Pandemic success boosts appeal of "misunderstood" gaming sector

Playing video games became a go-to entertainment form for millions in the pandemic, boosting revenues of gaming companies and proving the segment to be a good bet for VC and PE backers. Eliza Punshi reports

"There's not a lot to not like about games, and people are slowly waking up to that fact," says Ian Livingstone, the founder of Games Workshop and a partner at games-focused VC firm Hiro Capital. Livingstone notes that people who previously worried about games are now embracing them: "The World Health Organisation has acknowledged the benefit of video games in creating digital communities where people can meet and play together, especially evident during the pandemic."

Lars Jörnow, a partner at EQT Ventures and an early backer of Candy Crush Saga creator King, agrees: "During the pandemic, playing games has helped fill a void in people's lives. Take Small Giant Games' Empires & Puzzles for example, where you're playing with 24 other people in a team. When you're sitting at home and feeling lonely, being part of a gaming community is much better than watching TV."

Gaming is now bigger than the film industry, according to data from International Data Corporation (IDC): global video game revenues soared to 20% to $179.7bn last year, while the films business reached $101bn in revenues for the first time in 2019. UK-based mobile games studio Tripledot – which raised £57m from Eldridge, Access, and Lightspeed Ventures last month in a deal that valued it at around £500m – says it has nearly doubled its user base from six million six months ago to 11 million, and has grown rapidly to profitability. French fantasy football game developer Sorare raised €48m in a series-A funding round in February led by Benchmark and angel investors, including Reddit founder Alex Ohanian. The company stated it was already profitable, and had seen an "explosive" 52% month-on-month growth over the last 12 months.

Investor appetite returns

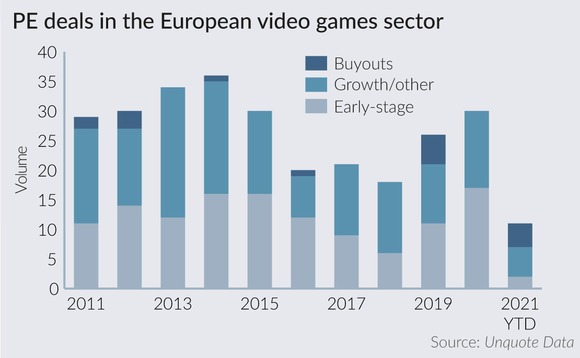

Investor appetite for gaming companies has returned, following a lull in deal-doing between 2015 and 2018. According to Unquote Data, yearly investment in gaming businesses amounted to €90.7m in 2015, €212m in 2016, €81.3m in 2017 and €321m in 2018 – a far cry from the high of €778m seen in 2011.

Jörnow says: "By 2015, except for a handful of large companies, many VCs thought that the gaming space had matured, while others who had made a few investments in 2012-2013, and burnt their hands, thought investing in games was like finding a needle in a haystack. With the pandemic, however, there has been a resurgence in investor appetite, especially for mobile gaming companies. The industry is seeing double-digit growth every year, and valuations for some companies have gone up significantly. Small Giant Games, for instance, went from a €20m valuation to €700m in two years. So, there is a renewed interest in companies in this space."

Livingstone thinks that the lack of information in the European investment community around the gaming sector has made it a very misunderstood one in terms of opportunity: "In the US, you see a higher proportion of specialist and generalist funds attending games conventions to meet the games developers and better understand the space." He also adds that many European studios are not as investor-ready as they are in the US. "Many have great ideas and are able to start their companies thanks to friends and family and seed investment, but they're often unsure how to scale up or how to go about attracting VC funding. There is sometimes a disconnect between the content creators and the investors in content in the gaming space."

But he also thinks that this is slowly changing: "Because the video games industry has done so well during the pandemic, investors have become more aware of it. Revenues are up, and not many studios had to furlough their staff. It's been business as usual in terms of consumption and content creation via digital platforms. A cultural, social and economic phenomenon, it has proven itself to be a future-proof industry that ticks all the boxes for a post-Covid digital economy."

The interest in gaming companies has been strong at the later stage as well, with a rush to consolidate a market made up of numerous small gaming studios – often presenting attractive exit routes for early VC or even PE backers. According to market research firm DDM, there were 220 M&A deals in the gaming industry globally last year, which is a 33% year-on-year increase. Notable deals in 2020 and this year include Microsoft's acquisition of US-based gaming studio ZeniMax Media from Providence Equity Partners for $7.5bn in cash; Swedish gaming studio Embracer Group's acquisitions of Easybrain, Gearbox and Aspyr Media; and EA's $2.1bn acquisition of listed mobile gaming company Glu Mobile.

As evidenced by the sale of Tonic Games to Epic in early March, backing the right developer can certainly reward growth-focused PE firms with venture-like returns: backer Synova netted a 9x money multiple and 200% IRR after just two years of backing the business. The GP had bought the studio from Frog Capital (which itself netted a 7.4x return) shortly before it developed and released family-friendly battle royale game Fall Guys: Ultimate Knockout, which went on to achieve breakaway success.

Other success stories include Team17, most famous for developing the Worms series of games. LDC backed the business in 2016 and sold half of its 33% stake when it listed on the AIM segment of the London stock exchange with a market cap of £217m in 2018. Since then, LDC has sold several chunks of shares – including 4.6% for £19.2m in 2019 and a further 5.2% for £39.4m last year. Shares were priced at 165 pence at the time of the IPO; they now trade at 725 pence apiece.

Looking ahead

As lockdown restrictions ease in Europe, many investors feel confident that gaming companies will, albeit at a slower pace, continue their journey upward. Jörnow says: "We won't see as explosive a growth going forward as we saw in 2020. But I'm still convinced the industry will keep growing and there will be lots of new gaming companies coming up, just like films and TV shows on Netflix. It is mainstream consumer behaviour to play games on mobile devices now."

Hiro Capital managing partner Luke Alvarez says the industry could face stagnation, but that it is equally likely that things could go in the opposite direction: "On the one hand, there is too much leverage, too much cheap money going in, and inflationary pressures. On the other hand, as people come out of the lockdown, they have big appetites for entertainment, with lots of savings stored up by those who stayed employed through the pandemic. The industry is much more likely to continue to grow strongly, driven by new consoles, new content, new formats such as VR and AR, and new users worldwide."

Recent gaming and games-related deals in Europe

|

Company |

Description |

Investors |

Deal Type |

Deal Date |

Deal Value (€m) |

Country |

|

Developer of an online role playing game |

Carlyle Group |

Buyout |

Jan 2021 |

n/d (250-500) |

UK |

|

|

Game developer |

Sagard |

Buyout |

Jan 2021 |

n/d (50-100) |

France |

|

|

Mobile games studio |

Eldridge, Access Industries, Lightspeed Venture Partners |

Expansion |

Apr 2021 |

66.5 |

UK |

|

|

Developer of multiplayer gaming software |

Inbox Capital, Club Network Investments |

Expansion |

Oct 2020 |

47.5 |

Sweden |

|

|

Developer of fantasy football game |

Balderton Capital, Accel, Partech |

Expansion |

Feb 2021 |

41.2 |

France |

|

|

Video game developer |

Makers Fund, Galaxy Interactive, NetEase |

Expansion |

Sep 2020 |

35.8 |

UK |

|

|

Provider of services to video gaming industry using technology and automated workflow system |

Phoenix Equity Partners |

Buyout |

Mar 2021 |

n/d (25-50) |

UK |

|

|

Developer and provider of game hosting and server software |

Flex Capital |

Buyout |

Feb 2021 |

n/d ( < 25) |

Germany |

|

|

|

Video game developer and maker of 3D virtual world game Avakin Life |

Tencent, Novator, David Helgason, Hilmar Pétursson |

Expansion |

Nov 2020 |

21.47 |

UK

|

|

Developer of an e-sports platform for video game tournaments |

eWTP Innovation Fund, Elia Ventures, GP Bullhound, Back in Black Capital |

Expansion |

Aug 2020 |

10.2 |

Sweden |

|

|

Developer of mobile games |

EQT Ventures, Play Ventures, Initial Capital, Heartcore Capital |

Early-stage |

Jul 2020 |

8 |

Finland |

Source: Unquote Data

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds