Back to school: education dealflow heats up as pandemic settles

The Covid-19 pandemic has led to significant disruption in education and vocational training, but digital opportunities and long-term growth drivers have resulted in an influx of deals in recent weeks. Harriet Matthews and Greg Gille look at dealflow and future prospects for the sector

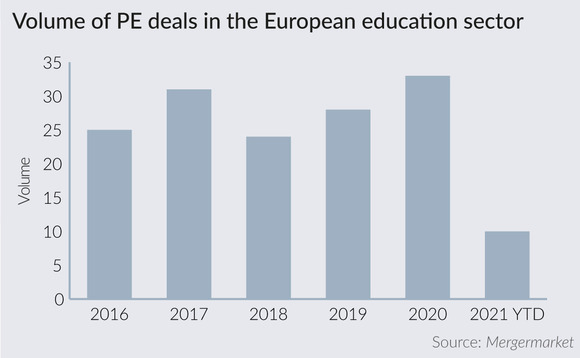

Activity in the education sector has got off to a promising start in 2021, with 10 deals accounting for more than €700m in aggregate value inked already, according to Mergermarket and Unquote Data. These include Bowmark's split sale of Oxford International, as well as Magnum Capital's acquisition of Spain-based postgraduate business school operator ISDE. Most recently, Stirling Square reportedly agreed to acquire Medisup Sciences, a provider of preparatory courses for admission tests to French medical university; the deal valued the business at around €350m (14x EBITDA).

Further processes currently in the pipeline include ECI's educational safeguarding software provider CPOMS, Eurazeo's Swiss hospitality management education group Sommet Education, and Palatine's TTC Group, a UK-based provider of road user education and compliance services, according to Unquote sister publication Mergermarket.

Since the start of 2020, the sector has seen 33 deals with an aggregate value of more than €6.7bn, a figure bolstered by large-cap buyouts such as Providence Equity Partners' €2.5bn sale of Galileo Global Education to a consortium of institutional investors, as well as Permira's $1.5bn acquisition of English language school EF Kids & Teens and Ardian buying a majority stake in higher education platform AD Education.

There were concerns at the onset of the pandemic that social distancing measures and travel restrictions would significantly dent processes in the sector. Oxford International could be seen as a case in point: the auction launched in early 2020, but suitors for the asset started raising concerns about the potential impact of the coronavirus outbreak on the business in February 2020, as reported. The process, which came close to a conclusion, was put on ice shortly after. But the business ended up performing better than expected in lockdown, leading to a renewed push to get a process moving again this year.

Top marks

Last year's increase in dealflow also built on an upward trend recorded since 2018. A number of factors continue to drive private equity's interest in the sector, says Mark Hall, senior partner at Graphite Capital, which recently acquired a stake in online education platform Higher Ed International. "There are a lot of healthy fundamentals at work in education where the mega-themes are very supportive to growth – there are strong positive demographics, as well as a fast-growing middle class globally, combined with strong demand and low cyclicality. The UK is well-regarded as an education market, which is positive in terms of exporting brand UK, as well as attracting students into the UK."

As evidenced by some of the multiples seen in recent high-profile transactions, pricing is suitably frothy – especially when a digital angle is involved. Manuel Zulueta, CEO of DC Advisory in Spain, identifies three core types of businesses in the education sector and the impact that they have seen from the pandemic: "Assets related to language learning, with a higher reliance on international students, have certainly been impacted, as these businesses are much more tied to the fortunes of the travel industry. The second group, which would include stable assets like schools and universities, has proven pretty resilient throughout the crisis and multiples have actually trended upwards – even if they have been impacted in the short term, prospects remain good and valuations shouldn't be impacted in the long run.

"The third bracket would comprise assets focused on education technology and online learning, and the market has been very hot for these, with multiples in the 15-20x range becoming the norm. Overall, the number of assets in the education sector is relatively small, so good opportunities attract a lot of competition."

This competition is fuelled by the fact that deals for education providers have been increasingly appealing for consumer-sector-focused GPs, which have seen dealflow dry up in areas such as travel, leisure and retail in the wake of the pandemic, says Baird managing director Martin Luen: "These GPs are looking at other consumer-facing businesses to deploy in, and when they see that companies in online education have performed very well in the past year and tie in with their consumer-sector remit, of course there is clear attraction. And as there aren't that many of these assets around, competition and therefore pricing have shot up."

However, while online learning and digitalisation have boosted both growth and valuations in the sector, travel restrictions since the outbreak of the pandemic have been a downside for businesses that depend on international students having the ability to travel.

But even in that segment, prospects appear to be on the up, says Luen. "When it comes to the impact of Covid for businesses relying on international students, I think Sommet Education is likely to give a lot of players hope," he says, referring to the aforementioned process for the Swiss hospitality education business. "Their international bookings got put on hold when Covid hit, and as it is a practical course, it is trickier to pivot to purely online learning. But ultimately their bookings stuck, and that gave other providers and investors a lot of confidence."

ICT fever

But the most powerful driver of investor interest remains the intersection between software and education, as asserted by several sources with whom Unquote spoke. "This is where we expect some of the more interesting opportunities, and therefore some of the more heated processes, to come from," says Luen. "Companies selling software to UK schools in order to digitise their records, for instance, have tonnes of opportunities in front of them. And that's just the tip of the iceberg, there should be a good number of assets coming to market over the next couple of years."

Hall concurs, citing examples from Graphite's own portfolio that demonstrate how different technology-based models can work in the sector. "One of our portfolio companies, Explore Learning, has developed its own in-house adaptive e-learning tool, which is proprietary – it's a positive that this can be leveraged. Higher Ed International, our latest investment in a global online programme manager, uses its skill set combined with technology to offer a solution for universities. So both angles can be successful."

Online learning has to a large extent allowed businesses in the education space to weather the brunt of the pandemic, and in some cases resulted in net benefits for specialised players and service providers involved in that vertical. Looking ahead, as face-to-face interactions ramp up across the world, it remains to be seen whether it will stick as a permanent fixture and continue to boost the sector's appeal. "Our take is that, much like the rest of the economy, we can see a future where it is a structural change," says Luen. "And that is driving quite a lot of the fast-growing providers to look for capital, in turn creating growth capital or even buyout dealflow."

In spite of the challenges created by the pandemic, overarching growth themes in the sector mean that education provision will remain a key target for PE and continue to see attractive exit opportunities for GPs already invested in the space, says Hall: "If you think about education on the listed markets, it is not as well represented as, for example, business services. There are few big potential corporate acquirers, and maybe this will evolve over time – but for now, there is lots of interest from investors including GPs and sovereign wealth funds due to the sector's long-term growth and low cyclicality."

Zulueta also notes that deal pipelines should continue filling up in the years to come, especially since PE is still in the early stages of penetrating the sector and going beyond bricks and mortar institutions. "Four or five years ago, there wasn't as much activity around vocational training, ed-tech and even universities, which has only picked up more recently. Since then, there has been a growing opportunity for digitalisation, and a greater perception of the importance of education in general as well. So we have seen more dealflow – especially for consolidation and internationalisation plays – but it has mostly been primary. We expect that we will see a number of these assets coming to market in a couple of years as PE exits, and this should significantly boost dealflow in the sector."

A selection of education assets in PE portfolios

| Asset | Sponsor | Deal date | Country | Original deal value (€m) | Business description |

| Career Partner Group | Oakley | Nov 2017 | Germany | n/d (100-250m) |

Provider of educational training and consulting services |

| Kisimul | Antin Infrastructure Partners | Jul 2017 | UK | 228 |

Provider of education and care services to children |

| NACE Group | Providence Equity Partners | Feb 2017 | Spain | 350 |

Owner and operator of international schools |

| Van Dijk Educatie | Towerbrook Capital | Dec 2016 | Netherlands | 300 |

Provider of textbooks, educational books and education-related products |

| Eaton House Schools | Sovereign Capital | Jul 2016 | UK | n/d (25-50m) |

Operator of private schools |

| Orbis Education and Care | August Equity | Sep 2016 | UK | n/d (25-50m) |

Provider of special-needs education services |

| Studialis | Providence Equity Partner | Aug 2015 | France | 250 |

Provider of higher education services |

| Ibis Acam | Quadriga Capital | Oct 2014 | Austria | n/d (50-100m) |

Provider of education and qualification services |

| Cambridge Education Group | Bridgepoint | Dec 2013 | UK | 223 |

Provider of pre-university education |

| Explore Learning | Graphite Capital | Aug 2012 | UK | 38 |

Provider of academic tuition services |

Source: Unquote Data

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds