkaar wants to scale up from $93m to $200m. Both are considered well-established impact players, but neither would appeal to most pension funds.

It is not only a matter of minimum check size constraints but also fulfilling fiduciary responsibilities by generating the best risk-adjusted returns for investors. "The track records for existing impact investment firms, while growing, are probably still too nascent for institutional investors to take full comfort," says Maya Chorengel, who joined Rise as a partner last year, having previously co-founded impact venture firm Elevar Equity. "The entry of established PE brand names, whose teams have achieved financial returns that meet investment committee requirements, is important."

Bain signaled its intent to introduce an impact strategy in 2015 by announcing that former Massachusetts Governor Deval Patrick would lead a new business focusing on investments with significant social impact. However, Partners Group was arguably the first multi-strategy private equity firm actually to create an institutional product for the space. Having initially made social investments through its employee foundation, the group formed a separate affiliated investment unit – also in 2015 – to raise capital from third-party investors.

It received a €60m ($74m) seed investment and has so far raised €110m towards a target of €200m. Most of the investors are foundations and family offices with experience in philanthropy. All the management and performance fee income earned by the GP goes to the foundation and is re-invested in early-stage social enterprises that would not qualify for funding with institutional client money.

"We want to build a track record and in the long term convince institutional clients to do more impact investing, so we needed to have an institutional fund," says Urs Baumann, co-founder and CEO of PG Impact Investments. "We didn't market it openly. Once word got out, we were surprised that a lot of clients wanted to talk about it. But on the institutional side, they want to learn and watch what you do. Moving from that to being ready to deploy money, it's a different story."

Mobilizing money

Rising interest in active mandates that pursue economic and social returns has deep roots. Sustainability is an important consideration for any long-term investor and over the past few decades concerns ranging from climate change to inequality have begun to influence allocations across multiple asset classes. In private equity, this was first manifested in more considered approaches to environmental, social and governance (ESG) standards.

Turning that interest into commitments for impact funds is not just driven by the prioritizing of sustainability and a recognition that it can be achieved alongside profitability, according to Steve Okun, ASEAN representative for EMPEA and CEO of APAC Advisors, a consultancy that specializes in government relations, policy, and sustainability issues. The definition of impact is also evolving so it encompasses a broader cross-section of investments.

To capture that evolution – impact as more than just a trade-off of social impact for financial return – Bain and TPG drew on past commercial deals that also addressed social and environmental needs. Furthermore, the teams assembled to execute this strategy comprised existing staff from their traditional investment areas as well as executives who have an impact background.

One LP in Rise describes being convinced by the combination of elements from the existing TPG growth investment division, impact imports like Chorengel who came from Elevar, and a strategic relationship with Elevar itself. Rise has allocated a small portion of capital for co-investments in Elevar portfolio companies from an early stage, ultimately with a view to featuring prominently in follow-on rounds. "It's a hybrid model that gets around the issue of the first-time fund manager and the impact issue because you have experienced people," the LP adds.

Double Impact and Rise differ, however, in their approaches to measuring impact – a critical issue for institutional investors considering allocations to the space. While Rise has created a formula for calculating and comparing impact across different investments, Double Impact has not. It assesses impact on a company-by-company basis across a spectrum of environmental, social and financial metrics.

"We are going to deliver commercial returns. It will be easy to evaluate us on that measure," says Warren Valdmanis, a managing director at Double Impact. "But we will also be able to tell you that dollars invested by the fund will generate a certain number of new gym memberships for a company that operates gyms in areas prone to higher obesity levels. Or through waste diversion through our green recycling business."

The Rise methodology was crafted with the support of Bridgespan Group, a Bain & Company spin-out that provides consulting services to non-profit organizations. Input also came from a founder's board comprising notable philanthropists, social activists and business people, like Jeff Skoll, Richard Branson, and Bono.

The approach is based on two frameworks: one that is intended to mirror the steps taken by a traditional private equity investor conducting due diligence; and another that looks at the business outputs linked to the impact a portfolio company wants to create, using third-party research and data, and applies an economic value to it.

"We are trying to identify impact, quantify it, find supporting evidence, and make it measurable in a way that allows us to establish tangible impact goals for companies we might invest in," says Chorengel. "It's not just driving towards a number, but also towards a way of working with companies over time to maximize impact. It is not dissimilar to an investment committee looking at the potential IRR and money on money multiple to determine whether it is worth spending the investment dollars on."

Defying definition

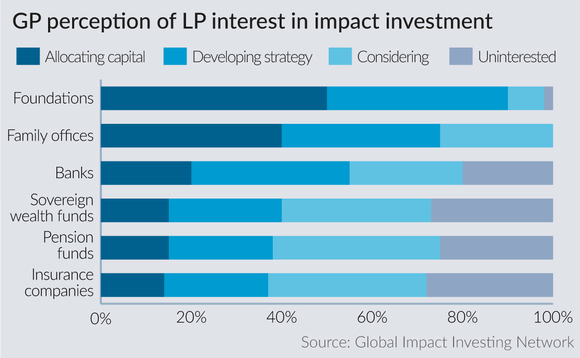

The Double Impact LP base features some pension funds and endowments but is disproportionately weighted towards family offices and high net worth individuals that have relatively more flexible mandates. While Rise also found favor with private investors – UBS is said to have accumulated $200-300m from its clients in a matter of weeks – the fund has a backbone of public institution and sovereign wealth fund capital. Washington State Investment Board, Sweden's AP-funds, and Temasek Holdings are among those involved.

The long-term expectation is that a formal benchmarking system will emerge for impact, making it easier for pension funds to participate, but it could take a decade or more to develop. There are two obstacles: the lack of robust historical financial data; and no consensus on how to measure impact.

Cambridge Associates and GIIN created an impact investing benchmark in 2015 using data from 51 funds targeting a market rate return launched between 1998 and 2010. Only considering financial performance, they found that funds below $100m outperformed their larger peers (with an IRR of 9.5%-8.3%). They also struggled to build a large dataset due to difficulty obtaining performance data and the limitations of strict selection criteria.

"Institutional investors seem to be experimenting in the space to see how it plays out. Commitments are relatively small because they don't have a set of benchmarks," says Michael Fernandes, a partner at LeapFrog. "The consultants that work with pension funds like to have depth in a category, so they can make an asset allocation call on a category. They don't have that with impact. It is only possible to make individual assessments, which makes it harder to onboard."

As for an impact metric, the open question is whether most institutional investors would know what to do with one if they had it. There is growing support for the SDGs as a starting point, but they are no more than that – 17 predefined outcomes ranging from ensuring access to water and sanitation for all to reducing inequality within and among countries. Investors must decide for themselves how to incorporate these goals into due diligence metrics.

There are plenty of resources that help investors shape their understanding of impact, establish a set of priorities, and translate that into goals. Indeed, some would say too much. "There has been a proliferation of organizations that measure performance, rank managers, and have algorithms for mapping the landscape," explains Jennifer Forster, a managing director at Hall Capital Partners, a US-based outsourced CIO service that primarily represents high net worth families and is invested in Double Impact. "It has created confusion and it has been onerous for the managers themselves."

At the same time, Forster and several other LPs don't necessarily want to see impact distilled into a number like IRR for fear that this would oversimplify an area that is complex and nuanced in terms of measuring different impact levers. Similarly, there is an argument against a standardized definition of impact: investors just need to understand that it is broad, and the outcomes sought by a $1bn fund will be very different to those of a $50m fund.

"Most institutional investors are not clear as to what impact they want and how they would measure it. They have sensible impact frameworks, but no more detail. Some say they want to support certain SDGs and nothing else, but most of the time they are quite open," says Baumann of PG Impact. "I would advise them to avoid being too specific at the beginning in terms of impact because the investment world would become too narrow."

Stepping stones

In this context, products that serve as stepping stones between traditional private equity and impact investment might be the best fit for most institutional players. Several global GPs have already taken a first step under responsible investment initiatives.

KKR, for example, has a solutions investments sub-category in its commercial portfolios, identifying companies that have a positive social impact. Thirteen Asia-based businesses currently qualify for this distinction for their work in food safety, environmental protection through alternative energy and resource efficiency, and providing access to financial services. Anyone with an impact agenda might find themselves investing under the same broad themes.

Whether the next step is an impact fund that focuses on growth-stage companies or a vehicle that samples socially and environmentally-oriented deals from a wider commercial pipeline – backed up by impact assessment methodology – the idea is that investors will get a financial return and material insight into the difference their money has made. Emboldened by this performance, the investors would then ask for products that create even more impact and develop clearer notions of what areas they want to support and how they want to track performance.

It is a bold ambition and success is by no means guaranteed. "The challenge is how do you offer those opportunities and maintain the same high level of impact," says Robert Kraybill, managing director of Impact Investment Exchange Asia, which is currently raising an early-stage impact fund that focuses on frontier markets. His thoughts echo the results of a GIIN survey published last year in which respondents were asked for their views on the arrival of large-scale financial firms in the impact space. Nearly three-quarters cited impact dilution as a concern.

Other industry practitioners raise the same issue in the context of deal supply: Are there enough assets available that offer scale as well as meaningful impact? Renewable energy infrastructure is routinely described as the impact segment that has become the most mainstream, attracting billions of dollars a year in funding. Microfinance is headed in the same direction, but other areas are well behind.

"Looking at India, there are large-scale financial services and dairy players that can certainly not only meet impact investment criteria but also achieve scale and profitability. With some other business models, such as healthcare and education, it will be difficult to find scale assets," says Venky Natarajan, a managing partner at Lok Capital. He also expresses reservations about commercial investors backing companies with a strong social mission: they are either disappointed by the growth rates or negate impact in the pursuit of higher growth.

This underlines the growing segmentation in the GP community between those who pursue larger thematic investments with less extreme impact but locked in returns and those who take higher risks with nascent enterprises. If the likes of Rise are to be truly transformative they will form a bridge between the two – the missing link in the impact chain that provides the capital and expertise to help sub-scale companies expand and facilitates an exit for early-stage players.

En Lee, a partner with LGT Impact Ventures, notes that these larger firms will also introduce a level of investment expertise, sophistication and discipline that has often been lacking in markets where the social sector grew out of philanthropy.

This view is also expressed in the GIIN survey, which overall portrays an uncertainty about the changes taking place but also an appreciation for how widely they could reach. "The more capital that comes into the impact space, from venture philanthropy to the largest of the funds, the more that incentivizes entrepreneurs to create businesses because they know they are going to get funding," adds EMPEA's Okun.

There is clearly interest among institutional investors in this narrative and the challenge is finding ways to covert that into commitments. LPs expect to see plenty of new product launches, supported by wide range of metrics and methodologies for measuring impact. However, the underlying imperative remains the same – demonstrating an ability to source, screen, manage and exit in a way that aligns with the strategy of the fund – and it might pay to be orthodox.

"We are going to see some different models and products because people are experimenting, but the most successful ventures will be those that look and smell to institutional investors most like what they are used to seeing," says Rise's Chorengel. "If you try to create something too unique or too funky you won't appeal to them; you will have to keep going to family offices and high net worth individuals where the dollars are more limited."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds