Exit volumes surge despite tough conditions

unquote” data shows that exit volumes surged in 2011 as private equity houses sought to satisfy investor demands, but it is uncertain if this trend will continue in 2012. Anneken Tappe reports.

An ongoing challenge for post-crisis private equity is that, despite dire conditions, money needs to be put to work as investors demand returns more than ever. Investment periods did not take a break during the 08/09 crisis or when the eurozone began to struggle in 2010, although some GPs asked to prolong their investment periods.

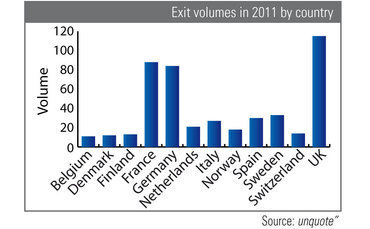

Considering the increase in investments in the years leading up 2007, it is therefore hardly surprising that exit volumes were comparably high in 2011, showing higher numbers than in 2004. unquote" data shows that exit volumes increased by almost 20% from 2010 to 2011, with the United Kingdom leading the list with 115 divestments.

The UK, France and Germany are historically the best performing private equity markets in Europe. In all three countries, strong sector trends were recorded. Support services, a sector as popular as it is broad, led the ranking, following by software & computer services. In Britain, the largest divestment on record was the sale of Capital Safety Group in November 2011 at and estimated €794m. The company changed hands from Arle Capital Partners and Electra Partners to KKR.

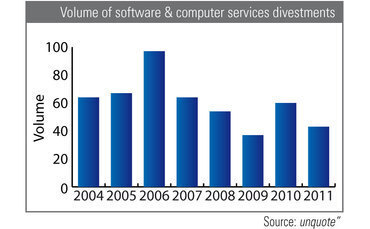

A closer look at the technology sector shows another interesting trend: even though exit values rose by nearly 20% in 2011 in year-to-year comparison, exits from tech companies were much higher in 2010.

The cycle of investment periods provide a reason: 2002 saw the largest number of tech investments in Europe, followed by the largest number of tech exits in 2006. Two years later, in 2008, tech investments rose to a high again, with 213 deals recorded across Europe. This time, however, holding periods seem to have been much shorter, possibly due to the economic environment and performance pressure.

But considering deals done and exits made so far, this could mean that exit volumes will shrink again in 2012. The coming year is expected to see a further glut of secondary or tertiary buyouts, offering GPs a way of putting money to work and showing returns. However, this may raise further concerns among LPs keen to see values realised through IPO or trade sale.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds