Software top destination for investment in 2012

A string of major software & computer services buyout deals have made the sector Europe's most invested in since the beginning of 2012, according to unquoteт data.

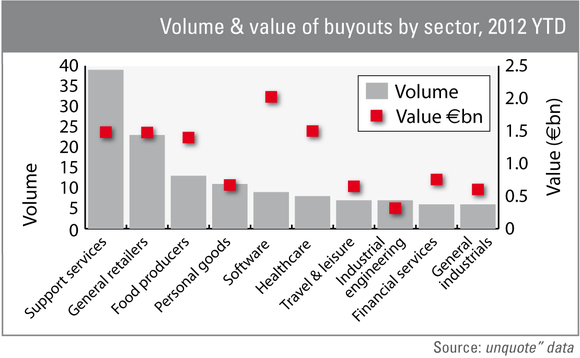

Investment in the software sector has totalled more than €2bn across nine deals since the beginning of the year, followed by healthcare equipment and services, which came to just shy of €1.5bn.

The buyout of Misys was the major driver behind the software sector's position. The financial software specialist was acquired by Vista Equity Partners for £1.27bn following a bidding war with CVC Capital Partners.

However, software companies have seen other major deals this year. Nordic Capital delisted Orc Group for SEK 2bn in February. Like Misys, Orc Group specialises in software for financial services companies. In July, Francisco Partners bought British firm Kewill, which creates software focused on trade and logistics for a reported £102.7m.

Despite software's dominance in value terms, the support services sector continues to be the most active in Europe. In 2012 it has seen a massive 39 deals worth a combined €1.48bn.

Highlights include legal services firm Parabis, which Duke Street acquired for €164.4bn. The deal was particularly notable as it is Duke Street's first since the firm announced it would raise funds on a deal-by-deal basis. Equistone's acquisition of Fircroft for £140m in June was another major deal for the sector. Fircroft is a specialist recruiter, focusing on oil & gas services, and was bought in an all-equity transaction.

General retailers were the second most popular type of investment, with 23 deals worth €1.47bn, followed by food producers, which saw 13 deals valued at €1.39bn.

Interestingly, the industrial sector, which is normally a strong performer, saw just seven deals worth €310m. This may be an indicator of the pressure being put on manufacturing in Europe as the eurozone crisis continues.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds