Trade buyers buoy mega-exit market

While large buyouts have been a rare creature in private equity since the eurozone crisis exploded last year, the mega-exit is making a strong return to the fold, according to research by unquote” data.

Predictions based on current data indicate that 2012 will be the first year to see more than 20 mega-exits (defined as those businesses sold for €1bn or more) since 2007.

So far, 13 European portfolio companies have been exited for €1bn or more by their private equity investors. This compares with 18 last year and 16 in 2010, and if the current trend continues then Europe should see around 22 of these large exits in total by the end of the year.

Previously, mega-exit numbers have hovered around the 30-mark, peaking at 31 in 2006, but were severely hit during the financial crisis and recession, dropping to eight in 2008 and just four in 2009 as buyers around the world put the brakes on expansion, fearing an economic apocalypse.

However, since 2009 large exit activity has picked up and, crucially, maintained its momentum despite the crisis in the eurozone and double dip recession. This contrasts with buyout activity levels, which have stumbled since Greek's debt troubles became apparent.

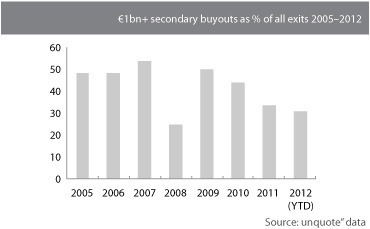

Interestingly, by examining the number of €1bn+ secondary buyout deals we also see that the proportion of major exits made up by secondary transactions is falling. Given the frequent criticism levelled at GPs – particularly large-cap investors – that they simply pass companies between themselves without realising real value, this should provide some vindication that the industry is able to fully exit substantial investments to trade buyers.

The data also indicates the relative strength of corporates in the M&A market compared with private equity funds. While GPs are struggling to raise cash from banks to fund deals, anecdotal evidence suggests many corporates are fairly cash-rich because they hoarded capital when the financial crisis first hit in 2008.

Today, corporates are far more able to pay top sums for high-quality assets than funds, which explains why exit growth has not fallen back this year despite a stalling in new private equity funded acquisitions.

The positives of this are that those GPs with good-quality assets nearing the end of their holding period should be able to make a profitable exit to a trade buyer. The disadvantage is they may well see the same buyers competing against them when looking to acquire new portfolio companies.

With the crisis in the eurozone showing little signs of letting up after the summer, it seems new investment activity will remain subdued. GPs are likely to focus their efforts on successful exiting their portfolio companies to acquisition-hungry trade buyers and attempting to raise new funds to ensure the future of their business.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds