UK hit by lack of larger deals

Amid a welcome recovery across the board, the European buyout landscape is markedly different from last year, with the UK registering a noticeable setback. Greg Gille reports

This year has so far continued the uptick in buyout activity witnessed in 2010, following hard times for the industry in the wake of the financial crisis. Compared to the same period last year, European buyouts are up by 17% in volume and more than a quarter in value, according to unquote" data.

That said, not all countries benefited equally from this improved environment. Most notably, the UK has seen its position as market leader endangered, with France and Germany narrowing the gap. Tellingly, Britain is absent from the top five largest buyouts recorded so far this year, three of which took place in Sweden - including the €2.36bn secondary buyout of Securitas Direct by Bain Capital and Hellman & Friedman.

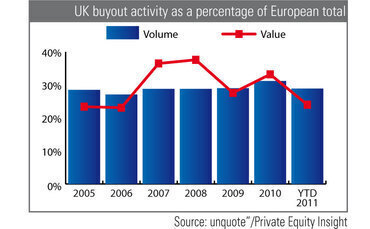

While still the most active market in Europe, the UK has lost ground to France and Germany, which saw increases in activity of 45% and 35% respectively. As a result, the UK's market share of European activity in volume has slid from 31% in 2010 to 29% so far this year - France's has grown from 17% to 19% while Germany's has increased from 12% to 14%.

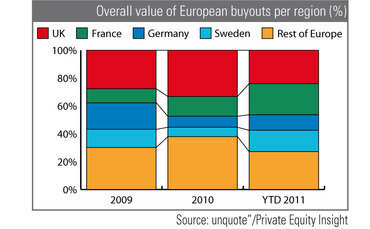

The balance of power is upset even further when looking at the combined value of all buyouts for these three countries. While the UK accounted for 33% of all European deals in value last year, this share has decreased to 24% in the first eight months of 2011. French and German contributions have risen from 14% to 22% and 8% to 11% respectively. Thanks to the three mega-buyouts mentioned above, Sweden's market share in terms of value invested has also soared from 6.7% to 15.3%.

Large-cap woes

It would seem that the UK was primarily let down by a dip in upper mid-cap deals: dealflow in the €250-500m value range fell by a third in the UK compared to the same period last year, while the overall amount invested recorded an even sharper 41% decline. Meanwhile, dealflow in this bracket increased five-fold in Germany and was up by two thirds in France. As a result, the UK accounts for 25% of all European upper mid-cap deals so far in 2011, down from 45% last year.

The UK has also failed to benefit from the spectacular large-cap recovery witnessed in other countries. The number of UK deals valued in excess of €500m remains stable compared to the same period last year, but the total value of these transactions has almost halved from €9.4bn to €5.3bn.

In France, dealflow in the >€500m range is up by 50% year-on-year with six deals worth a combined €6bn – nearly double the €3.4bn recorded between January and August 2010. Leading the pack were Clayton Dubilier & Rice and AXA PE, which teamed up on the €2.1bn buyout of engineering group SPIE. Germany was home to three transactions valued at a total of €2.1bn – these included Rhone Capital and Trion Partners acquiring a division of CVC-owned Evonik for more than €900m, as well as Blackstone buying outdoor equipment and clothing company Jack Wolfskin for €700m. This is up markedly from last year, when the country witnessed just a single buyout in this range with Apax buying clothing retailer Takko from Advent for close to €1.3bn.

Back to normal

These figures would seem to corroborate the concerns voiced by several UK-based professionals – an increasing number of those surveyed in the latest unquote" UK Watch were anticipating a lacklustre second half of the year compared to previous quarters.

But while the UK's share of European buyout activity has taken a step back since last year, historical data shows that it has merely gone back to pre-2007 levels (see chart below). The impressive French and German recovery highlights the fact these two countries are also catching up to pre-crisis levels – albeit a couple of years later than the UK. The worrying news might be that Britain hasn't enjoyed an uptick in investment activity akin to its neighbours, while it is faced with the same dry-powder deployment issues.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds