Turning the tables – an M&A downturn means investment banks are now targets themselves

A drought in M&A has left European rainmakers to pursue dealmaking among themselves as they seek to position for an eventual rebound in activity.

Five sector deals worth EUR 3.8bn have been announced across Europe's investment banking sector year-to-date while a further 17 have been declared with undisclosed deal values, according to Mergermarket data.

It has set up the sector for one of its hottest M&A years in almost a decade – with plenty more transactions in the pipeline.

Year-to-date sector activity has been headlined with the take-private of Rothschild by its founding family. The Rothschild family is seeking to buy the 46% of the bank they don't already own for EUR 1.7bn in a deal which values its equity at EUR 3.6bn.

UBS's state-backed rescue of Credit Suisse, while also a transaction of note at CHF 3bn (EUR 2.9bn), is not included as an investment banking sector M&A deal because the target is in the separate commercial banking sector.

Boutique bank consolidation also continues apace with Credit Agricole's EUR 1.6bn acquisition of Brussels-headquartered Degroof Petercam, Deutsche Bank's GBP 395m (EUR 449m) takeover of Numis and Clearwater's purchase of Dutch peer PhiDelphi Corporate Finance among the examples.

Market dislocation

Some of the industry's other key names may also be in play soon. "Like any dislocation in the market – and the market has been turbulent – it will lead to some people gaining share while others lose," said a boutique banker at an acquisitive firm. "There will be some firms that will be seeking the help of bigger firms to navigate these choppy conditions."

Deal activity targeting investment banks has been a hotspot for M&A in EMEA during 2023. Year-to-date deal volume at EUR 3.8bn is up almost 10-fold on the same period last year, according to Mergermarket data. Deal count is 22, up from 20.

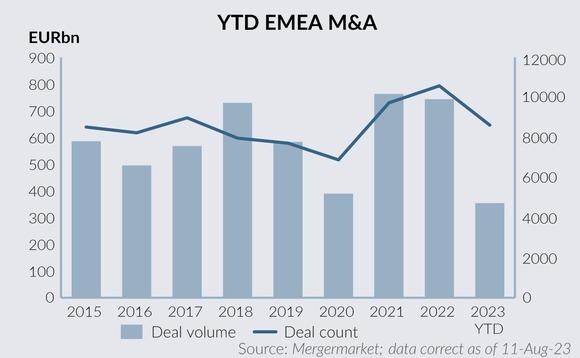

Growth in M&A in the sector is happening at a time when broader dealmaking activity is in fast retreat. Deal volume in EMEA across all sectors has more than halved to EUR 354bn and deal count has dropped by a fifth to 8,617 from the same time last year.

A slowdown in general M&A may have triggered some of the investment banking consolidation seen so far in 2023, according to a sector banker. After two years of record-breaking deal activity in 2021 and 22, some of the most recognisable brands in the investment banking industry have "lost their way" in the subsequent downturn. Dealmakers became too reliant on large-cap deals producing lumpy cash-flow. Much of this kind of activity has now dried up, the banker said.

Others with large books of corporate clients missed out on the private equity dealmaking boom or did not allocate enough resources to the build-out of teams in on-trend sectors such as TMT, he added.

Banks are actively looking for deals

That provides opportunities for advisory firms with the balance sheet to pursue their own acquisitions. Tech advisory boutique Arma, now backed by Mediobanca following a tie-up earlier this year, is looking closely at taking over peers, particularly in North America, as reported. Similarly, mid-market firm Alantra is looking at targets with niche specialisms, also with an eye on the North American market, as reported.

Other players in a position to do deals could include Houlihan Lokey. It has already completed eight acquisitions since 2015 that were either European or had a significant European component, according to Shaun Browne, co-head of European corporate finance at the bank. They have included deals in niches within consumer and TMT.

"We are active regardless of the cycle we are in as we are pursuing a long-term strategy," Browne said.

"The acquisitions have been totally transformational for our corporate finance business in Europe – taking us from a firm with 20 bankers completing four deals in 2014 to a firm with 400 bankers completing over 200 deals in 2022."

For some, the slowdown in M&A activity will give them a stronger hand in negotiations with players who are contemplating their options in a tough market.

"As bankers, when the market is booming, we try to believe that there's always fantastic growth and will ask for very high valuations and it's very hard to fill the valuation gap," said another banker.

"But when the market is facing challenges, shareholders of some advisors may be more reasonable in their valuation expectations."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds