PE firms study rivals' IPOs as they consider options

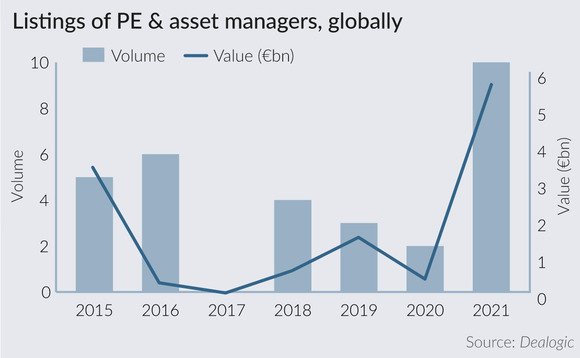

Private equity firms across Europe are looking closely at a recent slew of peer listings such as Bridgepoint and Petershill as they mull options for their own businesses.

"EQT has given us some illustration of what an IPO can do," said an executive from one rival European sponsor who is considering options, including an IPO or stake sale. "What I find remarkable is that they are now investing in other asset classes, buying credible venture companies and going into healthcare and biotech, which you just can't set up from scratch."

Since listing in 2019 – raising SEK 5.8bn (EUR 542m) in proceeds – Swedish sponsor EQT has pursued the acquisitions of Philadelphia-based real estate investor Exeter Property Group for USD 1.9bn and healthcare venture capital firm LSP for EUR 475m in a bid to expand its offering.

The topic is becoming so prevalent within the industry that "a week doesn't go by where we and many of our peers haven't been approached with a party offering GP liquidity," IK Partners CEO Christopher Masek told Mergermarket.

"With liquidity going into GP holding companies, this opens the door to M&A activity in our industry where the opportunity for accelerated growth and consolidation is real, just as for the companies our firms invest in," he added.

CVC and Ardian are among the latest European private equity firms that are now looking at floating their businesses, according to media reports, joining TPG in its reported quest for a US IPO. French private equity firms could also consider the IPO route, as an abundance of French listed comparables offer sponsors plenty of benchmarks, a sector banker noted.

Among the French players that have gone down the public markets road are Eurazeo and Tikehau Capital. Infrastructure-focused Antin also debuted on Euronext Paris in September.

Sponsors have long seen the appeal of an IPO as a way of unlocking liquidity for shareholders – many of whom are employees of the GP – especially if it can be listed at an attractive multiple. Bridgepoint's initial public offering saw 166 individual investors in the British buyout firm make GPB 380m from selling shares, according to a media report.

Not only can partners and employees alike be enthralled by the prospects of further enriching themselves, but a listing can also be seen as a useful way to further professionalise an organisation and ultimately make it more successful.

"I think the private equity market needs to become more institutional," one former partner at a large fund said. An IPO could offer the opportunity for a fund to institutionalise, setting up proper company processes and structures. Decision-making could therefore be less reliant on the persuasion of any one individual, he added.

Proceed with caution

Institutionalisation can, however, ultimately be a double-edged sword for an industry that has historically thrived on its entrepreneurial spirit. "For people like me who left big firms, I wouldn't be happy working within a large bank or a large institution," the partner said. "You need to have the right balance to keep entrepreneurs' willingness to grow, the ambition to create and to develop the business further."

Another part of the challenge for GPs is to convince LPs that their interests remain aligned even if some partners and founders decide to cash out their stakes, said an adviser with experience in LP fundraising. "LPs put up with it, especially public pension funds. But I know some LPs don't like it and will not invest. They see the incentives as misaligned," he said. "Listed PE will care about shareholders, quarterly earnings, and a stable fee income. Public markets want this, but LPs don't – they want you to shoot the lights out on each deal and get the carry. That's not the same as earning a steady fee base."

On the other hand, floating shares effectively opens up an exclusive asset class to other types of investors that would otherwise struggle to gain exposure to its dynamics, including retail investors, a sector consultant said.

Private equity has experienced a boom since the global financial crisis, as investors ditched vanilla asset classes for alternative investments in quest of yield. The trend is here to stay even as central banks consider tightening monetary policy to combat inflation, a sector lawyer said, arguing that rates would need to climb significantly to make a dent.

EQT shares have gone up 650% since the IPO, whereas Bridgepoint's are up 44% and Antin's 41%. Petershill, however, bucked the trend with its stock down 17% since its September debut.

Regardless of the paper gains, one thing is certain: public markets' attitude towards private equity appears to have changed since the days when Carlyle co-founder David Rubenstein famously said: "I can't imagine why any private equity firm would ever want to go public."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds