Sponsors ponder ESG questions as EU Taxonomy spurs gas, nuclear funding flow hopes

Gas and nuclear sector businesses have welcomed an EU proposal to classify these energy sources as green, hoping for increased investment, but sustainability-focused sponsors remain wary.

The EU Taxonomy – a reporting framework intended to facilitate environmentally friendly investing – is set to include gas and nuclear assets from next year under certain conditions, despite some concerns that those energy sources aren't truly sustainable.

For financial sponsors, the EU framework will apply to any new funds they bring to market, and sector players believe it could boost access to funding.

"We would expect this ruling will pave the way to greater investment in nuclear energy, uranium and uranium mining companies," said John Ciampaglia, CEO of Sprott and founder of the Sprott Global Uranium Miners UCITS ETF (URNM). Nuclear energy can facilitate decarbonisation and energy security, but European institutional investors have been waiting on the sidelines for the Taxonomy to be approved, he argued.

Some energy-focused sponsors welcome the clarity. "One or two opportunities that we were reviewing were really on the edge of being Taxonomy-compliant," said Nicolas Piau, partner at Tilt Capital Partners. "We knew they would have a great impact from an energy transition point of view, and this change [to include gas and nuclear assets] allows us to stay on the safe side."

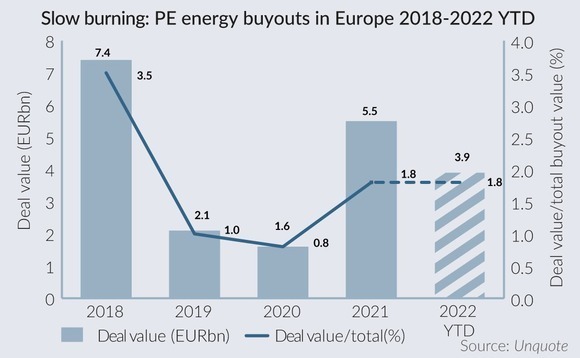

Energy has accounted for a limited proportion of European private equity investments in recent years. According to Unquote Data, the EUR 20bn or so worth of sector buyouts since 2018 until today (18 November) accounted for just 1.8% of aggregate PE buyout value during the period. But sector investments could increase thanks to significant amounts of dry powder. Sponsors with a European remit have raised EUR 23.5bn across 17 vehicles with energy among their sector focus areas in 2022, according to Unquote Data. The majority of these are classified as Article 9 funds within the EU's Sustainable Finance Disclosure Regulation (SFDR), meaning that each fund has sustainable investment or a reduction in carbon emissions as its objective.

Amidst the broader push towards environmental, social and governance (ESG) investing, private equity appetite in green energy seems evident. But the EU's plan to include nuclear and gas in that pool of assets has raised eyebrows among some investors.

"[A]n energy source whose waste products pose a high-level risk to their surroundings for millennia cannot be sustainable," German investment firm KGAL said in a written comment from its ESG office. And as for natural gas, it "produces significant greenhouse gas emissions throughout the process chain," it added.

The inclusion of gas in particular goes against many sustainability-focused investors' ethos, said Fabio Ranghino, partner and head of Strategy & Sustainability at Italy-based investment firm Ambienta. "We consider natural gas at best a transition step – we have never felt there was anything good enough or sufficiently beneficial there from an investment or sustainability point of view," he told this news service.

It is hard to assess whether the EU Taxonomy's inclusion of gas and nuclear really meets sustainable criteria, said Marie Luchet, managing director of ESG at ACA, a governance, risk and compliance advisory firm. The objective of the Taxonomy to point out the direction of travel in the fight against climate change is great, and many financial players will want to disclose their Article 8/9 funds' alignment from the start of next year, but "the signals are unclear, between political compromises and complexity of implementation" she conceded.

While many institutional investors are subject to the EU's regulations, they also tend to have internally decided blacklists of areas to avoid – often including nuclear and gas alongside sectors such as tobacco, gambling, weapons and oil. So the magnitude of new funding flows into Europe's nuclear and gas segments may depend on the sponsors' limited partners (LPs) aligning their internal investment guidelines with the Taxonomy.

"What struck me when we started our fundraise is how conscious LPs are of reputation," said Tilt Capital's Piau. "This is a major driver for them. Not stepping into…gas is a rational move for them as it makes them unattackable from a reputation point of view."

With some LPs spooked by the potential for greenwashing accusations and "stranded assets", energy sector investors can play an important role in communicating risks and opportunities, Piau said. "It's part of our work not to be too black and white, explaining why investing in something makes long term sense from an environmental and social point of view," he argued.

The EU regulation is still complex and confusing, and much remains to be clarified, said Ambienta's Ranghino. Any future regulatory changes should allow for investments that will make a real difference for decarbonisation. But, he added: "I want to give the regulator the benefit of the doubt that the purpose is still there."

[Editor's note: Post-publication, the tenth paragraph has been amended to clarify that ACA is a governance, risk and compliance advisory firm.]

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds